Risk Management Solutions

Accelerate and streamline your end-to-end credit risk management processes

Improve your credit risk workflows by harnessing our robust credit assessment scores, models and tools, plus default and recovery data, for rated, unrated, public, and private companies across the globe.

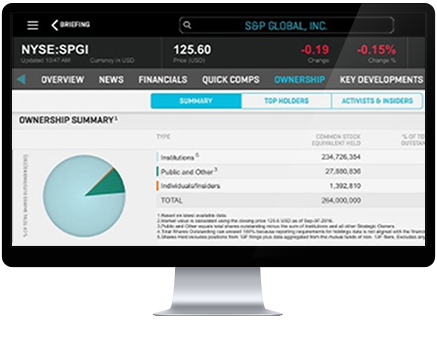

Get a detailed picture of your credit risk exposure with data, models and tools that provide early warning indicators to monitor credit risk deterioration, transparency into drivers of default risk, indicators to assess potential losses and recovery. S&P Global Market Intelligence’s qualitative insights and news provides a deeper view of issues impacting your counterparties.

Automate your workflows with real-time credit data via our powerful data feed management solution, Xpressfeed™ or through API solutions for on-demand data delivery integrated with your systems, portals, and business applications. Alternatively, use our Excel-based financial templates, portfolio-specific news & research, all customized for your portfolio and key workflows.

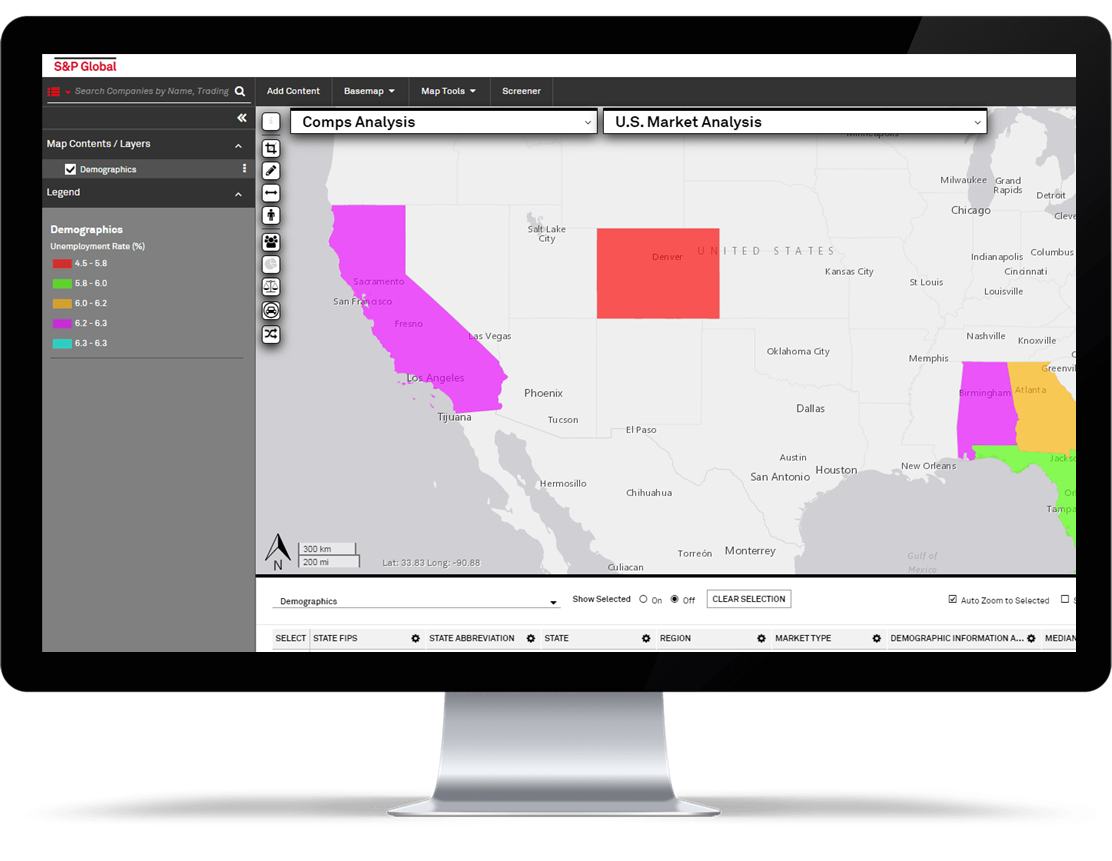

Evaluate the impact of different climate-related scenarios on counterparties and portfolios with Climate Credit Analytics. Perform climate stress testing and scenario analysis, as well as comply with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.