Worldwide bank ranking series

Click to view stories in this series as they are published

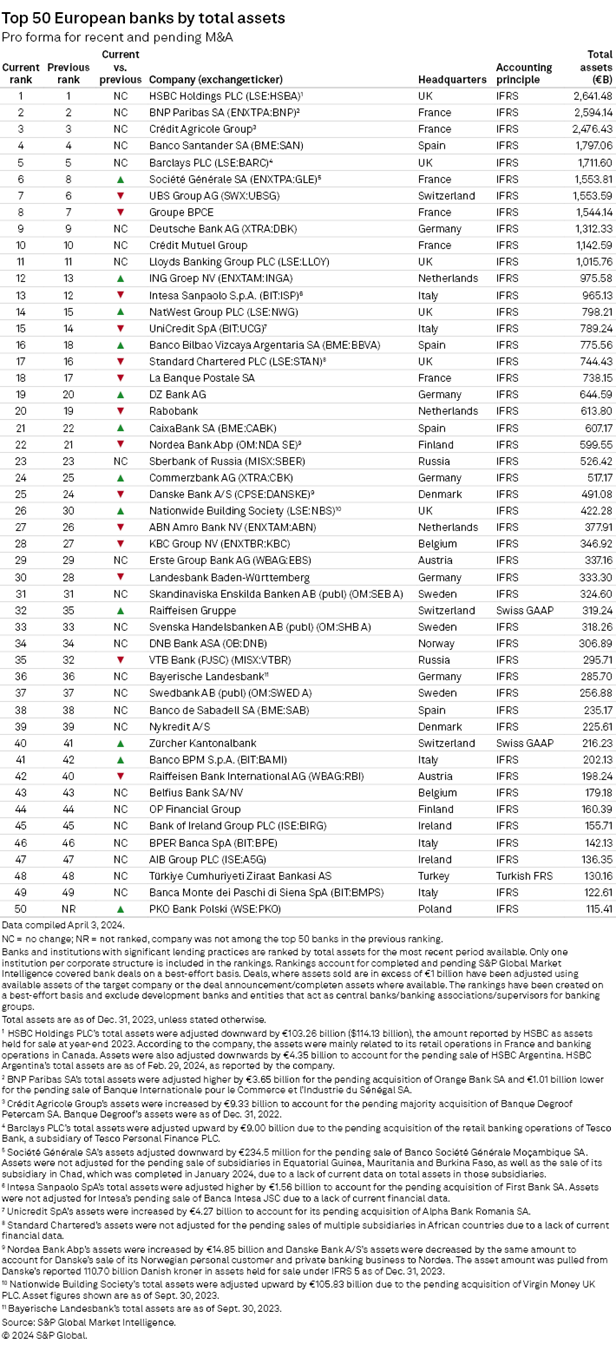

HSBC Holdings PLC held on to its position as Europe's biggest bank at the end of 2023, even as its continued push into Asia saw it dispose of assets in other parts of the world.

The UK-headquartered lender had assets of €2.641 trillion at the end of 2023, S&P Global Market Intelligence data shows.

Its ongoing efforts to sharpen its focus on Asia — where it generates most of its income — already triggered the sales of all or part of its businesses in other regions, notably Canada and France. More recently, HSBC reached a deal to sell its operations in Argentina for up to $550 million. It was also reported to be exploring a potential sale of some of its businesses in Germany.

At the same time, HSBC made several acquisitions in Asia, including Citigroup Inc.'s retail wealth management portfolio in China, comprising roughly $3.6 billion in assets and deposits.

France's BNP Paribas SA was not far behind in second place, with assets of €2.594 trillion, the data shows.

The Paris-based bank, which has been looking to redeploy €11.6 billion in capital gains from its €16.3 billion sale of US-based Bank of the West, said in October 2023 that it could invest more of its excess capital in mergers and acquisitions in 2024. It recently secured a deal to take over Orange Bank SA's customer portfolios in France and Spain.

![]()

For the latest ranking, company assets were adjusted on a best-efforts basis for pending mergers, acquisitions and divestitures, as well as M&A deals that closed after the end of the period. To be eligible for inclusion in pro forma adjustments, the amount of assets being transferred had to be at least $1 billion, unless otherwise noted. Assets reported by non-US-dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an "as-reported" basis, and no adjustments were made to account for differing accounting standards. The majority of banks were ranked by total assets as of Dec. 31, 2023. In the previous ranking, published April 18, 2023, most company assets were as of Dec. 31, 2022, and were adjusted for pending and completed M&A as of March 31, 2023.

In addition to BNP Paribas, four other French banks made it to the top 10 of the list.

Crédit Agricole Group ranked third with €2.476 trillion in assets. The bank in 2023 agreed to take a €923 million majority stake in Belgian asset and wealth manager Banque Degroof Petercam SA, and earlier this year it announced it took a 7% stake in French payments group Worldline SA.

Société Générale SA climbed two notches to sixth spot, while Groupe BPCE and Crédit Mutuel Group claimed the eighth and 10th spots, respectively.

In the UK, mortgage lender Nationwide Building Society surprised markets in March when it announced a £2.9 billion deal to acquire Virgin Money UK PLC, marking the biggest bank deal in the UK since 2008. Nationwide rose four places higher to 26th, with assets of €422.28 billion as of Sept. 30, 2023.

High street rival Barclays PLC, meanwhile, in February said it agreed to acquire most of Tesco Personal Finance PLC's UK retail banking business for £600 million. Barclays remains at No. 5 on the list with €1.712 trillion.

Italy's UniCredit SpA and Intesa Sanpaolo SpA have registered an increase in their assets after inking deals to expand in Romania. UniCredit is merging its Romanian subsidiary with that of Alpha Services and Holdings SA as part of its investment in the Greek lender, while Intesa Sanpaolo will double its assets in Romania with its purchase of Bucharest-based First Bank SA.

Both banks slipped one notch to rank 13th and 15th, respectively.

Swiss bank UBS Group AG, whose assets grew following its state-engineered acquisition of Credit Suisse, has made progress on scaling back its former rival's operations. UBS recently agreed on a deal for the latter's wealth management business in Japan and was reported to be in talks relating to Credit Suisse's China platform and Turkish investment bank. However, UBS continued to face increased regulatory scrutiny due to its scale and market dominance and will be required to meet higher capital requirements.

UBS had assets of €1.554 trillion as of 2023-end and is down a notch to seventh on the list.

Meanwhile, PKO Bank Polski SA has joined the list to rank 50th. The Polish lender's assets totaled €115.41 billion as its customer base grew and loans and deposits increased, helping drive a 66% rise in its 2023 net profit.

France and the UK continued to have the highest number of banks on the list with six each, followed by Germany and Italy with five apiece and Spain with four.

French banks had the highest aggregate asset value at €10.049 trillion.