In our latest According to MI blog, we’re talking about a modern-day bank run, a return to normal for supply chains, and generative AI has its iPhone moment.

Banks in focus

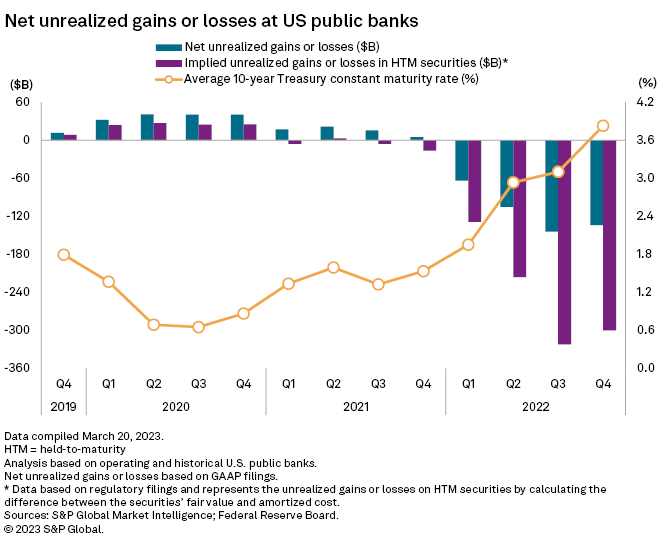

After the second and third largest bank failures in US history, our research shows that:

- Most US banks do have bond portfolios that are deeply underwater.

- Banks are feeling liquidity pressures while funding costs move higher.

- Most banks don’t have dangerous amounts of money tied up in illiquid assets like loans and held-to-maturity securities meaning that this event will be an earning issue rather than a safety and soundness concern.

Having deeply underwater bond portfolios proved unfavorable for at least SVB Financial Group, which purged its available-for-sale securities portfolio for liquidity and ultimately saw a run on its bank. The bank run and others that followed sparked investors' concerns over the stability of the industry's funding. The events also prompted some members of the investment community to write down the values of bonds in their held-to-maturity portfolios, which are not marked to market, when evaluating companies in case more banks need to harvest securities for liquidity needs. While that approach could continue to weigh on bank stocks, most banks likely will not have to go down that road and will continue to utilize alternative sources of funding like wholesale funding, CDs or the Federal Reserve's new term funding program. Read on >

Supply chain normalcy

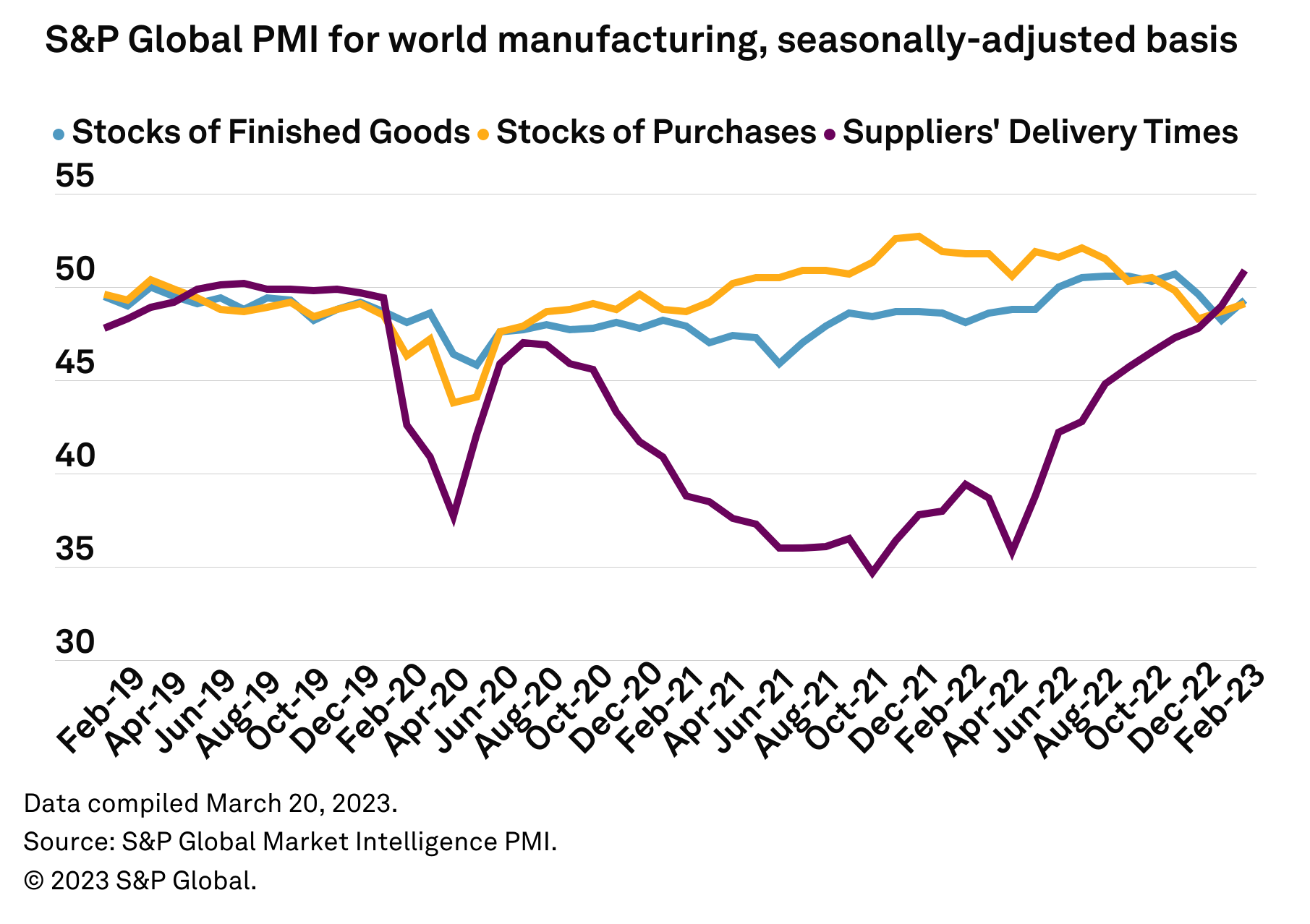

According to Market Intelligence, we’re getting back to normal in 2023.

- Supplier delivery times and shipping rates are back to 2019 levels and seasonal shipping patterns are re-emerging.

- Looking ahead, we’re seeing firms implement new inventory and reshoring strategies. Those strategies to cut risk come at a cost, however, which may not be popular with investors in a recessionary environment.

View Infographic - Global Supply Chains Q2’23 >

Latest on AI

Pivoting to tech, where the release of ChatGPT has the whole world talking about generative AI.

- Product announcements are happening almost daily as vendors accelerate timelines and our analysts are tracking the latest releases.

- Early use cases are focused on customer experience and marketing, but our team predicts that generative AI may fundamentally change how we interact with applications.

We’ll be closely monitoring regulation here, as US authorities are already warning companies about overhyping AI in their advertising. Listen to podcast - The future of practical AI >

And that’s According to Market Intelligence.