Today is Tuesday, December 8, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

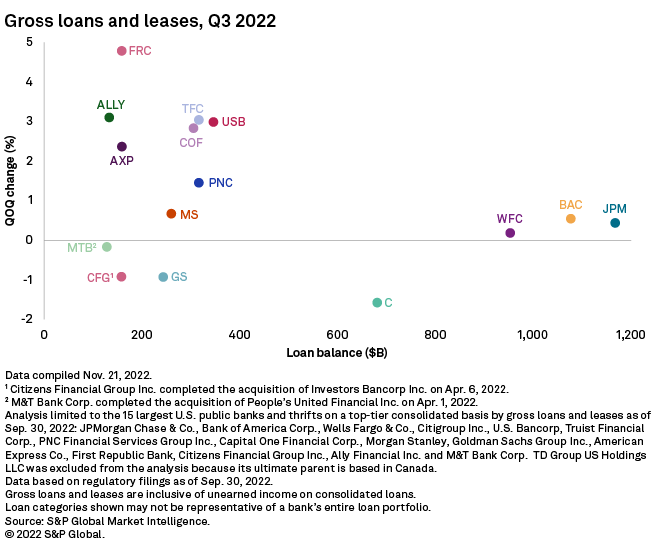

In this edition of Insight Weekly, we take a close look at the U.S. and European banking sectors as they brace for looming recessions. U.S. banks continued to tighten lending standards in the third quarter as demand for commercial and industrial loans also dropped for the first time in more than a year. As a result, median growth in gross loans across the 15 largest publicly traded banks slowed to a sequential rate of 0.7% from 4.4% in the second quarter, according to S&P Global Market Intelligence data. In Europe, the biggest lenders are likely to set more money aside for possible loan losses in the fourth quarter, having already bolstered provisions in the third quarter.

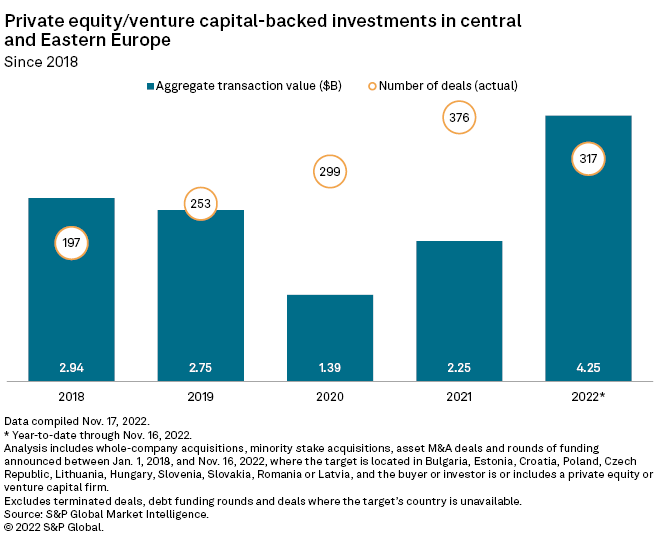

Private equity and venture capital deal value in central and Eastern Europe amounted to $4.25 billion in the year through Nov. 16, marking an 88% surge from the full-year total in 2021, S&P Global Market Intelligence data showed. Industry players expect private equity activity in central and Eastern Europe to expand further as the region's economic growth consistently outperforms Western Europe.

The number of shipping containers carrying solar photovoltaic panels to U.S. ports jumped 59% sequentially in the third quarter after U.S. President Joe Biden waived some import tariffs in June, according to research firm Panjiva. The import resurgence comes as U.S. developers race to complete delayed solar projects and several domestic producers expand their U.S. manufacturing footprints.

The Big Number

Read on S&P Global Market Intelligence

According to Market Intelligence

In this edition of According to Market Intelligence, we look into our crystal ball for the year ahead and explore these topics in depth via our Big Picture: 2023 Outlook reports.

Watch the video on S&P Global Market Intelligence

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.