Today is Tuesday, June 28, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

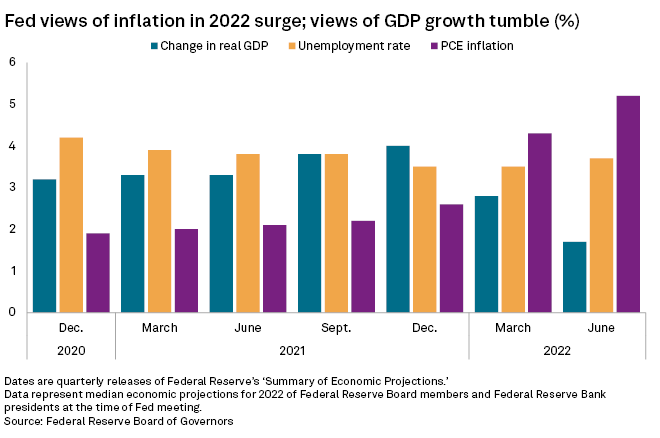

In this edition, we take a close look at soaring inflation in the U.S. Consumer prices jumped 8.6% year over year in May, the biggest rise in more than 40 years. In response, the Federal Reserve tightened monetary policy more aggressively than anticipated, delivering its largest rate hike since 1994. Expectations for more rate increases have caused the S&P 500 to tumble into a bear market, led by a slump in consumer-discretionary stocks. Retail sales also unexpectedly fell month over month in May, as inflation hit consumers ' pockets.

U.S. commercial property transaction volumes fell year over year in April, the first decline since February 2021, prompting concerns about the effect of inflation and rising interest rates on the sector. The commercial real estate market is facing challenges that will significantly impact underwriting, investor sentiment and capital market trends in the medium term. Investors that rely more heavily on debt may be the first to back away from making deals.

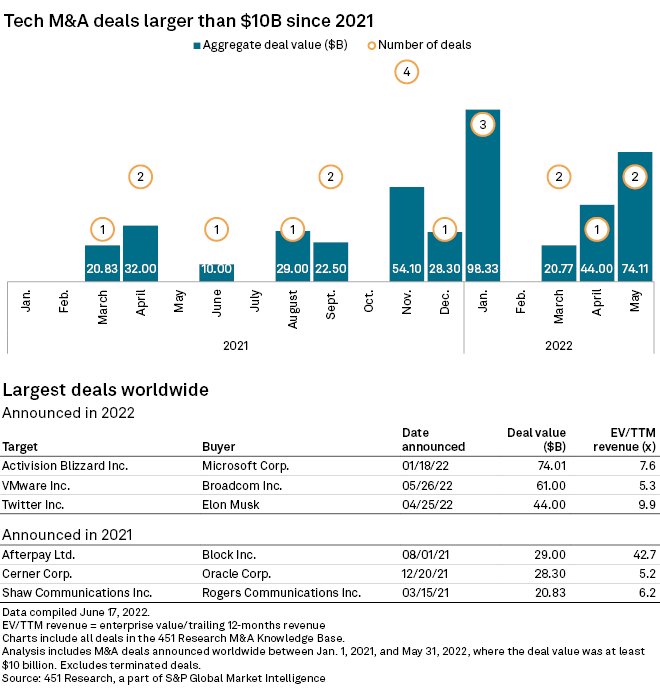

A record year for technology M&A could cool as interest rates climb and markets turn sharply bearish. The unprecedented 2022 volume has also been heavily reliant on megadeals, with eight agreements surpassing $10 billion between January and May. Examples include Microsoft's proposed $74 billion acquisition of Activision Blizzard, Broadcom's $61 billion bid for VMware and Elon Musk's $44 billion takeover offer for Twitter.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @ddimolfetta on Twitter.

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

Written and compiled by Louis Bacani