Today is Tuesday, April 12, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

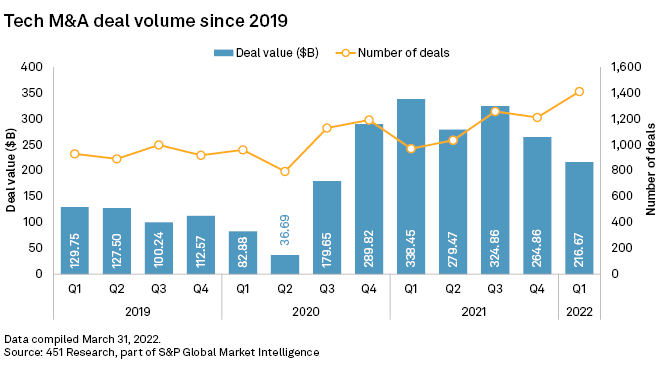

In this edition, we examine the current state of the M&A market in North America. After a record-breaking 2021, deal-making has slowed this year due to several factors, including the prospect of interest rate hikes in response to soaring inflation. Some sectors, such as insurance and technology, are seeing declines in deal volume or transaction values. Elsewhere, fintech M&A activity continues at a steady pace as banks look for new growth avenues.

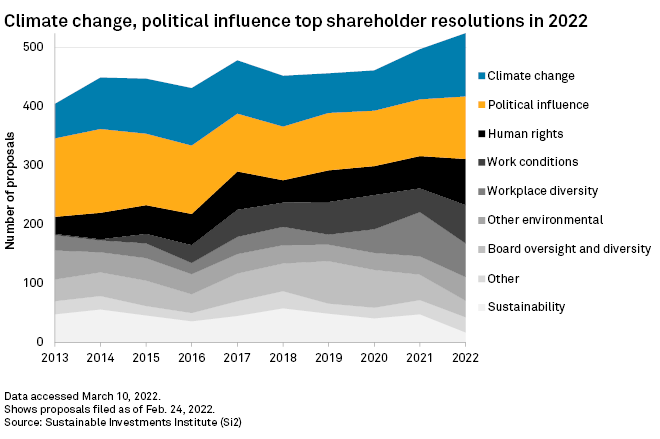

Climate-related proposals compose the largest share of the record number of shareholder resolutions filed so far this proxy season. Climate proposals have surged this year amid growing investor concern over business risks that stem from increasingly extreme weather and other events affecting infrastructure and supply chains.

Demand for cryptocurrency is sustaining record levels of private equity and venture capital investment in blockchain, the technology that powers it. After raising a record $18.4 billion in 2021, blockchain businesses have attracted $5.03 billion in 2022 as of late March, double the annual amount invested in most of the five years to 2020, according to S&P Global Market Intelligence data.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @seanlongoria on Twitter

Navigating Risks and New Realities

Geopolitical tensions are at an unprecedented high and markets are noticeably stressed. Explore the data and analysis you need to stay ahead of evolving conditions with insights on credit risk, supply chain, maritime & trade, economic & country risk, and more.

Written and compiled by Louis Bacani