Worldwide bank ranking series

Click to view stories in this series as they are published

Capital One Financial Corp.'s announced acquisition of Discover Financial Services shook up the top 50 US bank rankings.

The announced acquisition boosted Capital One's total assets above $500 billion on a pro forma basis in the 2023 fourth quarter, logging the largest asset increase at 33.6%. With the addition of Discover's $151.52 billion in assets at Dec. 31, 2023, Capital One jumped to the eighth-largest US bank by total assets, up from No. 12 at the end of the third quarter, according to S&P Global Market Intelligence data.

Largest US bank deal in 15 years

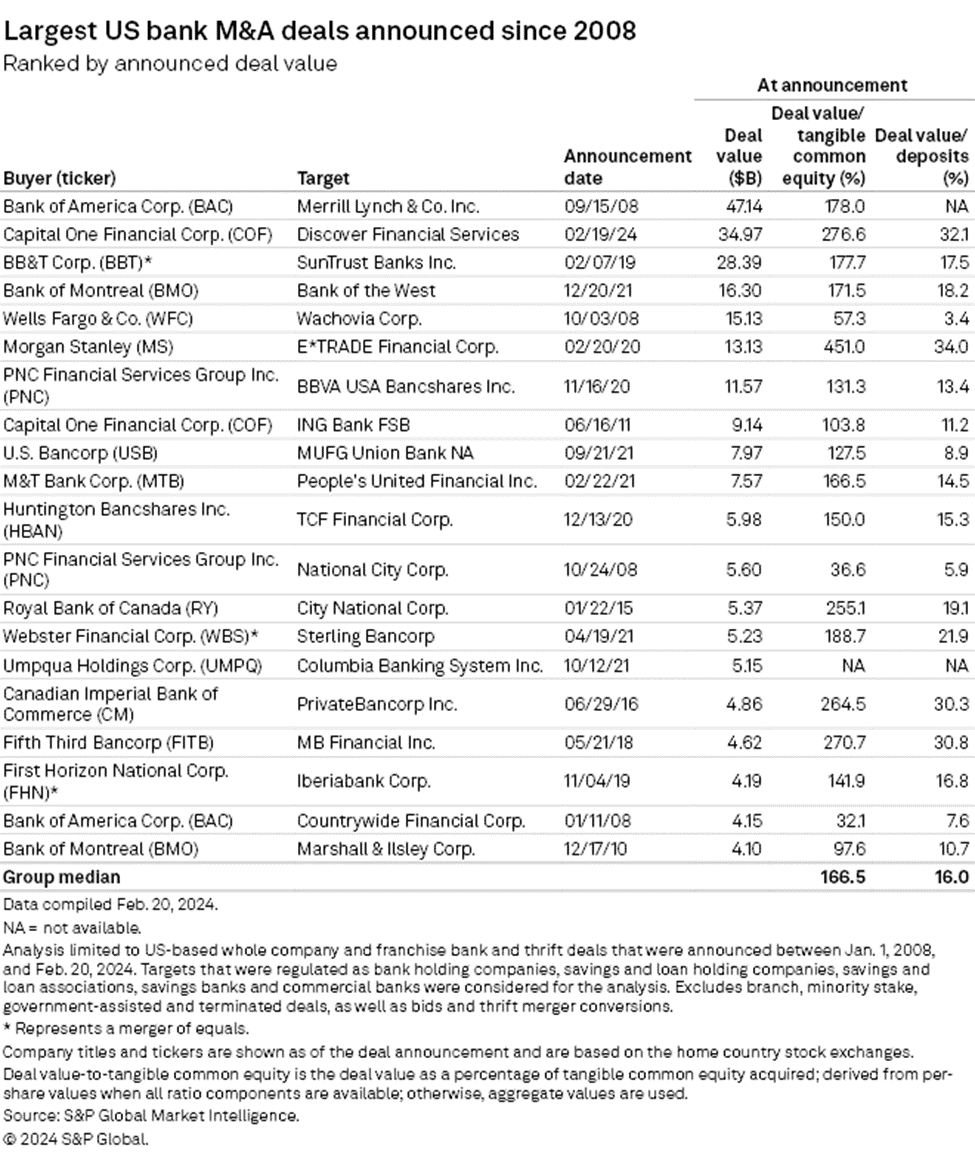

On Feb. 19, Capital One announced the acquisition of Discover Financial for $34.97 billion, marking the second-largest US bank deal since Bank of America Corp.'s acquisition of Merrill Lynch & Co. Inc. for $47.14 billion during the 2008 financial crisis.

A tough regulatory review threatens the deal's approval, which is already facing opposition from the National Community Reinvestment Coalition and lawmakers who believe it will hurt financial stability.

![]()

To conduct this analysis, S&P Global Market Intelligence examined the largest US banks and thrifts by assets with a deposits-to-assets ratio of at least 25% or at least $30 billion in deposits as of quarter-end.

To compile a pro forma ranking, S&P Global Market Intelligence calculates pro forma assets after accounting for pending M&A transactions as well as transactions that closed after quarter-end. To be included in pro forma adjustments, the deal value must be over $1 billion or involve assets or deposits in excess of $5 billion. Loan portfolio deals are not included because of a general lack of data on both deal consideration and the impact on total assets.

Combined assets of Big 4 increase

Aggregate assets at the four largest US banks increased $70.69 billion, or 0.6%, in the fourth quarter of 2023.

However, JPMorgan Chase & Co., the largest US bank by total assets, reported a sequential decrease of $22.94 billion, or 0.6%, while Bank of America, Citigroup Inc. and Wells Fargo & Co. reported sequential asset growth of 0.9%, 1.8% and 1.2%, respectively.

Top gainers and losers

Thirty-six of the 50 largest US banks and thrifts reported sequential asset growth in the fourth quarter of 2023, while only 14 banks reported declines.

Altogether, the 50 institutions reported a total of $23.141 trillion in assets as of Dec. 31.

New York Community Bancorp Inc. posted the second-largest increase in the period as its assets grew 4.6% to $116.32 billion. New York Community's purchase of Flagstar Bancorp Inc. and the failed Signature Bridge Bank NA helped diversify its loan portfolio but also pushed the company past $100 billion in assets, which makes it subject to tougher regulatory standards.

Following a bruising quarter that saw the bank report a net loss of $260 million as it set aside provisions due to weakness in its office and multifamily loan portfolios, the bank is considering asset sales and a capital raise to strengthen its balance sheet.

Meanwhile, HSBC North America Holdings Inc. logged the highest sequential decrease in total assets at 2.2%, followed by Citizens Financial Group Inc., which logged a 1.4% decline.

Growth outlook

Bankers expect growth for the industry to continue in 2024.

According to S&P Global Market Intelligence's fourth-quarter US Bank Outlook Survey, bankers are becoming more optimistic about loan growth, with 62.1% of those surveyed expecting higher balances at their institution over the next 12 months, up from 56.9% from the third-quarter survey. However, the majority of bankers are still expecting a recession within a year.

US bank M&A activity is also expected to bounce back in 2024 with several US banks already showing interest in pursuing M&A deals.