| Economic Risk | 4 |

|---|

| Economic Resilience | High Risk |

|---|---|

| Economic Imbalances | Low Risk |

| Credit Risk In The Economy | Intermediate Risk |

| Industry Risk | 5 | |

|---|---|---|

| Institutional Framework | High Risk |

|---|---|

| Competitive Dynamics | High Risk |

| Systemwide Funding | Low Risk |

BICRA Highlights

| Overview | |

|---|---|

| Key strengths | Key risks |

| The banking sector's good efficiency and profitability, supported by strong digital capabilities. | Higher nonperforming loans (NPLs) and credit losses than many European peers. |

| No particular overvaluation risk in the housing market and sustained low unemployment. | Negative government interference repeatedly leading to additional cost burdens on banks, and notable government ownership might distort competition. |

| Stable funding and sound liquidity profiles based on domestic customer deposit funding and sizable security holdings. | Litigation risks from the Swiss franc-denominated legacy mortgages of several systemically important banks, which could still depress their profitability. |

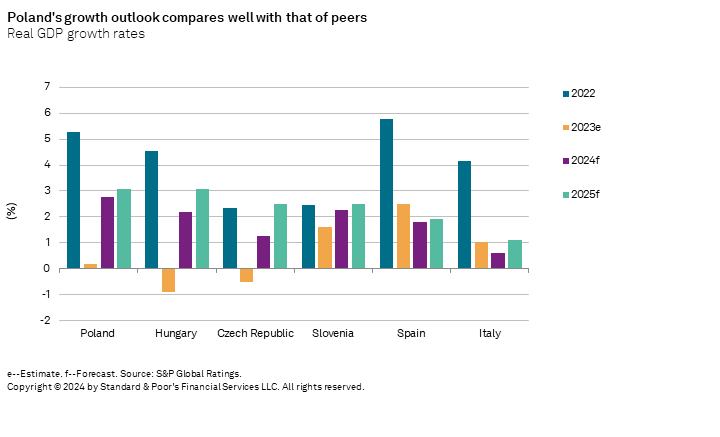

S&P Global Ratings expects Poland's economy to rebound in 2024 providing a favorable operating environment for banks. Despite geopolitical risks from the Russia-Ukraine war and a broader economic slowdown in Europe, we expect Poland's economy to remain resilient. After a temporary slowdown in 2023, with real GDP increasing only 0.2%, we anticipate that growth will pick up over 2024, due to stronger private consumption and the inflow of EU funds. We expect the labor market to remain resilient, with unemployment remaining near historical lows and robust real wage growth, which should also support house prices and prevent material rises in credit losses in the retail business. Given improving economic conditions and the working out of legacy problem loans, we expect NPLs to drop slightly. Positively, the continuing high policy rates support strong operating profitability in 2024 and 2025. However, with likely rate cuts starting in 2025, we expect banking sector profitability to decrease to more normal levels of about 10%.

Legal risks from Swiss franc (CHF)-denominated mortgages should gradually recede. On June 15, 2023, the European Court of Justice ruled in favor of mortgage holders and declared that the loans were invalid as it contained "unfair terms" and the banks are not allowed to charge clients for the use of capital. This resulted in higher provisioning needs by Polish banks on their legacy mortgage loan portfolios denominated foreign currencies as final court rulings and voluntary settlements became more costly. However, the materially improved operating profits during the year reinforced their ability to absorb these costs. Legal costs will continue to accrue but should gradually recede, with the pace depending on the proportion of clients with already-repaid loans that will target the legal route or settlements.

Risks to the banking sector's competitive dynamics and governance stem from government intervention. We continue to see high government involvement through state ownership of domestic banks and a track record of government intervention, which we regard as negative for the sector. The new government will need to prove its potentially more orthodox stance towards the sector, which could support investor confidence and ultimately improve domestic banks access' to internal capital markets. Despite the recent prolongation of credit holidays, the introduction of eligibility criteria will make it less costly for banks than the 2022 credit holidays. We expect to see further changes in management boards of state-related banks but no noteworthy strategic changes.

Economic And Industry Risk Trends

The economic risk trend for banks operating in Poland is stable. Despite near-term challenges from the conflict in Ukraine, we expect the Polish economy's resilience to protect banks from a structural increase in credit losses. However, pressure would most likely arise from stickier inflation, which we expect to reach about 4% in 2025 from highs of 13.21% in 2022. Positively, the Polish economy proved its resilience during the pandemic and ensuing inflationary period, and the new pro-European central government and flow of EU funds could further support the economic outlook and resilience.

