S&P Global Ratings' National Scale Credit Ratings are an opinion of an obligor's creditworthiness (Issuer, Corporate, or Counterparty Credit Rating) or overall capacity to meet specific financial obligations (Issue Credit Rating), relative to other issuers and issues in a given country.

National Scale Credit Ratings provide a rank ordering of credit risk within the country. Given the focus on credit quality within a single country, national scale credit ratings are not comparable between countries. S&P Global Ratings also assigns regional scale credit ratings for certain groups of countries.

Regional Scale Credit Ratings have the same attributes as National Scale Credit Ratings in that they are not comparable to other regional or national scales, and are a relative rank order within the region and exclude direct sovereign risks of a general or systemic nature. The Regional Scale Ratings definitions are the same as the National Scale Credit Ratings definitions but with the word "national" replaced with the word "regional”.

Both National and Regional Scale Credit Ratings use S&P Global Ratings global rating symbols with the addition of a two-letter prefix to denote the country or region.

National & Regional Scale Credit Rating Prefix

|

Scale Name

|

Prefix

|

Countries

|

|

Argentina National Scale

|

ra

|

Argentina

|

|

Brazil National Scale

|

Br

|

Brazil

|

|

Canada National Scale

|

no prefix

|

Canada

|

|

CaVal (Mexico) National Scale

|

mx

|

Mexico

|

|

Gulf Cooperation Council Regional Scale

|

gc

|

Gulf Cooperative Council countries

|

|

Kazakhstan National Scale

|

kz

|

Kazakhstan

|

|

Maalot (Israel) National Scale

|

Il

|

Israel

|

|

Nigeria National Scale

|

ng

|

Nigeria

|

|

Nordic Regional Scale

|

no prefix

|

Denmark, Finland, Sweden

|

|

Russia National Scale

|

ru

|

Russia

|

|

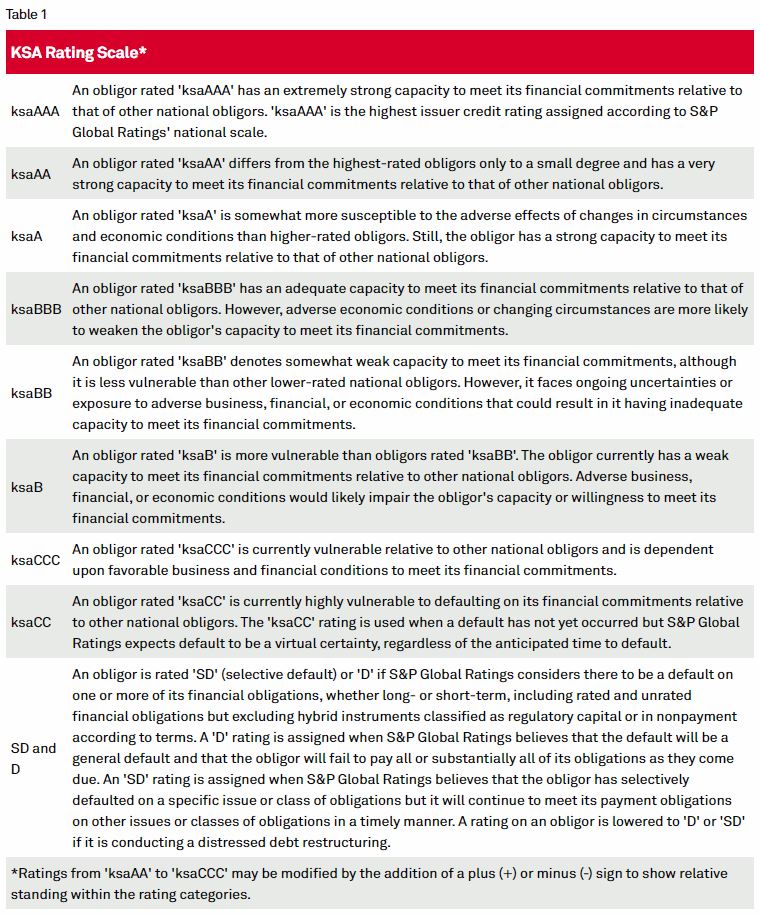

Saudi Arabia National Scale

|

ksa

|

Saudi Arabia

|

|

South Africa National Scale

|

za

|

South Africa

|

|

Taiwan Ratings National Scale

|

tw

|

Taiwan

|

|

Turkey National Scale

|

tr

|

Turkey

|

|

Ukraine National Scale

|

ua

|

Ukraine

|

|

Uruguay National Scale

|

uy

|

Uruguay

|