Today is Tuesday, June 14, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

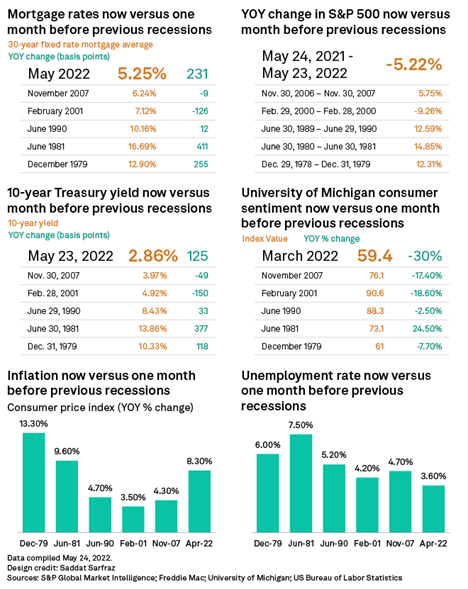

In this edition, we examine the prospects of an economic downturn in the U.S. The Federal Reserve is aiming for a "soft landing" where demand is reduced by tightening monetary policy just enough to cause a decline in inflation without sparking outright recession. The persistence of inflation will be decisive in determining whether household finances are healthy enough to cushion the impact. For now, economists expect consumers to weather a 40-year-high inflation rate and prevent an economy that shrank by 1.4% in the first quarter from falling into a recession. The banking industry is expected to be protected from a deep recession that would spark notable loan losses, thanks to strong institutional risk management and a tight labor market.

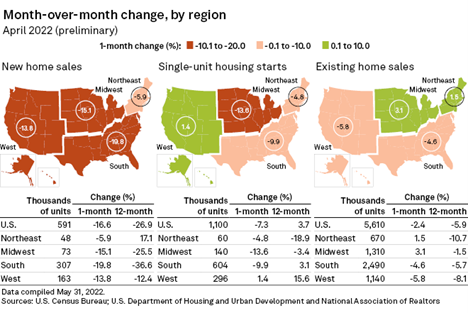

U.S. fixed mortgage rates are surging as the Federal Reserve raises interest rates as housing demand outpaces supply. Banks are fearful of how rising rates will impact mortgage banking activity. Some lenders are looking to trim expenses, namely through headcount reductions, to offset the decline in mortgage activity.

Publicly traded companies have been slow to adopt net-zero emissions goals. However, pressure from investors, regulators and other stakeholders to carefully document and disclose emissions up and down the supply chain is drawing more companies into the broader discussion about greenhouse gas emissions. With this push toward a more granular disclosure of corporate ambition and progress on climate issues, more companies will soon need to reduce their emissions.

The Big Number

Trending

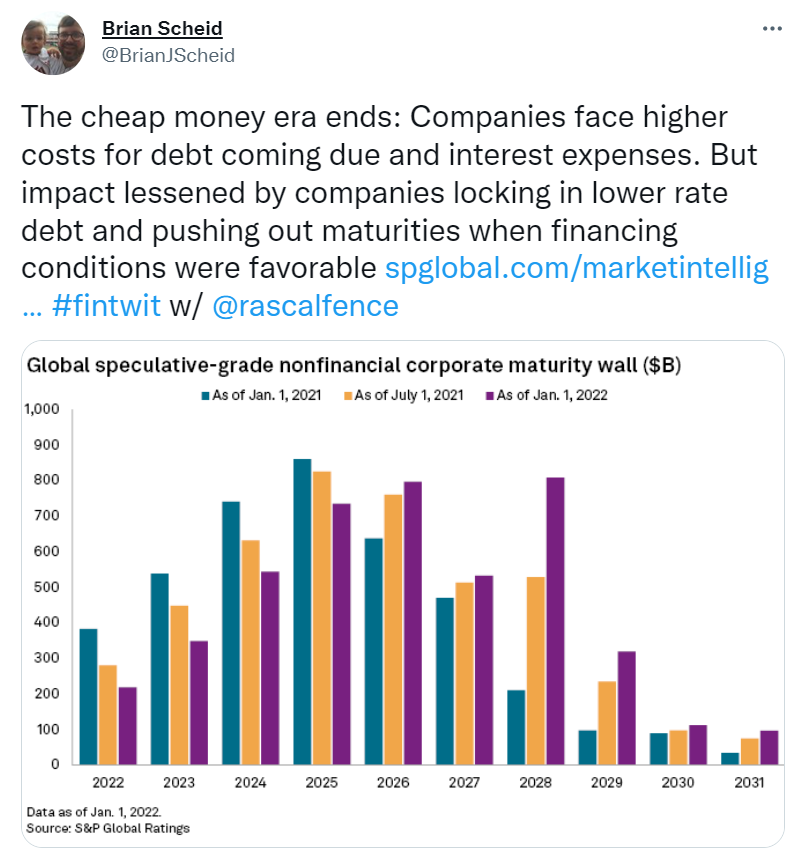

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up to date on how technology is reshaping the future of industries across global markets. Click here to subscribe.

Written and compiled by Louis Bacani