We view the trend for industry risk for Polish banks as stable. High interest rates support domestic banks' strong operating profitability, reinforcing their ability to absorb higher credit, legal, and operational costs. Legacy foreign-exchange mortgage loans continue to be challenged in courts and require material legal risk provisions. However, we expect affected banks to largely absorb these costs from operating profitability without impairing their capital positions. We continue to see risk from government intervention and will observe the effectiveness of the new government formed in 2023 in considering a more favorable view on industry risk.

Economic Risk | 4

Economic resilience: Economic growth is projected to rebound while the war in neighboring Ukraine remains the key risk

After a temporary slowdown in 2023, we expect Poland's economy to rebound, growing about 3% annually over 2024 and 2025. We think a tight labor market with rising real wages and improving consumer confidence will support consumption, and a relatively loose fiscal stance to further drive domestic demand. Our view is also supported by moderating inflation and the European Commission's unblocking of funds, which we expect to underpin investment.

However, on balance, we continue to assess Poland's economic resilience as high risk, considering its relatively low wealth levels in a global context, ongoing economic risks from the Russia-Ukraine War, somewhat sticky core inflation, and the economic slowdown in key trading partners.

Chart 1

Table 1

| Poland--Economic resilience | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024f | 2025f | ||||||||||

| Nominal GDP (bil. $) | 596 | 599 | 681 | 690 | 811 | 914 | 1,000 | |||||||||

| GDP per capita ($) | 15,697 | 15,792 | 18,378 | 18,698 | 22,072 | 24,912 | 27,328 | |||||||||

| Real GDP growth (%) | 4.4 | (2.0) | 6.9 | 5.6 | 0.2 | 2.8 | 3.1 | |||||||||

| Inflation (CPI) rate (%) | 2.1 | 3.6 | 5.2 | 13.2 | 10.9 | 5.0 | 4.4 | |||||||||

| Monetary policy steering rate (%) | 1.5 | 0.1 | 1.8 | 6.8 | 5.8 | 5.8 | 4.5 | |||||||||

| Net general government debt as % of GDP | 40.5 | 50.1 | 46.8 | 43.3 | 43.8 | 45.8 | 47.5 | |||||||||

| CPI--Consumer Price Index. f--Forecast. Sources: S&P Global Ratings. | ||||||||||||||||

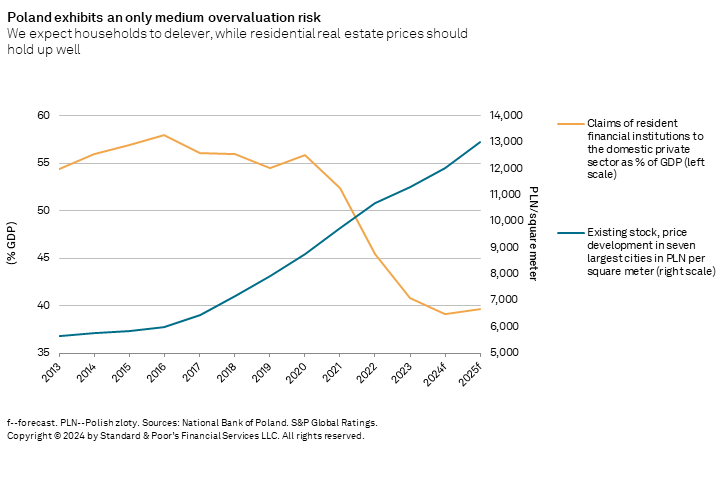

Economic imbalances: We expect real house price growth to pick up in 2024

We consider economic imbalances in Poland low risk. With financing conditions tightening over 2022 and 2023, residential house prices fell in real terms. The introduction of government subsidized mortgage lending programs in mid-2023 along with very low new construction, strong employment, high immigration, and real wage growth held up a revival of the nominal price growth over 2023.

With inflation easing and loan demand picking up, we anticipate that real house price growth will turn positive over 2024-2025. Combined with a stable labor market and improving real wage growth, and with the benefit from credit holidays and the Borrower Support Fund, we expect costs of risk in retail mortgages to remain low.

Lending exposure to higher risk commercial real estate sectors is immaterial for Polish banks and we do not consider it a source of systemic risk.

