Today is Tuesday, August 02, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

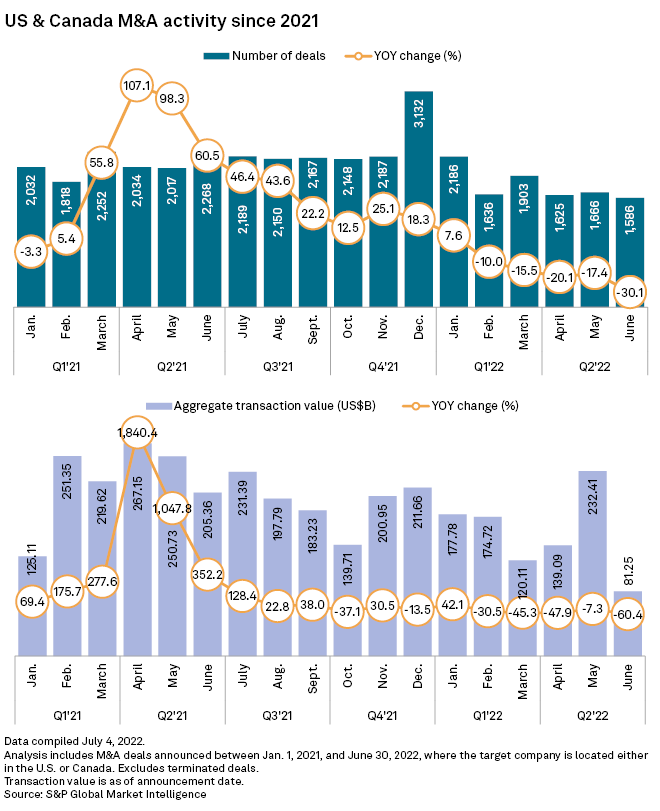

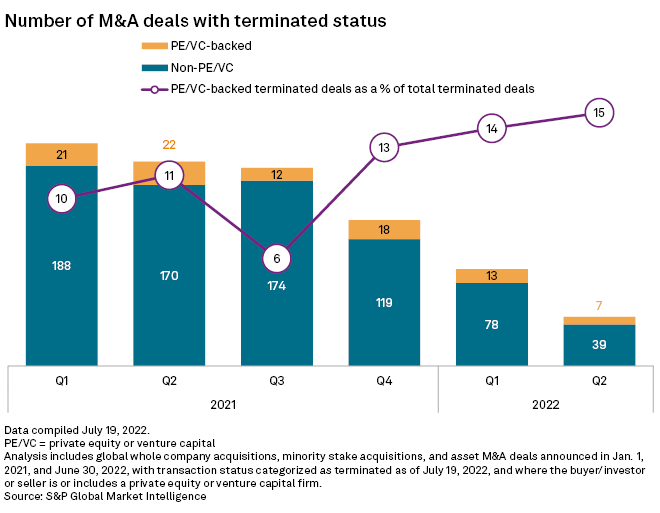

In this edition, we examine the M&A outlook across sectors. After a sharp decline in transaction volume and value in the first half of 2022, North American dealmaking activity is expected to remain weak for the rest of the year amid slowing economic growth, rising interest rates and increased regulatory scrutiny. In technology, cybersecurity M&A continued at a robust pace in the second quarter, but analysts see early signs of increasing caution among buyers. In the Asia-Pacific financial sector, pending deals may collapse due to market uncertainties.

The Federal Reserve's efforts to tame inflation by tightening monetary policy at the quickest pace in nearly 30 years will drive community bank margins higher over the long term. However, the speed of rate increases will cause deposits to reprice more quickly than loans, preventing margins from expanding in 2023. Community banks also will feel some earnings pressure in 2022 and 2023 as institutions record higher credit costs and weaker noninterest income.

In Europe's anticipated green hydrogen boom, technology-makers are planning to rapidly expand their domestic manufacturing footprints. But before they can unleash their ambitious growth plans, industry players must overcome obstacles across regulation, financing, demand stimulation and the supply chain.

