Today is Tuesday, August 30, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

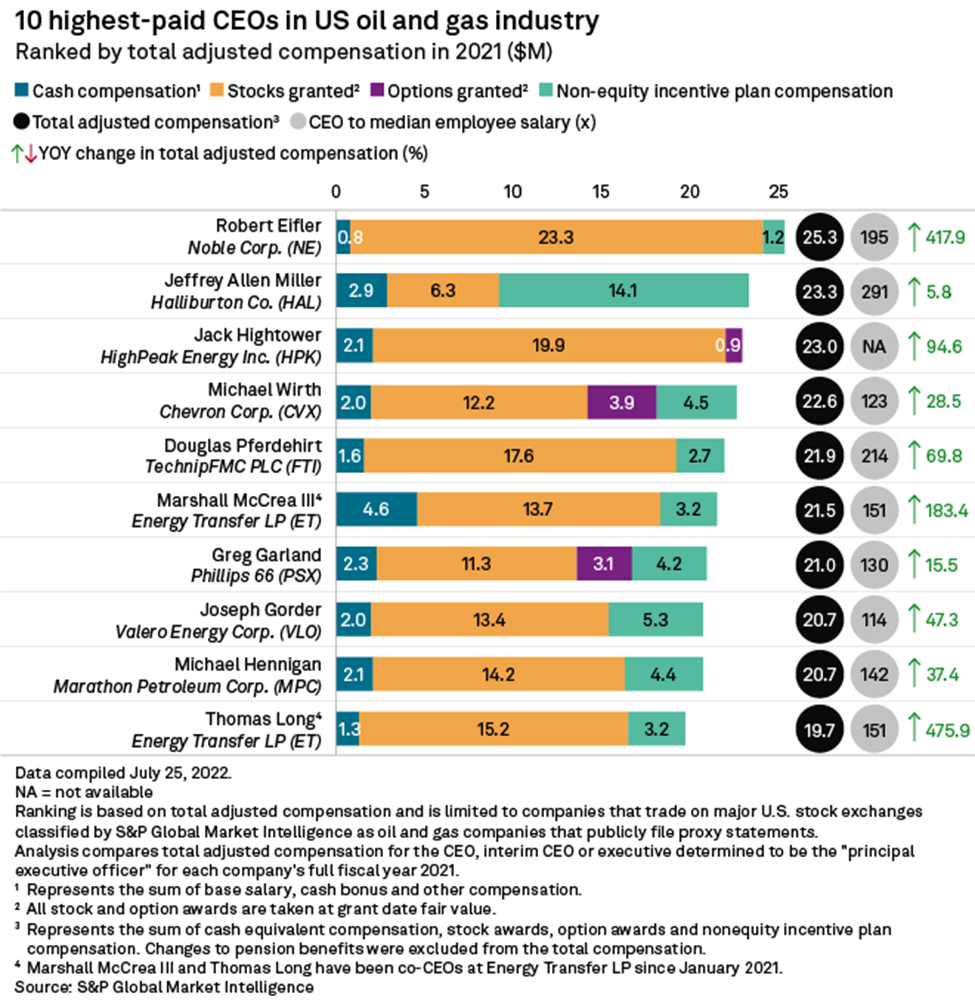

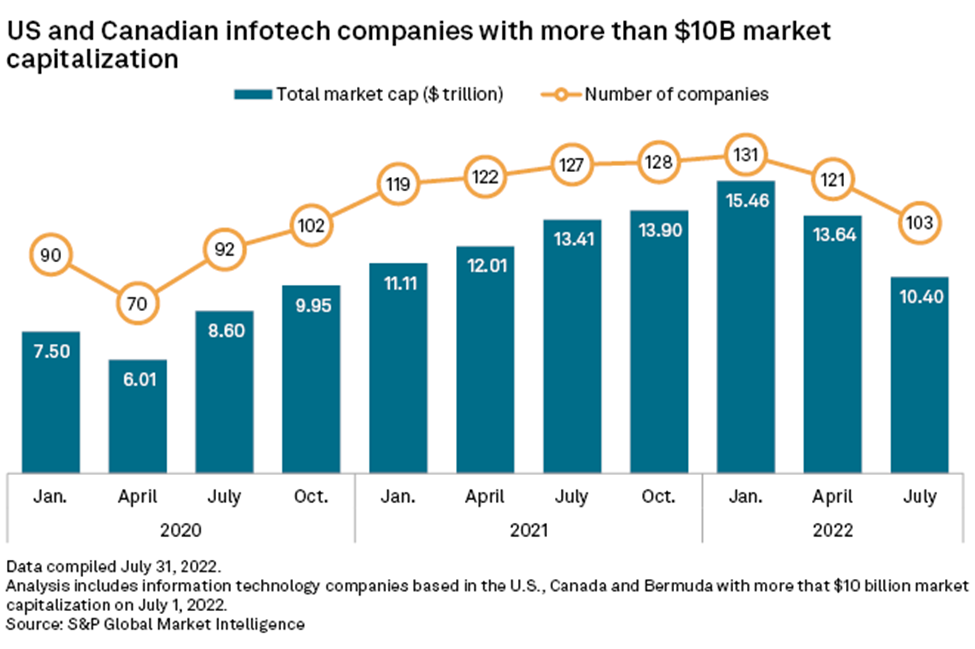

In this edition, we take a closer look at CEO remuneration across sectors. The 10 highest-paid CEOs at major U.S. fossil fuel production, refining and transportation companies saw their pay increase in 2021 as the oil and natural gas sector bounced back from the pandemic. Compensation also surged for many CEOs in the infotech, fintech and life insurance industries due to large stock and option awards or non-equity incentives.