Chart 2

Table 2

| Poland--Economic imbalances | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024f | 2025f | ||||||||||

| Annual change in total private sector debt (% of GDP) | (4.2) | 3.1 | (3.1) | (9.3) | (6.1) | 1.7 | (1.0) | |||||||||

| Annual change in inflation-adjusted housing prices (%) | 8.7 | 6.6 | 6.4 | (3.6) | (5.4) | 1.4 | 3.9 | |||||||||

| Current account balance/GDP (%) | (0.2) | 2.5 | (1.2) | (2.4) | 1.6 | 1.3 | 0.3 | |||||||||

| Net external debt/GDP (%) | 8.8 | 3.9 | (1.1) | (3.6) | (5.3) | (5.6) | (5.6) | |||||||||

| f--Forecast. Sources: S&P Global Ratings. | ||||||||||||||||

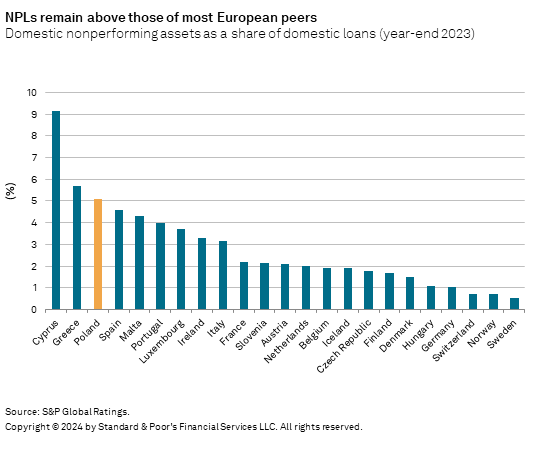

Credit risk in the economy: While asset quality metrics are likely to improve further, we expect them to remain structurally weaker than peers'

The debt capacity of Polish households and private sector leverage remain solid. Private sector debt fluctuated near 77%-87% of GDP over the past decade, but strong nominal GDP growth in 2022 and 2023, combined with a sharp reduction in loan demand, pushed the ratio down to about 62% in 2023, which is where we expect it to largely remain.

Considering improving economic conditions, easing inflation, and the prospect of lighter financing conditions and continuing working out of legacy NPLs, we expect this trend to continue, with the NPL ratio projected to decrease to 4.8% by 2025, down from 5.1% in 2023. However, compared with that of European peers, the Polish banking industry's asset quality remains weaker. This reflects comparably higher NPL ratios, longer workout processes, and a less established secondary market for NPLs.

Base-Case Credit Losses: We Expect Asset Quality To Improve Over 2024-2025

Backed by the general economic rebound, solid real wage growth, and a continuously tight labor market, we anticipate that asset quality metrics will improve over the coming two years. We expect credit losses to shrink to 40 basis points by 2026 from 57 basis points in 2023.

Chart 3

Table 3

| Poland--Credit risk in the economy | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024f | 2025f | ||||||||||

| Total private-sector debt (% of GDP) | 77.4 | 80.4 | 77.3 | 68 | 61.9 | 63.6 | 62.6 | |||||||||

| GDP per capita ($) | 15,697 | 15,792 | 18,378 | 18,698 | 22,072 | 24,912 | 27,328 | |||||||||

| Household debt as % of GDP | 34.4 | 34.6 | 32.2 | 26.6 | 23.7 | 22.6 | 21.7 | |||||||||

| Corporate debt as % of GDP | 42.9 | 45.8 | 45.1 | 41.4 | 38.2 | 41 | 40.9 | |||||||||

| Foreign currency lending as a % of total domestic loans | 19.3 | 19.5 | 17.7 | 19.2 | 17.4 | N/A | N/A | |||||||||

| Nonperforming assets (% of systemwide loans) | 6.1 | 6.5 | 5.4 | 5.2 | 5.1 | 4.9 | 4.8 | |||||||||

| Loan loss reserves (% of total loans) | 3.5 | 3.8 | 3.2 | 3.1 | 3.1 | 3.9 | 3.5 | |||||||||

| f--Forecast. N/A--Not applicable. Source: S&P Global Ratings. | ||||||||||||||||

Industry Risk | 5

Institutional framework: Banking supervision standards are largely in line with European peers', but risks from government intervention remains

In our view, the Polish Financial Supervisory Authority (KNF) applies international standards in banking regulation and supervision that are generally aligned with EU peers. While Poland is not in the eurozone and banks are not part of the Single Supervisory Mechanism, we consider the overall quality of regulation and supervision, and the regulatory track record, as still broadly in line. For example, we think that the KNF's recommendations have helped reduce loan-to-value ratios and risks for all mortgages, and we see mortgage lending standards as conservative in Poland. The resolution authority is effectively acting on struggling banks, like resolving Getin Noble in 2022 without any major impact on financial stability.

