Worldwide bank ranking series

Click to view stories in this series as they are published

Dozens of lenders dropped down S&P Global Market Intelligence's annual list of the world's largest banks by assets as monetary policy tightening in 2023 weighed on loan demand and growth in many regions.

Forty-seven banks fell in the ranking, while 29 rose and 24 maintained their places.

Industrial and Commercial Bank of China Ltd., with assets of $6.303 trillion, retained its place as the world's biggest bank as the Chinese megabanks occupied the top four positions. Agricultural Bank of China Ltd. overtook China Construction Bank Corp. to claim second place, in what was the only change to the top six spots from a year ago. Bank of China Ltd. placed fourth.

Agricultural Bank of China achieved loan growth of 14.5% in 2023, thanks to a national strategy to build a strong agricultural sector. China Construction Bank's loan growth was 12.6%.

Overall, Chinese banks took 20 places in the ranking. Despite a downturn in the property sector, China's overall banking assets grew between 9.6% and 11.1% over 2023, before moderating to 8.9% in February 2024, according to data from the National Financial Regulatory Administration.

Seven of the eight Japanese banks on the list fell in the ranking. The lone exception was Sumitomo Mitsui Financial Group Inc., which maintained its place at number 13.

India-based HDFC Bank Ltd. was a new entrant, landing in 74th position, after its assets increased to $464.34 billion following a merger with its parent company.

![]()

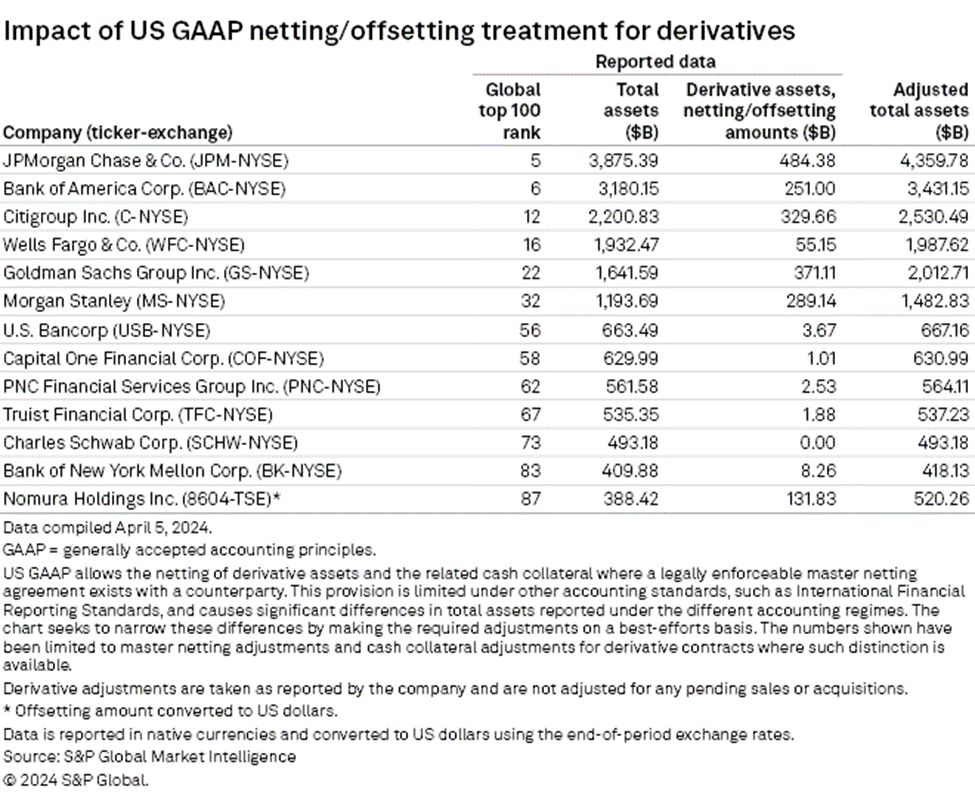

For the latest ranking, company assets were adjusted on a best-efforts basis for pending mergers, acquisitions and divestitures, as well as M&A deals that closed after the end of the period. To be eligible for inclusion in pro forma adjustments, the amount of assets being transferred had to be at least $1 billion, unless otherwise noted. Assets reported by non-US-dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an "as-reported" basis, and no adjustments were made to account for differing accounting standards. The majority of banks were ranked by total assets as of Dec. 31, 2023. In the previous ranking, published April 17, 2023, most company assets were as of Dec. 31, 2022, and were adjusted for pending and completed M&A as of March 31, 2023.

A 'dog fight'

Loan growth slowed across the world in 2023 as inflation hit economic growth and prompted central banks to increase rates, resulting in banks tightening lending standards.

"Loan growth is a dog fight right now," Bank of America Corp. (BofA) Chairman and CEO Brian Moynihan said in March.

BofA, with assets of $3.180 trillion, remained the sixth-largest bank in the world and second largest in the US, behind JPMorgan Chase & Co., which remained the fifth biggest globally. Citigroup Inc. fell one spot to 12th place — though it was still the third biggest in the US — as it continued to sell noncore assets as part of a restructuring.

European banks also experienced weaker loan growth in 2023. The European Central Bank, outlining the findings of its bank lending survey in January, said the impact of past tightening will continue to dampen loan growth in upcoming quarters.

Some of the biggest banks in the continent shed assets in 2023 and continue to do so in 2024, notably UK-headquartered HSBC Holdings PLC, which sold its Canadian operations and its retail business in France and has agreed to sell its Argentine business. It is nonetheless Europe's biggest bank, with assets of $2.920 trillion.

France-based BNP Paribas SA ranked eighth on the list with $2.867 trillion in assets. Fellow French bank Société Générale SA rose to 19th place from 22nd last year despite selling some businesses in Africa and mulling sales of other assets.

Looking ahead

Loan growth will be modest in 2024 amid challenging macroeconomic conditions and despite interest rates being expected to come down, according to the Deloitte Center for Financial Services. Banks are also expected to continue with their tight lending policies.

The impact of these macroeconomic conditions, meanwhile, is expected to vary across loan categories, and stress is likely to persist in the real estate market, Deloitte said. Demand for consumer lending will likely remain strong, but that for corporate loans may weaken before picking up later in the year.

In China, the government is targeting economic growth of 5% in 2024 after marginally exceeding a similar goal in 2023. The International Monetary Fund, however, expects mainland China's economy to grow at 4.6% in 2024, according to its World Economic Outlook Update in January.