Today is Tuesday, April 26, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

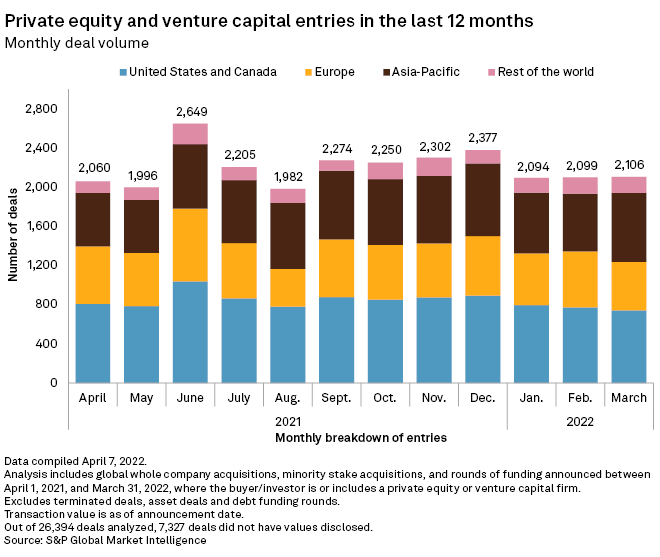

In this edition, we take a close look at deal-making activity among private equity and venture capital firms. In the U.S., the number of deals valued below $100 million dropped 53% in 2021 as investors loaded with cash sought bigger, later-stage investments. Energy transition companies were attractive targets, with experts noting the possibility of outsized returns from carbon capture, green hydrogen and emerging clean technologies. Global deal-making activity has been mixed so far in 2022, with a year-over-year increase in deal volume and a decline in total transaction value in the first quarter.

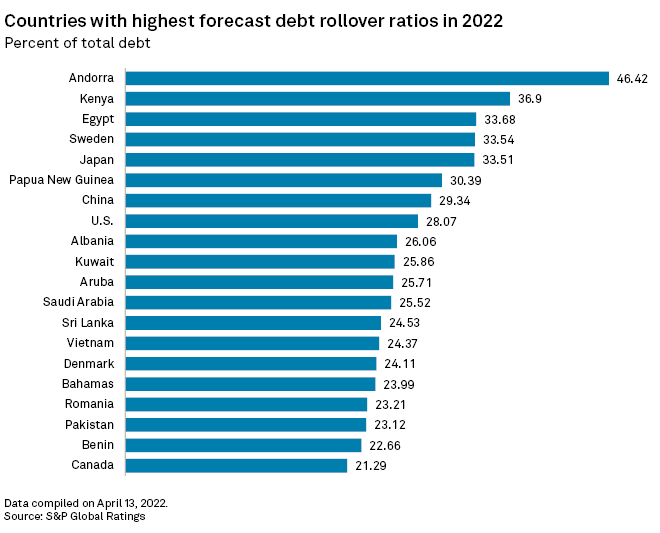

Record debt levels, rising interest rates, surging food and energy prices, and Russia's invasion of Ukraine threaten to spark the worst sovereign debt crisis in 40 years. Sovereign government borrowing surged to a record $14.871 trillion in 2020 and will remain above pre-pandemic levels through at least 2022, according to S&P Global Ratings. Governments borrowed heavily to fund measures to ward off the effects of the COVID-19 pandemic and are now facing steep cost increases to service that debt.

After registering its millionth light-duty electric vehicle sale in late 2021, California is bracing for millions more to hit the road, and the grid, in coming years. To ensure a smooth ride to higher levels of adoption, energy planners, researchers and utilities in the world's fifth-largest economy are gaming out scenarios for how many EVs Californians will purchase, how much electricity they will need and when they will need it.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and @ericwolff, @taykuy and @camillereports on Twitter

Navigating Risks and New Realities

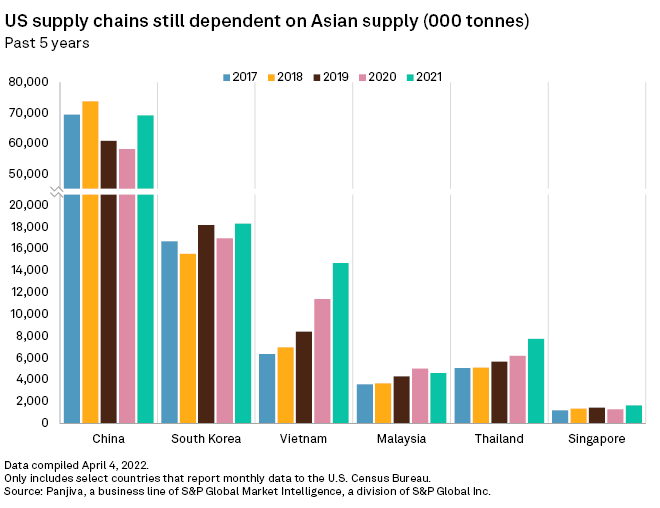

Geopolitical tensions are at an unprecedented high and markets are noticeably stressed. Explore the data and analysis you need to stay ahead of evolving conditions with insights on credit risk, supply chain, maritime & trade, economic & country risk, and more.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.