Today is Tuesday, June 07, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

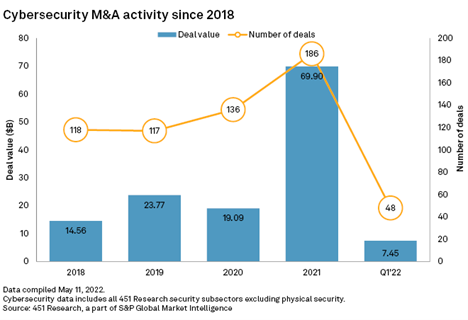

In this edition, we put the spotlight on M&A activity in the cybersecurity sector. Deal volume jumped 26.3% year over year in the first quarter, and the full-year total is likely to edge above 2021, a record year for sector deals. Several factors have driven the pace of M&A, including increasing cybersecurity demand due to new enterprise dynamics catalyzed by the COVID-19 pandemic. Analysts expect the M&A momentum to continue as the fundamentals supporting the sector's market-beating transaction valuations remain firmly in place.

U.S. bank lending has maintained its upward trend despite tightening financial conditions as the Federal Reserve moves to cool off the economy and rein in inflation. Commercial and industrial loans continued to lead lending growth, with a median sequential increase of 5.1% in the first quarter across the big banks. While lending has continued to expand and banks have refreshed projections for growth this year, a shift in the trajectory of underwriting standards is raising doubts about the outlook.

The skilled employee shortage impacting the global mining sector has intensified amid declining labor force participation rates in advanced economies and substantial changes in workers' preferences due to the COVID-19 pandemic. In the U.S., mining and logging sector employment, excluding oil and gas, declined 8.1% year over year in April, according to government data. A tighter labor market may result in higher labor costs as companies must pay more to competitively attract and retain employees.

The Big Number

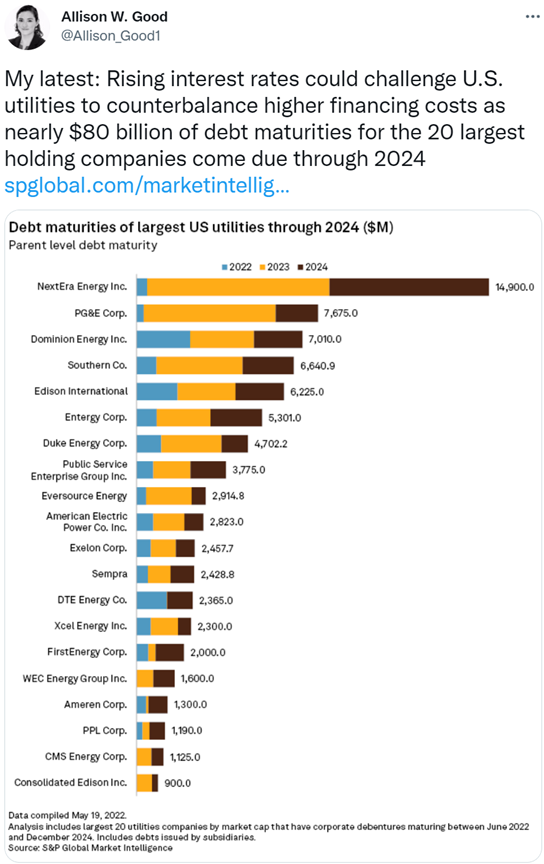

Trending

—Read more on S&P Global Market Intelligence and follow @Allison_Good1 on Twitter

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up to date on how technology is reshaping the future of industries across global markets. Click here to subscribe.

Written and compiled by Louis Bacani