Sustainability trends such as resource scarcity, climate change, or an aging population continuously reshape a company’s competitive environment. We are convinced that companies that can adapt to such challenges through innovation, quality, and productivity enhance their ability to generate long-term shareholder value. Developed 25 years ago, the CSA aims to identify companies that are better equipped to recognize and respond to emerging sustainability opportunities and challenges presented by global and industry trends.

Based on major global sustainability challenges identified by our ESG analysts at S&P Global, general assessment criteria relating to standard management practices and performance measures such as Corporate Governance, Human Capital Development, and Risk and Crisis Management are defined and applied to each industry in which companies are categorized for the assessment. The general criteria account for approximately 40–50% of the assessment, depending on the industry. The remaining part of the CSA questionnaire is made up of industry-specific risks and opportunities that focus on economic, environmental, and social challenges and trends that are relevant to companies within that industry. Within each criterion, we look for evidence of a company’s awareness of sustainability issues and for indications that it has implemented strategies to address them. We also evaluate the company’s progress in implementing such strategies as well as the quality of its reporting on these issues.

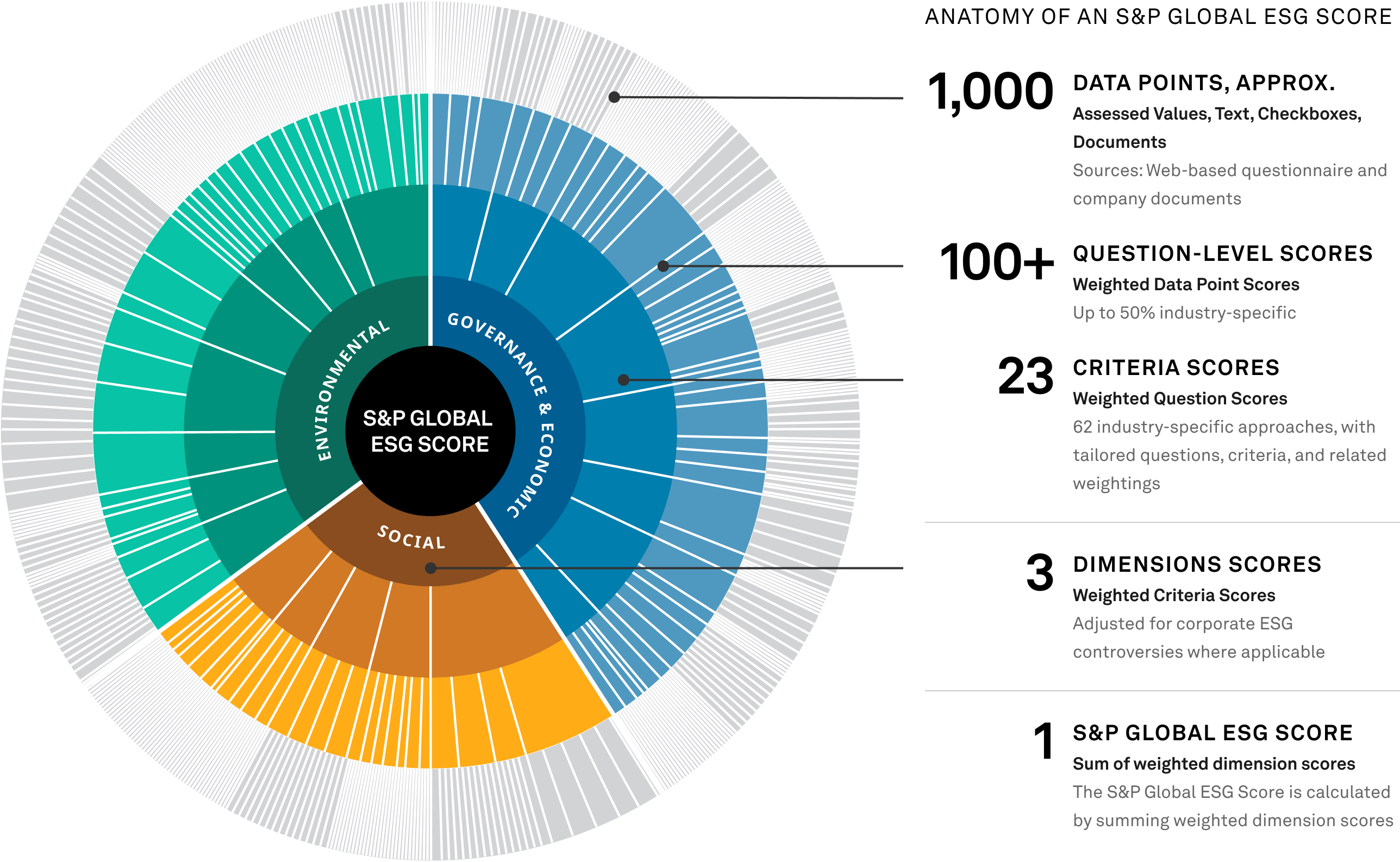

The S&P Global Corporate Sustainability Assessment (CSA) uses a consistent, rule-based methodology to convert an average of 1,000 data points per company to an S&P Global CSA Score (ranging from 0-100). The 62 industry-specific questionnaires each contain approximately 100-130 questions covering, on average, 23 different key themes across the economic, social, and environmental dimensions. The underlying metrics, questions, and criteria that make up the scores are weighted according to their relevance and materiality to a given sub-industry. S&P Global Sustainable1 defines a sustainability issue as material if it presents a significant impact on society or the environment and a significant impact on a company’s value drivers, competitive positioning, and long-term shareholder value creation.

Material sustainability issues can significantly affect an entity’s business operations, cash flows, legal or regulatory liability, and access to capital. They can also significantly improve or undermine an entity’s reputation and relationships with key stakeholders, society, and the environment. As such, S&P Global Sustainable1 considers double materiality as an integral part of the analysis of corporate sustainability performance and the resulting S&P Global ESG Scores.

The S&P Global CSA Score is the S&P Global ESG Score without the inclusion of any modeling approaches. S&P Global ESG and CSA Scores cannot be compared across industries. They measure a company’s sustainability performance relative to industry counterparts. The graphic below visualizes the CSA. The size of the segments reflects the financial materiality assigned at each level as well as the weight applied in the score aggregation process. Learn more at spglobal.com/esg/scores.