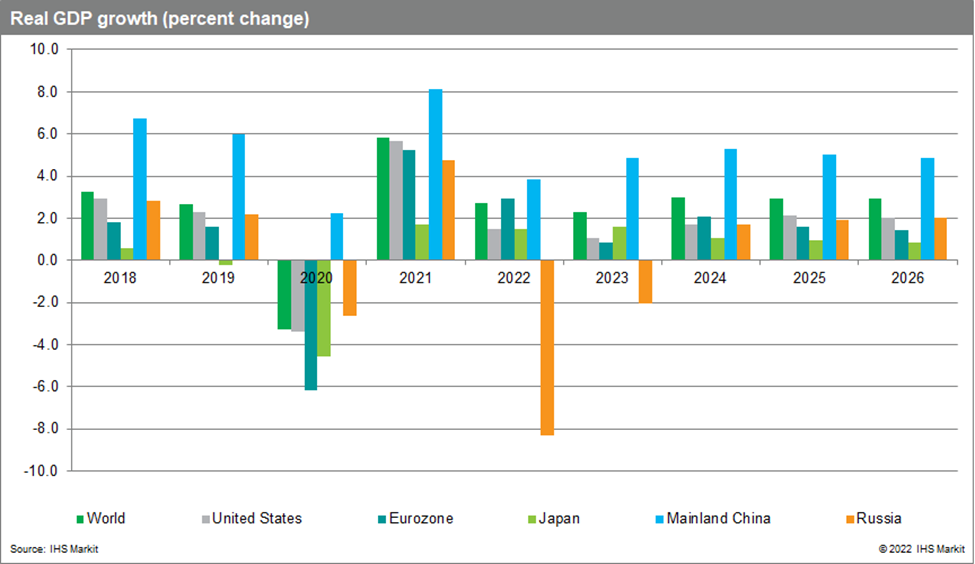

The difference between the yield on the benchmark 10-year U.S. Treasury note and the 2-year note is falling toward levels not seen since the early 1980s. As the Federal Reserve continues to raise interest rates to combat inflation, the yield curve will likely invert further, boosting the probability of a severe recession, analysts said.

Europe's largest wind-turbine makers continue to raise their prices in a market battered by inflated raw-material costs and supply chain snarls. Despite the price hikes, the major players incurred second-quarter losses as new orders dwindled, eating into profitability. Analysts and company executives expect the challenges will persist into 2023.

The Big Number

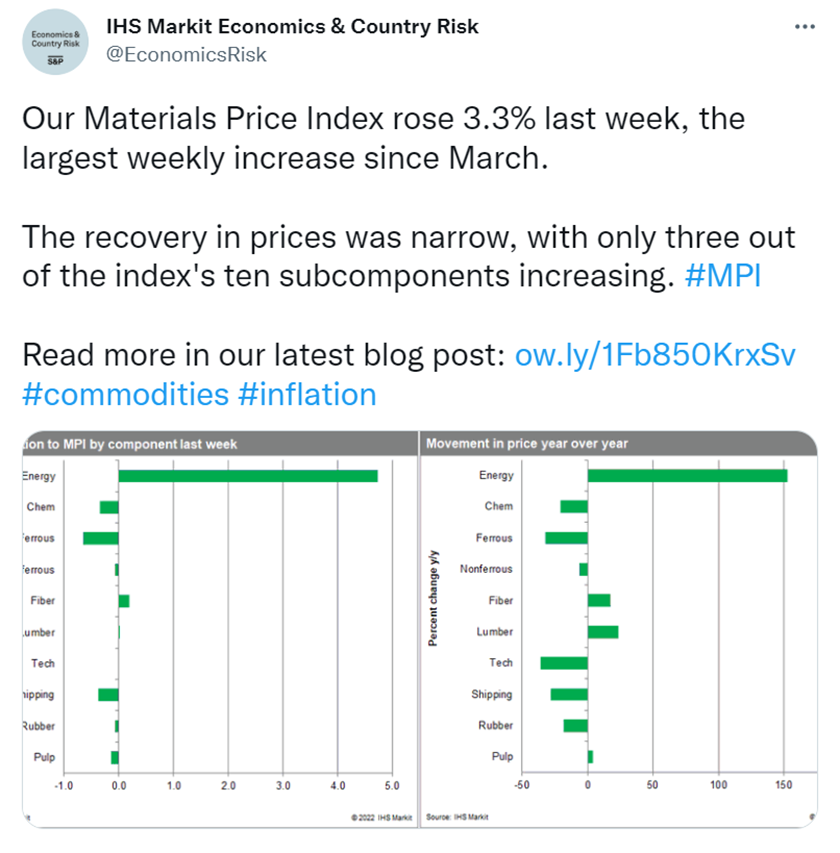

Trending

—Read more on S&P Global Market Intelligence and follow @EconomicsRisk on Twitter

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Louis Bacani