Today is Tuesday, August 09, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

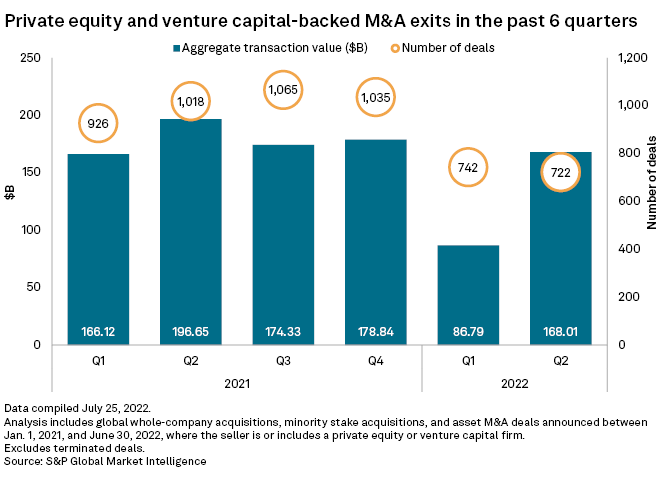

In this edition, we put the spotlight on global private equity activity. Unfavorable market conditions are forcing private equity and venture capital firms to hold onto portfolio companies for longer. The number of portfolio exits fell to 722 in the second quarter of 2022 from 1,018 deals in the same period in 2021, according to S&P Global Market Intelligence data. Falling company valuations could revive deal activity in the consumer sector after a first-half slowdown.

Citigroup, Goldman Sachs and Bank of America, three of the top special purpose acquisition company underwriters over the last year, have paused activities in the SPAC market. The pullback coincided with new rules proposed by the U.S. Securities and Exchange Commission requiring additional disclosures about SPAC sponsors, conflicts of interest and acquisitions between SPACs and private operating companies. Market participants have said SPAC offerings are likely to cool, partly due to the SEC clampdown.

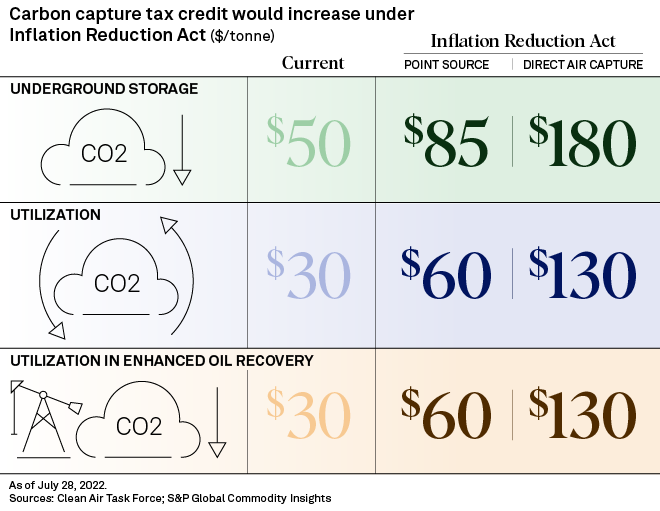

The U.S. Inflation Reduction Act, if passed, is poised to become a boon for carbon capture technology. The legislation seeks to increase subsidies by up to 70% for facilities that capture emissions. The expanded incentives, coupled with bipartisan infrastructure law spending, could spur a 13-fold increase in the deployment of carbon capture tools by 2035, according to the Carbon Capture Coalition.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @beckyisj on Twitter.

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

Written and compiled by Louis Bacani