Today is Tuesday, November 29, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

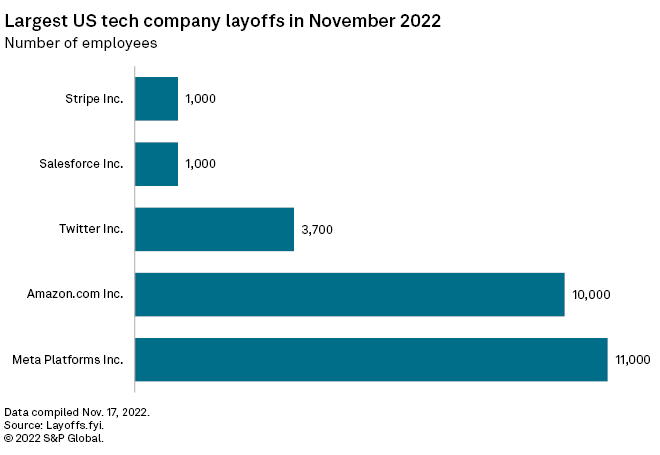

In this edition of Insight Weekly, we put a spotlight on recent layoffs across industries. Major U.S. tech companies are slashing staffing numbers after a year of rapid hiring and abundant spending driven by pandemic-related growth. More than 25,000 tech employees including at Meta, Amazon and Twitter have been laid off in November, about double the number in October. U.S. and European investment banks are also shedding jobs and cutting bonuses as advisory and underwriting revenues plummet due to a slowdown in capital markets and M&A activities.

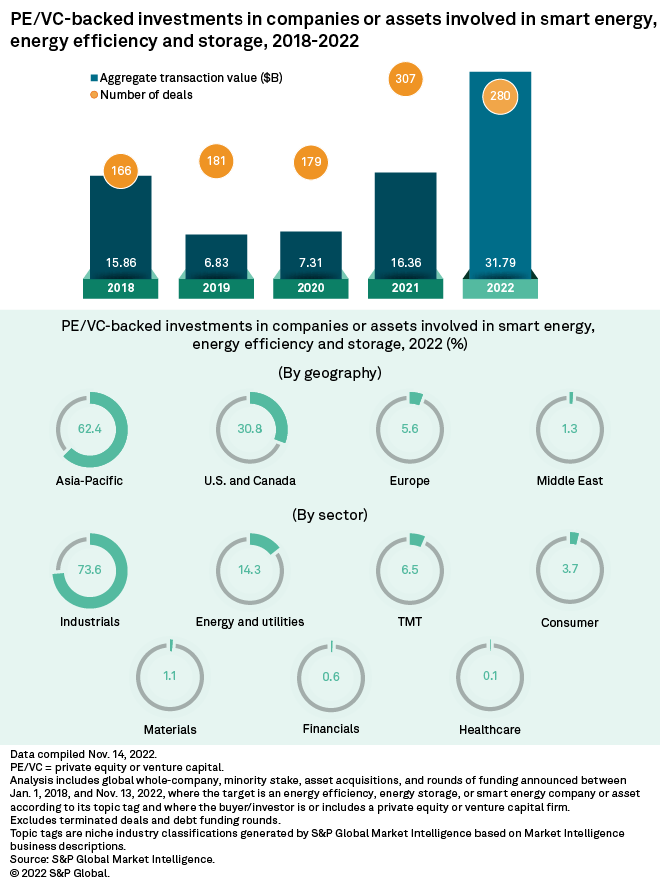

Private equity and venture capital deployment in the energy efficiency sector totaled $31.79 billion as of mid-November, compared to $16.36 billion in all of 2021, according to S&P Global Market Intelligence data. The investment growth in the space defies the overall downward trend of private equity and venture capital deals in 2022 as companies and governments race to adopt sustainable energy management strategies to meet carbon emission reduction targets.

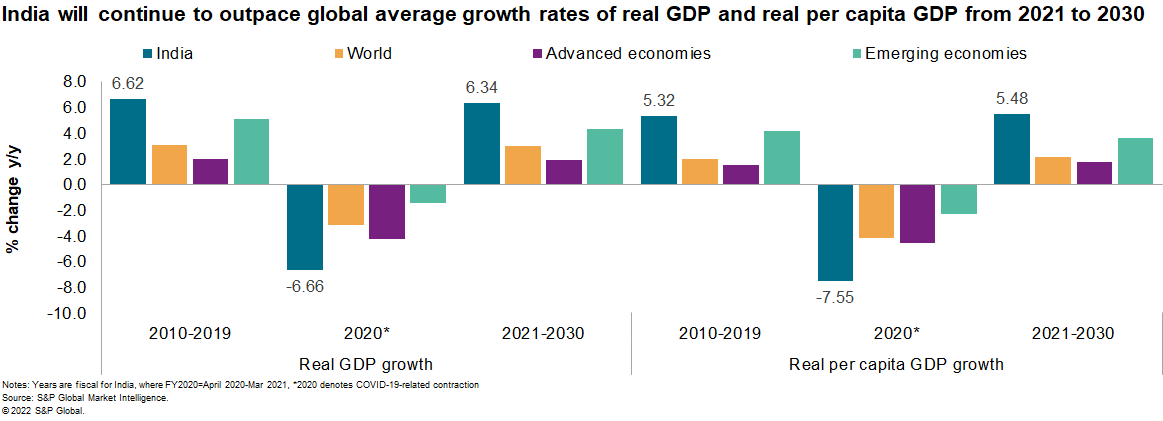

Economic and geopolitical headwinds such as the COVID-19 pandemic and Russia-Ukraine war will continue to reshape global structures and relationships in 2023, according to S&P Global Market Intelligence's Economics & Country Risk team. Five overarching themes will drive the economic and risk environment next year: global security unsettled, energy trade-offs, precarious supply chains, reshuffling labor markets and economic dissonance.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @EconomicsRisk on Twitter

The Big Picture

What will shape your big picture in 2023? How will disrupted supply chains, inflation, and new sustainability and M&A trends impact your sector? Our 2023 Big Picture Outlook reports can expand your perspective and enable decisions with conviction.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Roma Arora