Today is Tuesday, May 16, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

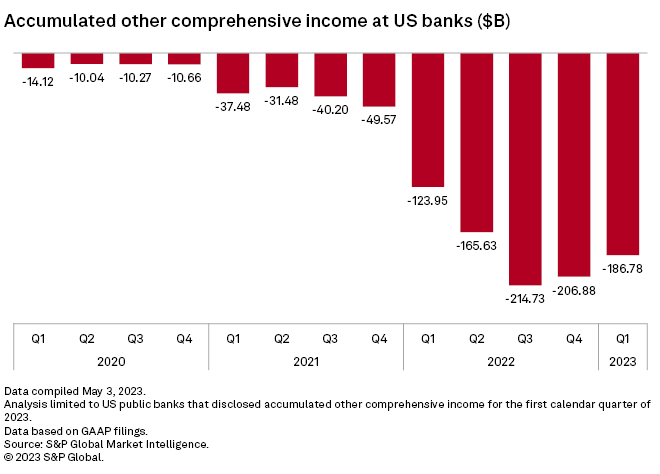

In this edition of Insight Weekly, we examine the issues in US banking regulation. Regulators have started to intensify their supervision of banks following recent regional bank failures. Deposits, liquidity and capital levels will be closely scrutinized, and regulators will have less tolerance for companies that are slow to fix their issues. Year to date as of May 8, regulators have issued five new severe enforcement actions, with the latest one targeting capital retention and liquidity and interest rate risk management. On the M&A front, Toronto-Dominion Bank’s long-pending acquisition of First Horizon was terminated, with industry experts saying that a regulatory issue with TD may have sidelined the deal.

The US private auto insurance industry had a year to forget in 2022 as the business line reported its worst underwriting results in over two decades. The net combined ratio for the sector, excluding policyholder dividends, came in at 111.8%, topping the previous high record of 110.4% recorded in 2000, according to an S&P Global Market Intelligence review of available annual regulatory statements.

Venture capital investments worldwide plunged 61.2% year over year in April, as the number of funding rounds also tumbled 47.8%, according to Market Intelligence data. The technology, media and telecommunications industry dominated global venture capital investments by attracting 37.6% of the total funding.

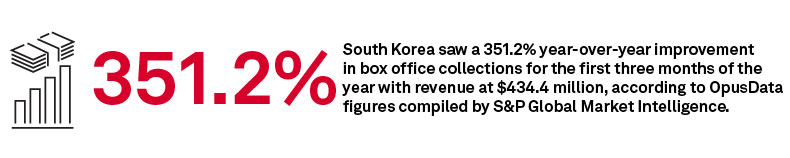

The Big Number:

Trending

—Read more on S&P Global Market Intelligence and follow @SPGMarketIntel on Twitter.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Alex Virtucio