Today is Tuesday, April 5, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

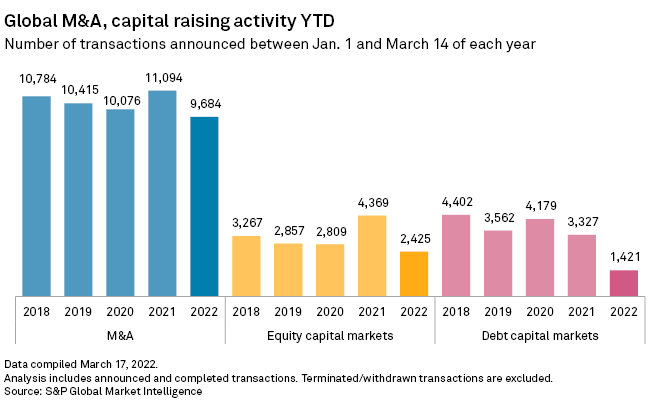

In this edition, we explore the revenue outlook for the global investment banking sector. Investment banks' underwriting and deal advisory revenues are set for a hard landing as companies shelve M&A and IPO plans amid hawkish central bank policies and uncertainty surrounding the Russia-Ukraine war. But there could be one bright spot for investment banks — the recent surge in U.S. credit union-bank M&A activity. A slowdown in such deals is not in sight, providing investment banks with plenty of opportunities to boost their advisory revenue figures.

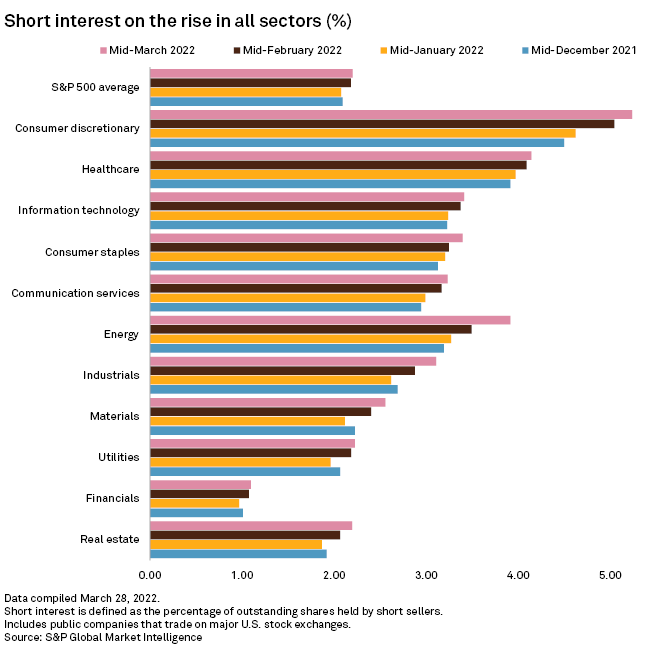

Short sellers, who bet on a stock's decline by selling borrowed shares in hopes of buying them later at a lower price, have steadily increased their positions against all sectors of the U.S. stock market since the start of 2022, when equities surged to all-time highs. The largest short interest has been in consumer discretionary, healthcare and energy stocks amid elevated global oil prices, surging inflation and persistent fears over COVID-19.

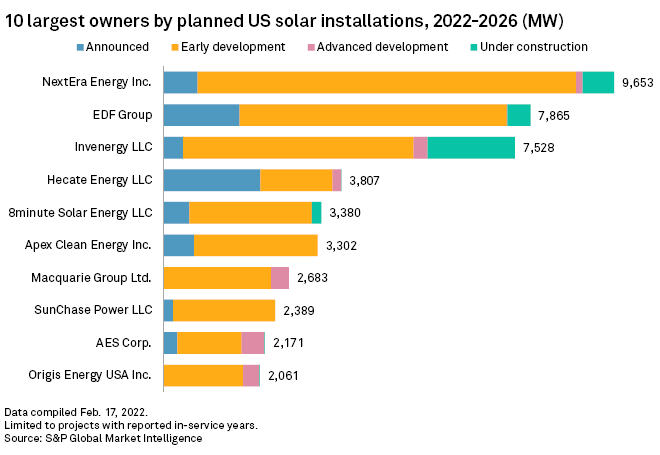

The Russian war on Ukraine has disrupted oil, natural gas and coal supply chains, exacerbating tightness across metal markets and heating up prices for nickel, steel, aluminum, copper and a host of other materials critical to electric vehicle manufacturing. EV makers, already struggling with a shortage in semiconductors alongside the rest of the auto industry, now face problems securing metals essential to the batteries that power the cars.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter

Navigating Risks and New Realities

Geopolitical tensions are at an unprecedented high and markets are noticeably stressed. Explore the data and analysis you need to stay ahead of evolving conditions with insights on credit risk, supply chain, maritime & trade, economic & country risk, and more.

Written and compiled by Louis Bacani