Today is Tuesday, November 15, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly

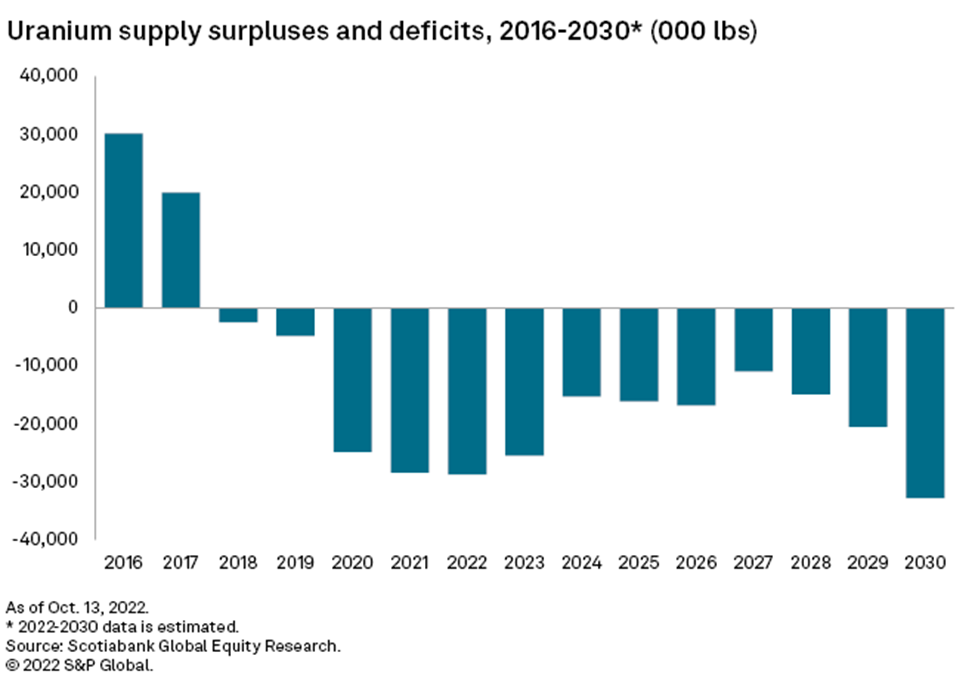

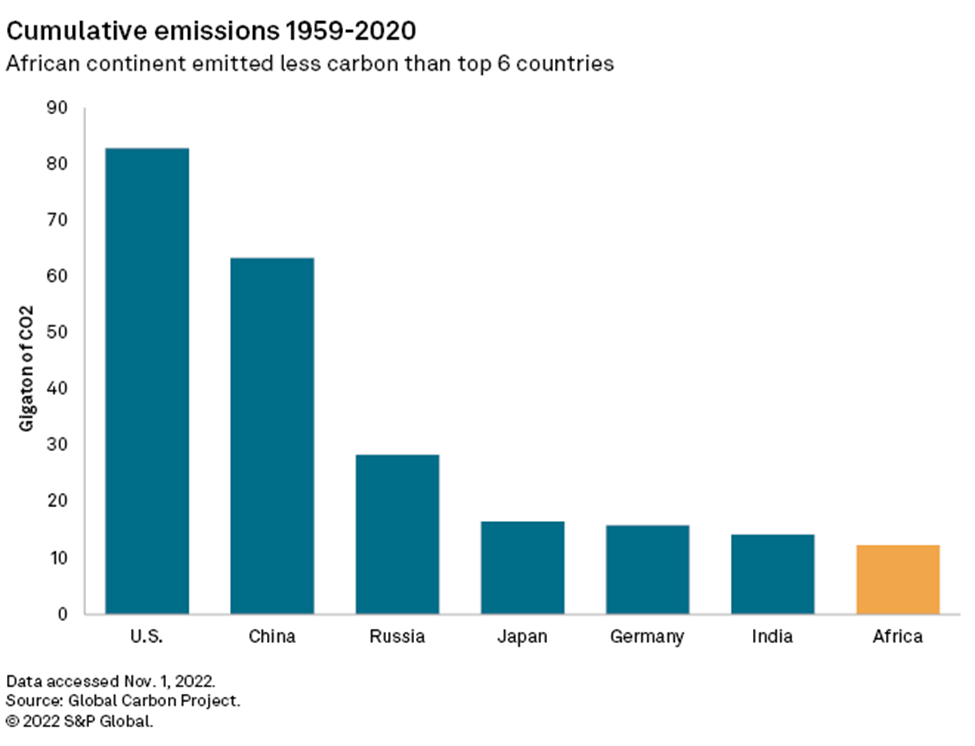

In this edition of Insight Weekly, we take a close look at the recent shifts in nuclear power. Climate change and the global energy crisis are making nuclear power attractive again. In the U.S., federal and state governments are offering new subsidies to keep aging nuclear plants online. Europe also is discussing life extensions for nuclear fleets to replace the loss of Russian natural gas. These efforts to revive nuclear power are creating a potential boom for uranium producers. Pressure for new uranium mines will build, but not until later in the 2020s and into the 2030s, according to analysts.

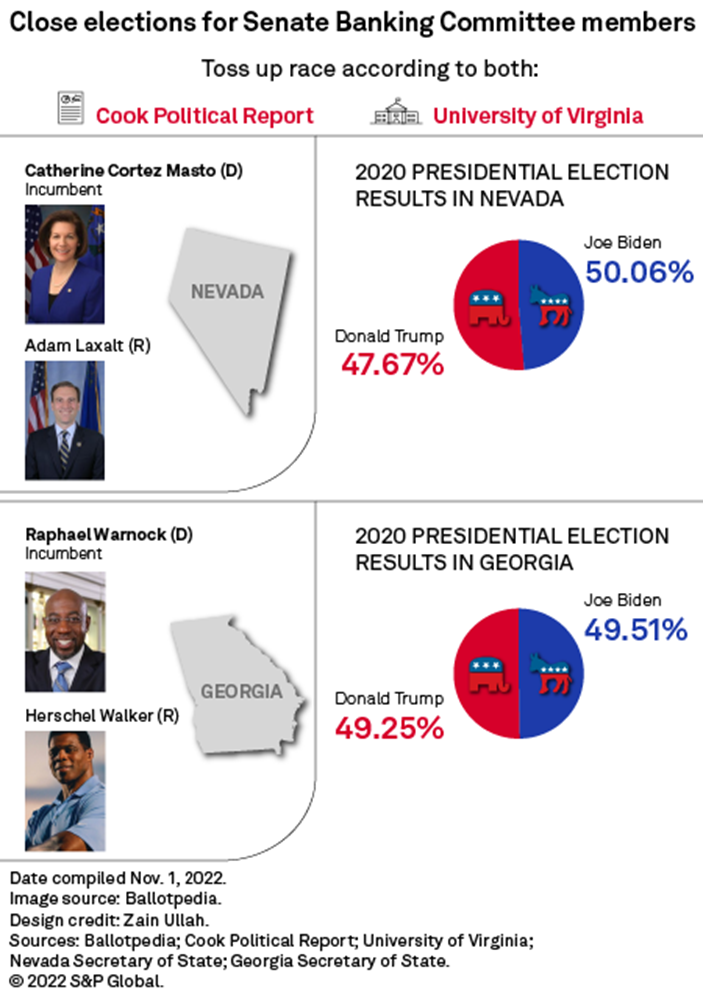

U.S. financial institutions welcome the return of higher interest rates, but it brings its share of risks as well, according to the 2023 Financial Institutions Industry Outlook, a new report published by S&P Global Market Intelligence. Higher interest rates and elevated inflation have raised recessionary fears and the prospect of notably higher loan losses for banks, slower growth for life insurers, risks to downside for the property and casualty insurance space and much greater demands from investors supporting fintech startups.

2022 is set to rank as one of the top years for global private equity investment in the electric vehicle ecosystem after a surge of deals in the third quarter. Through the first 10 months of the year, global private equity and venture capital investments in electric vehicles and components stood at $9.45 billion, compared to a record-high $12.64 billion in 2021, according to S&P Global Market Intelligence data.

The Big Number

Trending

—Read more on S&P Global Market Intelligence follow @EconomicsRisk on Twitter

The Big Picture

What will shape your big picture in 2023? How will disrupted supply chains, inflation, and new sustainability and M&A trends impact your sector? Our 2023 Big Picture Outlook reports can expand your perspective and enable decisions with conviction.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Roma Arora