Today is Tuesday, October 04, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

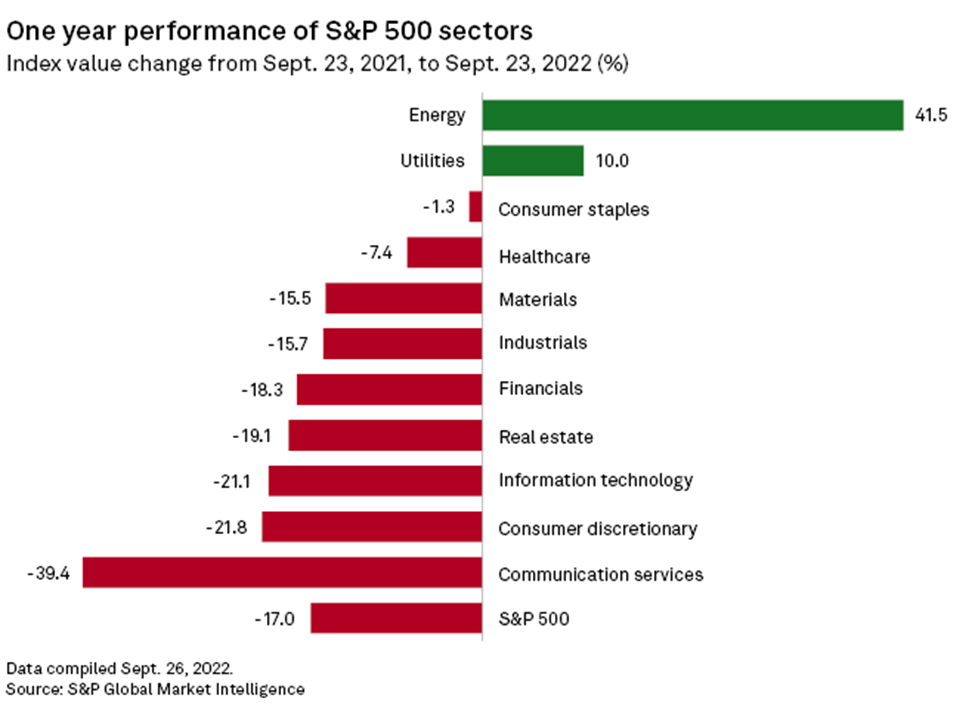

In this edition of Insight Weekly, we take a close look at U.S. equities. The S&P 500 fell 17% during the 12 months ending Sept. 23 as the Federal Reserve raised benchmark interest rates to combat soaring inflation and as recession fears grew. Investors have fled to higher-yielding, safer alternatives, pouring hundreds of billions of dollars into U.S. government debt securities. The yields on the benchmark 10-year and 2-year Treasury notes have climbed to their highest levels in over a decade.

The sharp worsening in financial conditions points to a further weakening in spending that will cause the U.S. economy to slide into recession in coming quarters. S&P Global's IHS Markit expects the recession to be mild by historical standards, with the unemployment rate rising by several percentage points.

U.S. corporate cash ratios are falling as pressures from rising interest rates, inflation and a slowing economy eat into cash reserves. The median cash ratio for investment-grade companies declined to 18.8% in the second quarter, down from 19.5% in 2019's fourth quarter just before the pandemic hit. The median non-investment grade ratio remained above the pre-pandemic level at 30.2% but was down from 34.2% in the first quarter.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @EconomicsRisk on Twitter

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Alex Virtucio