The Big Number

Trending

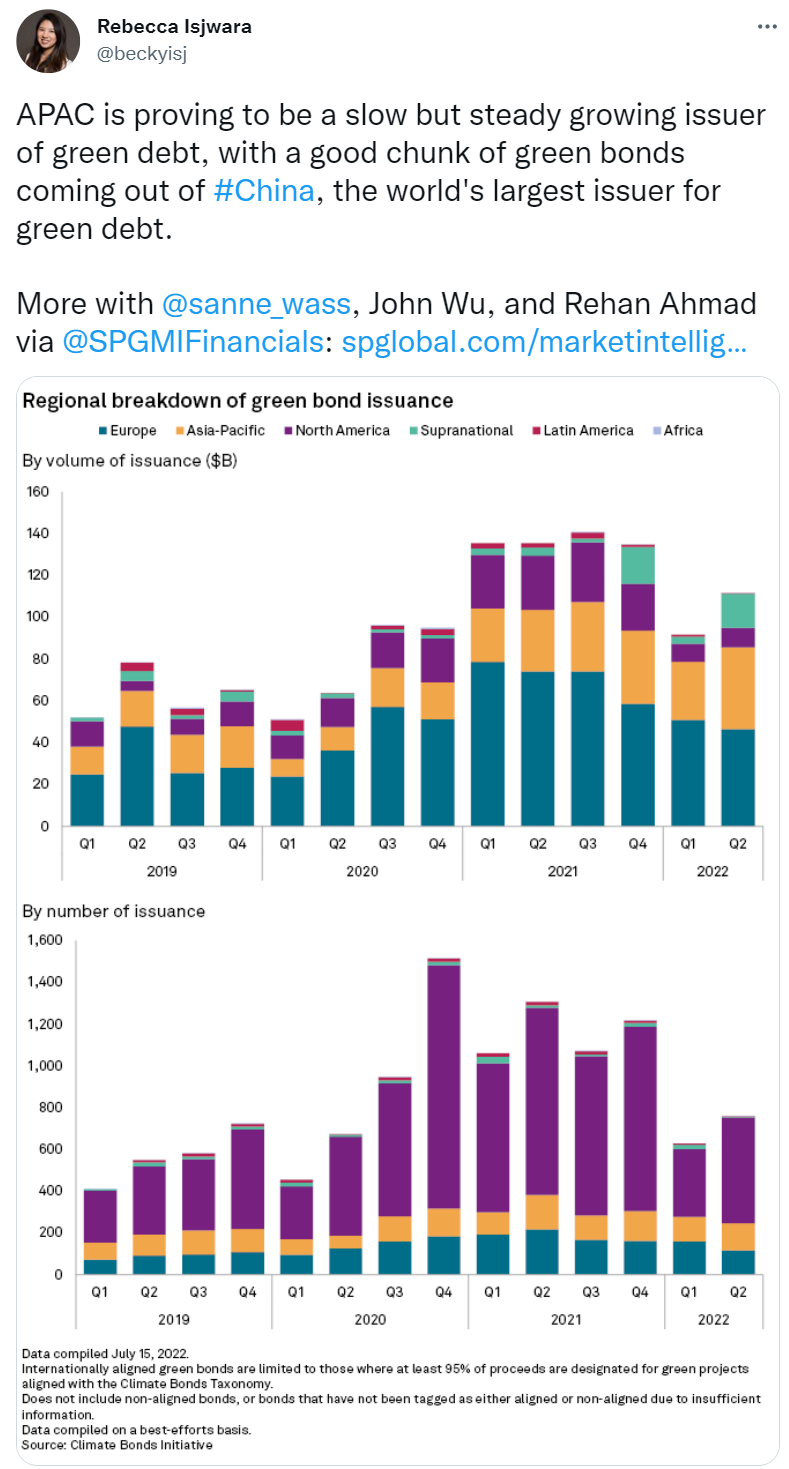

—Read more on S&P Global Market Intelligence and follow @beckyisj on Twitter.

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

Written and compiled by Louis Bacani