Today is Tuesday, December 20, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

Note: Insight Weekly will not publish on Tuesday, Dec. 27, 2022 or Tuesday, Jan. 3, 2023. Our next issue will be Tuesday, Jan. 10, 2023. We wish our readers happy holidays and a wonderful new year!

In this edition of Insight Weekly, we continue to examine efforts across industries to achieve net-zero carbon emissions. Major mining companies seek partners to help them finance their transition to renewable energy. Experts say big tech firms are likely to significantly increase investments in renewables due to lucrative federal tax incentives and growing pressure from shareholders. European insurers and reinsurers stick to pledges to reduce underwriting emissions even though several countries are reverting to fossil fuels to combat energy shortages.

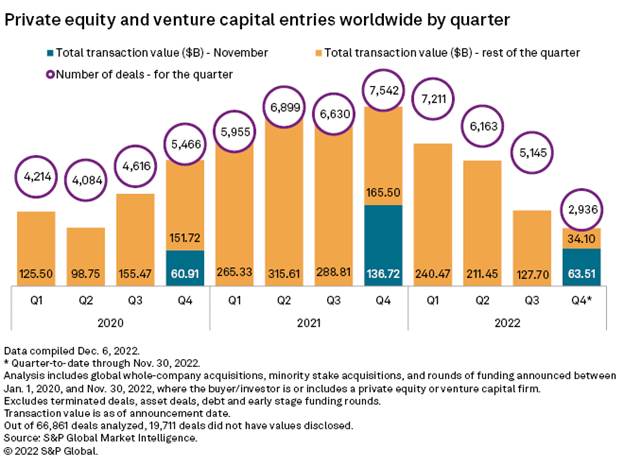

Private equity and venture capital entries worldwide fell 53.5% to $63.51 billion in November from $136.72 billion a year earlier, according to S&P Global Market Intelligence data. The number of deals announced during the month declined 40.5% year over year to 1,429 from 2,402. Asia-Pacific led all regions in dealmaking, while the technology, media and telecommunications sector garnered the most capital from private equity firms.

U.S. lithium-ion battery imports surged 88% year over year in the third quarter, extending their growth streak to nine quarters thanks to continued demand for electric vehicles, storage systems and electronics, according to data from Panjiva, the supply chain research unit of Market Intelligence. China accounted for 76.3% of the battery shipments as it is home to major manufacturers including CATL, the world's largest lithium-ion battery maker.

The Big Number

Trending

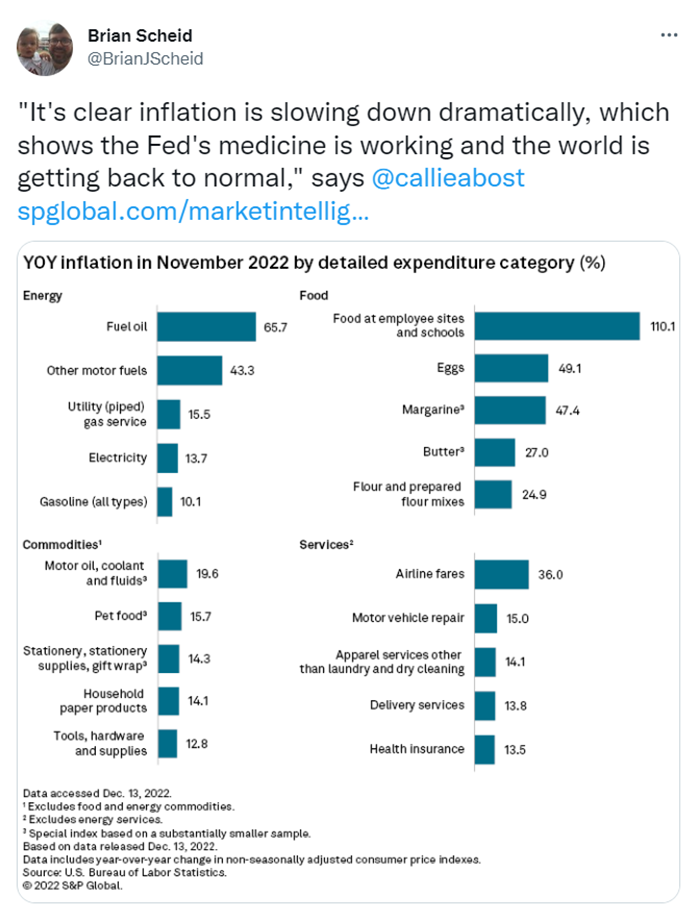

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter

The Big Picture

What will shape your big picture in 2023? How will disrupted supply chains, inflation, and new sustainability and M&A trends impact your sector? Our 2023 Big Picture Outlook reports can expand your perspective and enable decisions with conviction.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Waqas Azeem