Today is Tuesday, August 23, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

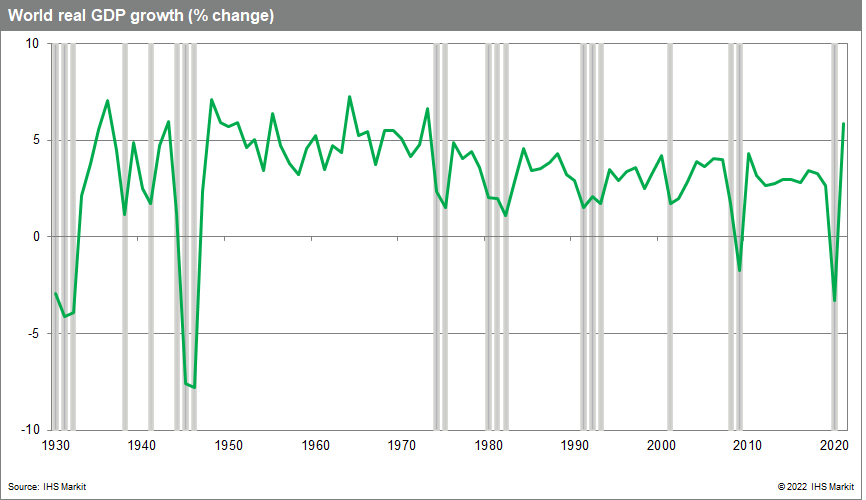

In this edition, we put the spotlight on the world economy. Real global GDP is likely to have declined in the second quarter of 2022, pulled down by contractions in emerging Europe, mainland China and the U.S., according to IHS Markit, a part of S&P Global. In Europe, energy-intensive industries are expected to bear the brunt of Russian gas supply cuts, reducing industrial output in economies already bruised by the impact of inflation on consumer spending power. Global commodity prices remain elevated compared to year-ago levels, but they have resumed a downward trajectory, reflecting fears of weakening demand.

Key revenue metrics for the U.S. banking industry reached all-time peaks in the second quarter, according to S&P Global Market Intelligence data. Commercial banks, savings banks, and savings and loan associations earned $93.16 billion of pre-provision net revenue in the quarter, well above the levels seen in the previous nine quarters. Margin expansion provided almost all of the 9.5% increase in net interest income, which in turn drove the jump in pre-provision net revenue.

Global semiconductor shortages in July were around six times their long-run average, according to the latest PMI survey data from S&P Global Market Intelligence. As such, price pressures remain sky-high, hurting sectors heavily reliant on semiconductors, such as technology equipment, automobile and auto parts, and general electronics. These industries saw a decline in new orders last month as demand conditions deteriorated.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @Yizhu_Wang on Twitter

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

Written and compiled by Louis Bacani