Government intervention has increased the sector's cost base over the last years. Among the most impactful measures: the introduction of general credit holidays in 2022, mandatory contributions to the borrower support fund, and a relatively high bank asset tax (0.44% based on banks' adjusted annual assets) since 2016. The asset tax increases banks' incentive to hold a high share of Polish government bonds in their portfolio, since these are tax-exempt; this increases the banks' sensitivity to sovereign risks.

These government interventions reflect a structural weakness of the Polish banking sector since the interests of different stakeholders are not always well-balanced. The political climate remains contentious, as highlighted by recent developments, including the motion to bring the Central Bank governor in front of the State Tribunal. Taken together, this influences investors' perception of Poland's financial market and weighs on our view of the institutional framework.

Competitive dynamics: High ownership of the state in domestic banking sector

We view Polish banks as having an adequate risk appetite in their traditional activities in retail and corporate banking but see risks from competitive dynamics overall as high due to state involvement in several large banks.

High interest rates continue to support very strong net interest margins and operating profitability increasing banks capacity to absorb any losses. However, we think this cyclical tailwind will gradually decrease, leading to return on equity that stabilizes at a higher level than from 2022 and before.

At the same time, we see a risk of market distortions from high government ownership. Concretely, the government maintains its stakes in Poland's two largest banks, PKO BP (29.4%) and Bank Pekao (indirectly, 32.8%), as well as the smaller Alior Bank (indirectly, 31.9%). Overall, this represents a materially stronger government ownership of domestic banks than in peer countries.

We consider the risk of tech disruption to Polish banks as low because the banks themselves provide advanced digital offerings and we expect digital banking products to become even more prevalent, benefiting the sector's efficiency (see "Tech Disruption In Retail Banking: CEE Banks Are On The Digital Fast Lane," published May 6, 2021, on RatingsDirect).

Table 4

| Poland--Competitive dynamics | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (%) | 2019 | 2020 | 2021 | 2022 | 2023 | 2024f | 2025f | |||||||||

| Return on equity (ROE) of domestic banks | 7.7 | (0.3) | 3.5 | 6.3 | 14.4 | 12.0 | 11.0 | |||||||||

| Systemwide return on average assets | 0.8 | (0.0) | 0.3 | 0.5 | 1.1 | 1.0 | 0.9 | |||||||||

| Market share of three largest banks | 44.0 | 43.6 | 44.2 | 45.0 | 42.2 | N/A | N/A | |||||||||

| Annual growth rate of domestic assets of resident financial institutions | 6.9 | 17.7 | 5.2 | 1.2 | 4.5 | 9.4 | 10.1 | |||||||||

| f--Forecast. N/A--Not applicable. Sources: S&P Global Ratings. | ||||||||||||||||

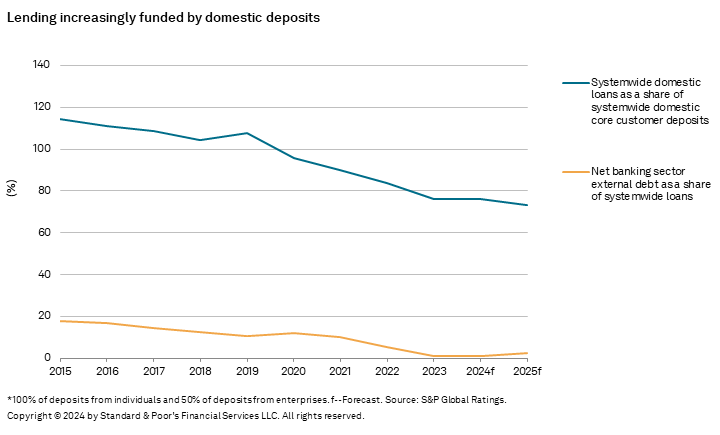

Systemwide funding: A strong deposit base with limited need of wholesale funding

Our systemwide funding assessment of low risk reflects the Polish banking sector's strong domestic deposit base, which has been spurred by economic growth and higher wages and wealth over the past decade. Most recently, increased savings, especially since the pandemic, have further increased deposits at local banks. Therefore, the country's ratio of domestic loans to S&P Global Ratings-adjusted core customer deposits decreased further to about 76% and we expect it to remain below 80%.

Over the past decade, funding conditions for the domestic banking sector have improved sustainably, including a reduced reliance on external funding. We expect net banking sector external debt to stay below 10% of domestic loans, compared with about 20% a decade ago. Overall, we think this makes banks' funding profiles resilient to shocks.

The ability of banks to place senior nonpreferred bonds to meet requirements on own funds and eligible liabilities underlined access to domestic and international investors, although these placements came at a cost.

