Today is Tuesday, May 10, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

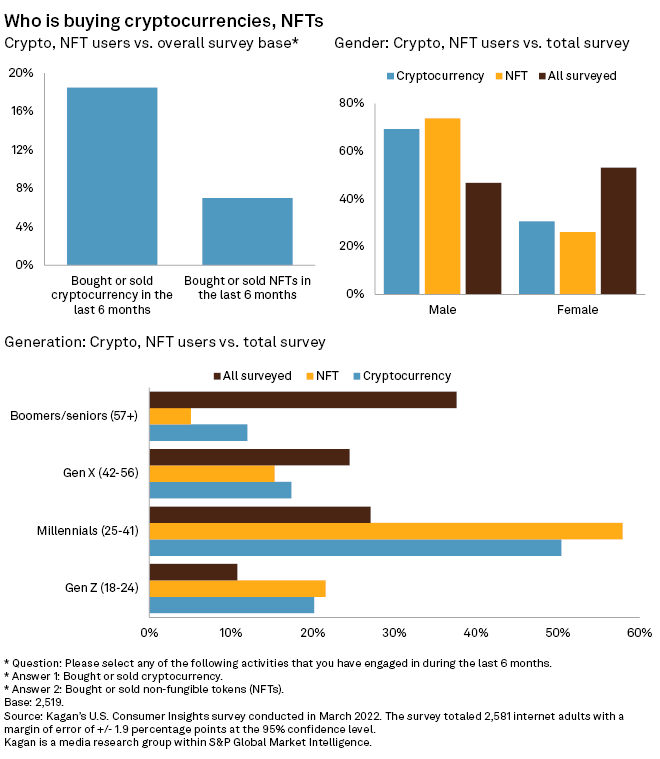

In this edition, we put the spotlight on the cryptocurrency sector. Nearly 100 countries are exploring central bank digital currencies pegged to their national fiat money, according to the IMF. In the U.S., advocates say that investing in cryptocurrencies can offer equal opportunities to groups of people who historically have experienced discrimination in accessing legacy banking systems. In Latin America, people are turning to cryptocurrencies and decentralized finance for their basic foreign exchange needs amid capital controls, rampant inflation and weakening currencies. As adoption of cryptocurrency spreads globally, regulators are taking a harder look at the sector and its risks to broader financial stability. The sector is also grappling with environmental issues as energy demand for crypto mining continues to surge.

Global green bond issuance fell 34.63% year over year to $83.8 billion in the first quarter, according to the Climate Bonds Initiative. The weak quarter ended a multiyear growth streak for the global green bond market, which was propelled by net-zero commitments from many countries. But as most central banks hike interest rates to tame inflationary pressures, financing costs for green bond issuers are increasing and creating uncertainties for investors, according to analysts.

Tight coal supplies and increased demand have driven up prices, allowing U.S. coal producers to reap profits after many faced bankruptcy and large debt loads in recent years. And with U.S. coal consumption on a path of long-term decline, coal companies are not investing in new production, but are instead returning much of their windfall gains to shareholders. With coal company share prices increasing as much as 986.2% in one year, some investors may now also collect the rewards of betting on the sector.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @ddimolfetta and @StefanJModrich on Twitter

Navigating Risks and New Realities

Geopolitical tensions are at an unprecedented high and markets are noticeably stressed. Explore the data and analysis you need to stay ahead of evolving conditions with insights on credit risk, supply chain, maritime & trade, economic & country risk, and more.