Today is Tuesday, July 19, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

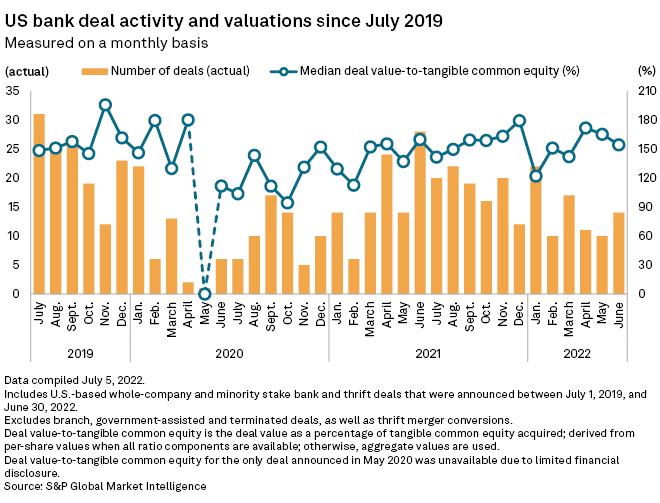

In this edition, we put the spotlight on M&A activity in U.S. banking. The slowdown in dealmaking during the first half of 2022 is likely to continue for the rest of the year at least due to factors including economic uncertainty and rising interest rates, according to industry experts. In the Carolinas, there is a dearth of potential acquisition targets because of a wave of banking consolidation over the last 12 years. The industry is also seeing extended closing times for large deals amid increased regulatory scrutiny.

Just 5% of the 1,554 non-investment-grade-rated issuers in North America have debt maturing in the second half of 2022. The amount due also stands at a "manageable" $56.1 billion, according to S&P Global Ratings. Low levels of maturing debt mean that companies should be largely protected from the consequences of sharply rising borrowing costs in the near term.

Texas remains a prime destination for cryptocurrency mining companies hungry for electricity. The Lone Star State continues to lure miners with inexpensive power and few regulatory hurdles. Texas has also used incentives such as generous demand response programs for large industrial and commercial customers.

Trending

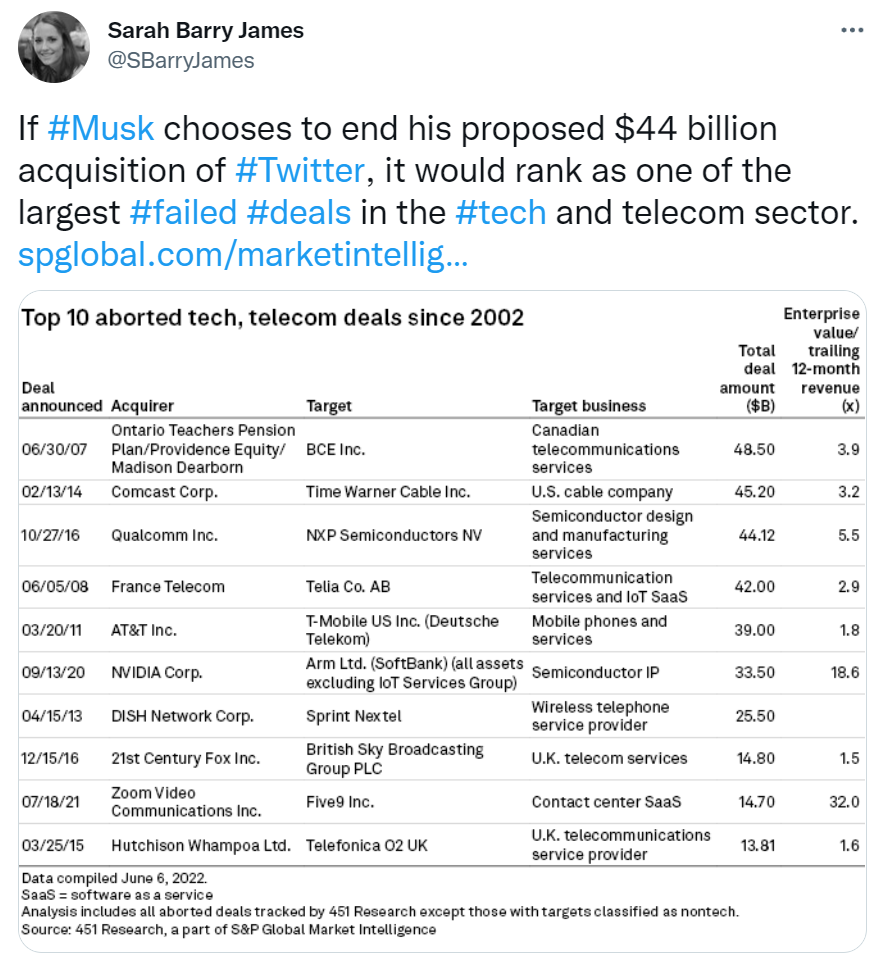

—Read more on S&P Global Market Intelligence and follow @SBarryJames on Twitter.

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

Written and compiled by Louis Bacani