Today is Tuesday, October 25, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly

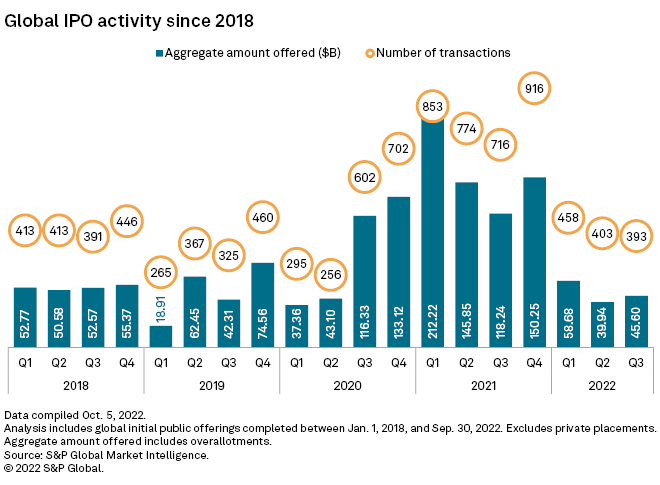

In this edition of Insight Weekly, we put a spotlight on the potential recession. Global business activity contracted for a second successive month in September, according to the PMI survey data compiled by S&P Global. In contrast to the worsening growth trends in the Eurozone and the U.K., the rate of decline moderated in the U.S. during September. As inflation continues to soar to four-decade highs and the domestic labor market remains stubbornly tight, shorter-duration bond yields are expected to climb further and faster than longer-dated yields, creating further inversion and increasing the likelihood of a deep recession. The number of IPOs throughout the world fell more than 45% year-over-year in the third quarter. There have been a 1,254 IPOs in the first nine months of the year, way down on the 2,343 launched in the first three quarters of 2021.

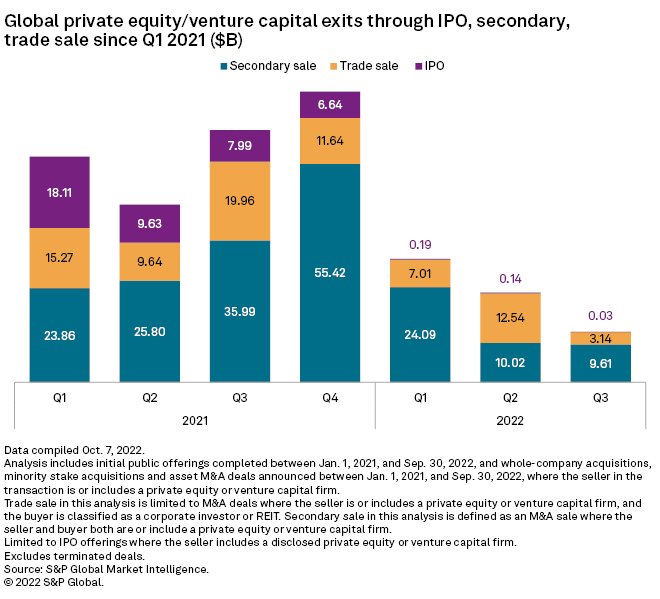

Global private equity and venture capital exit transactions slide further in the third quarter as macroeconomic headwinds continued to hit financial markets. Private equity exit routes including IPOs, secondary and trade sales totaled $12.78 billion during the third quarter of 2022, down from $63.95 billion in the same period a year ago, according to data from S&P Global Market Intelligence. The slowdown in the rate of exit transactions is expected to continue due to economic uncertainty and market volatility.

The volume of M&A transactions among European financial companies hit its lowest quarterly level in two years in the three months to Sept. 30, Market Intelligence data shows. Due to tight monetary policy across Europe, higher interest rates are causing increases in the cost of borrowing, making it difficult for companies to find financing for dealmaking. Dealmaking increased in September from August, but the total of 65 deals recorded was below the 92 registered in September 2021.

The Big Number

Trending

—Read more on S&P Global Market Intelligence follow @tdichristopher on Twitter

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Roma Arora