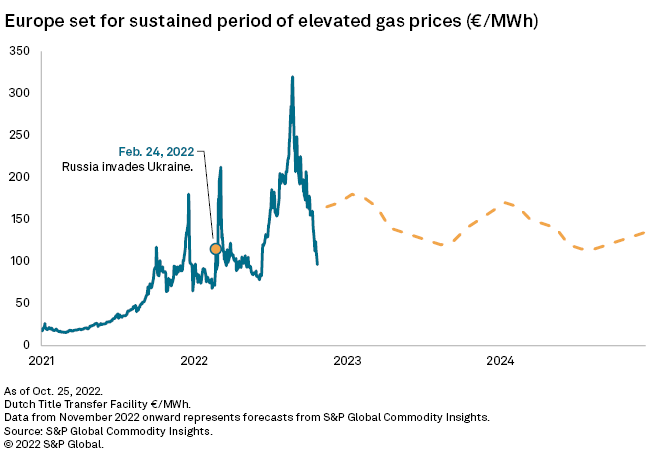

In this edition of Insight Weekly, we take a close look at Europe's energy crisis. After the loss of natural gas supplies from Russia, companies including BASF and ArcelorMittal have pulled back or stopped production, raising pressure on the European Union's manufacturing sector. Governments across the region have asked consumers to reduce energy consumption by 15%, resulting in gas storage levels at well above the targeted 80% ahead of winter. However, analysts say gas storage reserves could be almost completely depleted by the time spring rolls around next year if the winter is especially cold.

The trading desks of the largest U.S. and European banks will largely power their investment banking income after another strong quarter. In a sample of five U.S. lenders and eight from Europe, all but two posted double-digit year-over-year increases in their third-quarter income from fixed income, currency and commodities, S&P Global Market Intelligence data showed. Heightened volatility continued into the quarter, as well as elevated client activity, industry experts said.

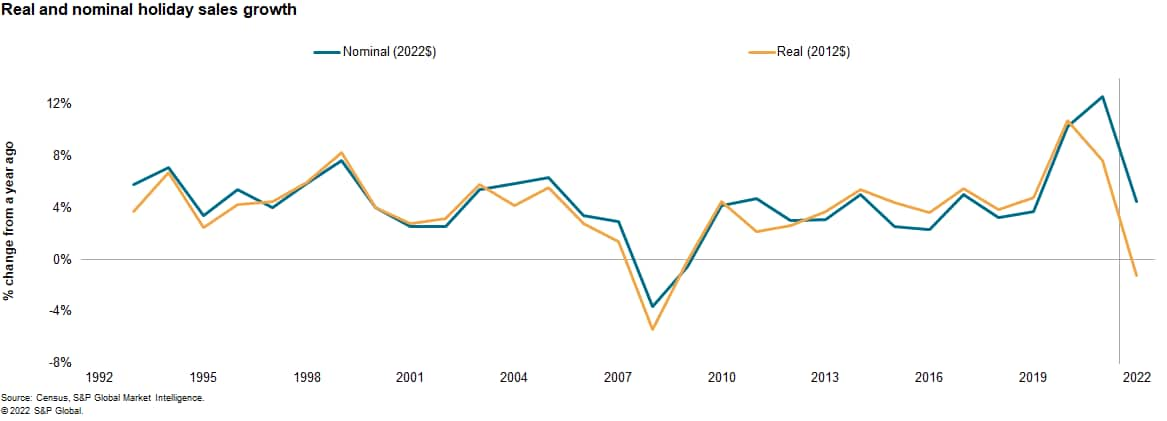

For the first time in 30 years, price increases are set to outpace growth in current dollar holiday spending, according to S&P Global Market Intelligence economists. Real holiday sales are forecast to decline 1.2% this year, compared to a projected 5.8% increase in the prices of holiday goods. Inflation and the end of pandemic stimulus support have weakened consumers’ purchasing power. Retailers need to pull out all the stops to get customers to open their wallets this year as they also look to reduce elevated inventory levels.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @SPGMarketIntel on Twitter

The Big Picture

What will shape your big picture in 2023? How will disrupted supply chains, inflation, and new sustainability and M&A trends impact your sector? Our 2023 Big Picture Outlook reports can expand your perspective and enable decisions with conviction.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Alex Virtucio

Article amended at 1:05 p.m. ET on Nov. 22, 2022, to remove Siemens from a list of companies that have pulled back or stopped operations after the loss of natural gas supplies from Russia.