Today is Tuesday, December 13, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

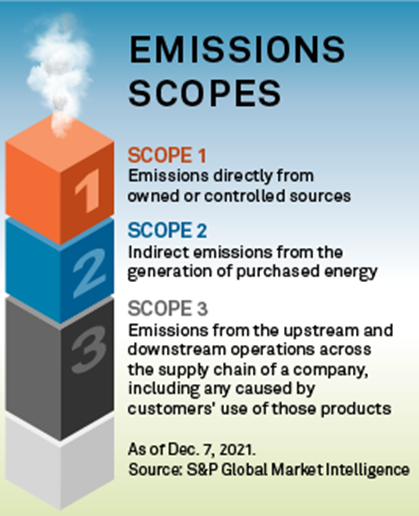

In this edition of Insight Weekly, we examine the challenges for businesses and investors on the path to net-zero emissions. U.S. companies looking for carbon offsets find themselves in an unregulated market facing growing scrutiny and accusations of greenwashing. The absence of standardized requirements for emissions reporting prevents investors from directly comparing companies' climate programs. Russia's invasion of Ukraine has fueled coal's resurgence, but European utilities remain steadfast that net-zero targets are in reach.

The U.S. banking industry had more female employees than men in 2021, but less than 5% of publicly traded banks had female CEOs, according to an S&P Global Market Intelligence analysis. Out of the 1.9 million employees in banking and related activities last year, 56.3% were women, compared to 43.7% of men. Only 10 public banks had female CEOs while 337 had male CEOs.

There were five $10 billion-plus M&A transactions worldwide in November, snapping a streak of five consecutive months featuring two or fewer such deals, according to S&P Global Market Intelligence data. The five deals brought the fourth-quarter total of global M&A deals worth $10 billion or more to $104.05 billion, dwarfing the third-quarter total of $33.27 billion.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @EconomicsRisk on Twitter

The Big Picture

What will shape your big picture in 2023? How will disrupted supply chains, inflation, and new sustainability and M&A trends impact your sector? Our 2023 Big Picture Outlook reports can expand your perspective and enable decisions with conviction.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Alex Virtucio