Today is Tuesday, July 05, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

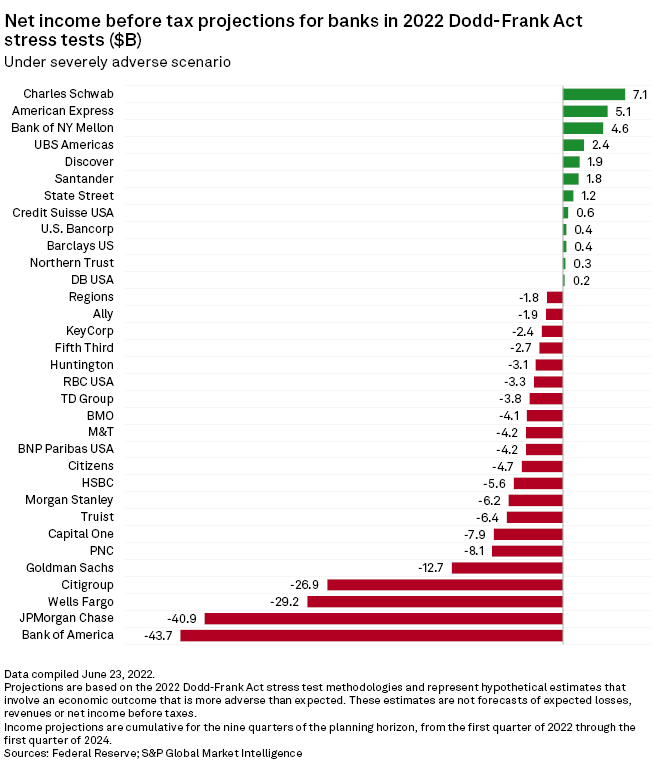

In this edition, we examine the results of the U.S. Federal Reserve's stress tests, which are conducted annually to help ensure that large banks have the capacity to keep lending during a severe recession. Losses projected under this year's stress tests are higher than last year, putting upward pressure on capital requirements and creating another headwind for shareholder payouts. Bank of America, Citigroup and JPMorgan face higher-than-anticipated increases in their stress capital buffers, likely constraining stock buybacks.

Signs are emerging that the U.S. housing market is starting to weaken after a run of record-shattering prices. Surging mortgage rates have significantly curbed the spending power of potential homebuyers, prompting sellers to sharply reduce the prices of their homes. This environment is the inevitable outcome of the Fed's push for tighter monetary conditions, according to realtors and economists.

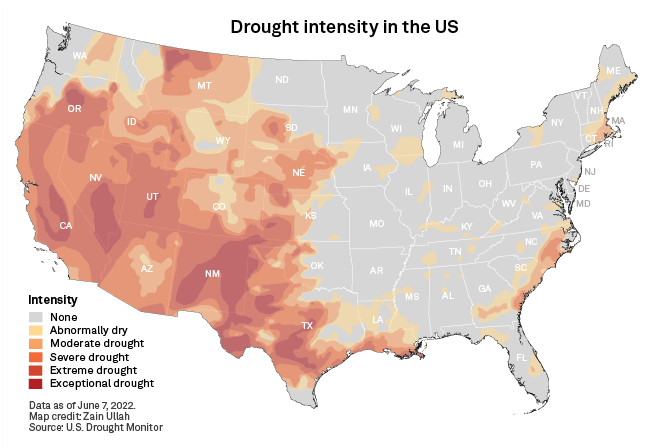

Wide swaths of the U.S. are being strained by drought as summer begins, heightening anxieties over hydroelectric operations and possible power outages, especially in the severely dehydrated Southwest. This summer's vast grid vulnerabilities highlight the need for technological, regulatory and market advances to support the new technologies being integrated into the grid, innovators and reliability experts said.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @LaurenSeay13 on Twitter.

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

Written and compiled by Louis Bacani