Chart 4

Table 5

| Poland--Systemwide funding | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024f | 2025f | ||||||||||

| Systemwide domestic loans (% of systemwide domestic core customer deposits) | 107.6 | 95.8 | 89.8 | 83.9 | 76.2 | 76.3 | 73.2 | |||||||||

| Net banking sector external debt (% of systemwide domestic loans) | 10.6 | 11.9 | 10.2 | 5.1 | 0.9 | 1.2 | 2.3 | |||||||||

| Bonds and CP issued domestically by the resident private sector outstanding (% of GDP) | 10.7 | 13.5 | 15.3 | 6.1 | N/A | N/A | N/A | |||||||||

| CP--Commercial paper. f--Forecast. N/A--Not applicable. Sources: S&P Global Ratings. | ||||||||||||||||

Peer BICRA Scores

Table 6

| Poland--Peer BICRA scores | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Poland |

Hungary |

Czech Republic |

Slovenia |

Italy |

Malta |

|||||||||

| BICRA group | 4 | 5 | 3 | 4 | 5 | 5 | ||||||||

| Economic risk | 4 | 5 | 3 | 4 | 5 | 4 | ||||||||

| Economic risk trend | Stable | Stable | Negative | Stable | Stable | Stable | ||||||||

| Industry risk | 5 | 5 | 4 | 4 | 5 | 6 | ||||||||

| Industry risk trend | Stable | Stable | Stable | Stable | Stable | Stable | ||||||||

| Government support assessment | Uncertain | Uncertain | Uncertain | Uncertain | Uncertain | Uncertain | ||||||||

| Assessment as of April 26, 2024. (Group '1' to '10' represent lowest to highest risk.) Source: S&P Global Ratings. | ||||||||||||||

Government Support: Uncertain

We consider the likelihood of extraordinary government support for banks in Poland uncertain, so we do not include uplift for support in our ratings on systemically important banks. We consider the country's bank resolution framework effective, which could allow us to include uplift for additional loss-absorbing capacity in our ratings on individual systemically important banks.

Table 7

| Poland--Largest commercial financial institutions by total assets | ||||

|---|---|---|---|---|

| Bank | Total assets (bil. PLN) | |||

|

Powszechna Kasa Oszczednosci Bank Polski S.A. |

502 | |||

| Bank Pekao S.A. | 306 | |||

|

Santander Bank Polska S.A. |

277 | |||

|

ING Bank Slaski S.A. |

245 | |||

|

mBank S.A. |

227 | |||

| BNP Paribas Bank Polska S.A. | 161 | |||

|

Bank Millennium S.A. |

126 | |||

|

Alior Bank S.A. |

90 | |||

|

Bank Handlowy w Warszawie S.A. |

73 | |||

| PLN--Polish zloty. Sources: Company Reports. S&P Global Market Intelligence. | ||||

Related Criteria

- Banking Industry Country Risk Assessment Methodology And Assumptions, Dec. 9, 2021

- Financial Institutions Rating Methodology, Dec. 9, 2021

- Environmental, Social, And Governance Principles In Credit Ratings, Oct. 10, 2021

- Sovereign Rating Methodology, Dec. 18, 2017

- Country Risk Assessment Methodology And Assumptions, Nov. 20, 2013

Related Research

- Poland 'A-/A-2' Foreign Currency Ratings Affirmed; Outlook Stable, May 10, 2024

- Sector And Industry Variables For Banking Industry Country Risk Assessment Update Published For March 2024, March 26, 2024

- Research Update: Poland 'A-/A-2' Foreign Currency Ratings Affirmed; Outlook Stable, Dec. 1, 2023

- Rating Actions On Three Polish Banks Reflect Differing Provisioning Needs Following ECJ Ruling, June 27, 2023

- Poland, June 26, 2023

This report does not constitute a rating action.

| Primary Credit Analyst: | Heiko Verhaag, CFA, FRM, Frankfurt + 49 693 399 9215; heiko.verhaag@spglobal.com |

| Secondary Contact: | Nicolas Charnay, Frankfurt +49 69 3399 9218; nicolas.charnay@spglobal.com |

| Sovereign Analyst: | Ludwig Heinz, Frankfurt + 49 693 399 9246; ludwig.heinz@spglobal.com |

| Research Assistant: | Alexander Maichel, Frankfurt |

No content (including ratings, credit-related analyses and data, valuations, model, software, or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced, or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees, or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness, or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P’s opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment, and experience of the user, its management, employees, advisors, and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.spglobal.com/ratings (free of charge), and www.ratingsdirect.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.spglobal.com/usratingsfees.