Today is Tuesday, June 21, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition, we examine the challenges facing various sectors on the path to net-zero carbon emissions. U.S. utility executives say their carbon-reduction goals are achievable, but only if promises of new technology and more federal support come true. Mining companies are off-loading coal assets to new owners, a strategy that critics worry will do little to curb overall global emissions. In the tech sector, chipmakers risk exacerbating supply constraints in their pursuit of environmental goals. Top global insurers are upping climate pledges, but gaps in their policies cast doubt on the effectiveness of these initiatives. Bank investors are willing to back lenders’ climate plans, although skepticism among campaigners and activist shareholders persists.

The S&P Global U.S. Manufacturing PMI, a closely watched indicator of manufacturing growth, hit a four-month low in May. Surveys from the Federal Reserve's regional branches have also reported slowing growth in the sector. The slowdown is partly due to the Fed's tightening of financial conditions. Supply chain issues, worsened by COVID-19 lockdowns in China, have also left manufacturers unable to obtain the raw materials needed to meet strong demand.

Chinese domestic lithium deals reached 16 billion Chinese yuan in the first five months of 2022, more than double the annual record set in 2021. Costs far higher than in overseas markets are failing to cool demand as Chinese companies rush to reduce geopolitical supply risks. The unprecedented M&A frenzy also came as lithium prices hit a new record in China amid a global shortage.

The Big Number

Trending

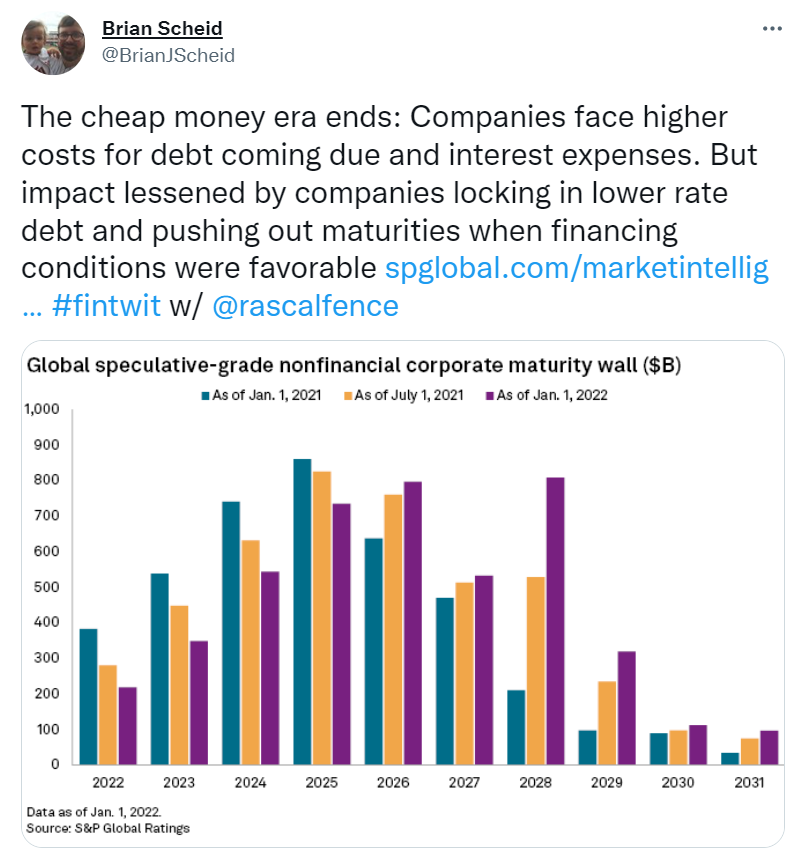

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up to date on how technology is reshaping the future of industries across global markets. Click here to subscribe.

Written and compiled by Louis Bacani