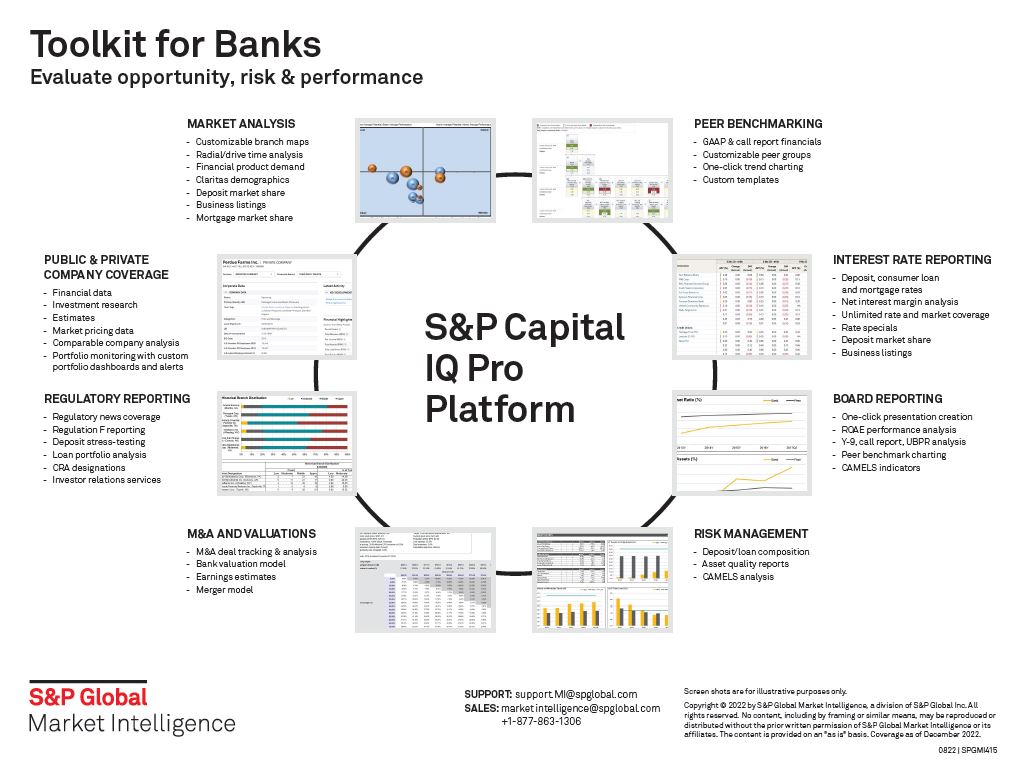

Finance

Balancing profitability and risk requires intelligence that cuts across silos

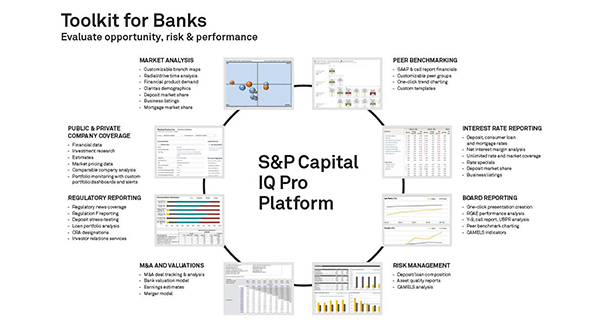

Community banks have reached a crossroads: Innovate or be left behind. Seize the moment with powerful reporting tools that bring essential insights to the surface, driving your institution’s performance and profitability.

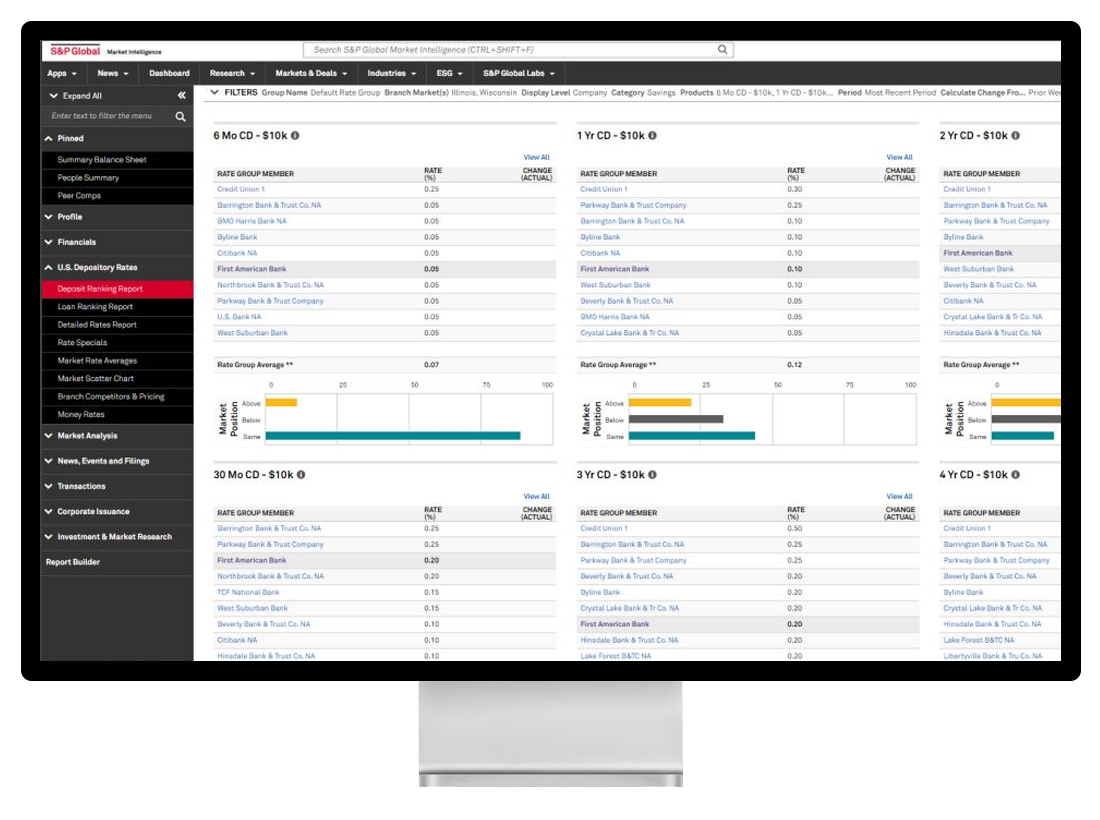

- Quickly compare yourself against your bank and credit union peers.

- Model mergers and acquisitions.

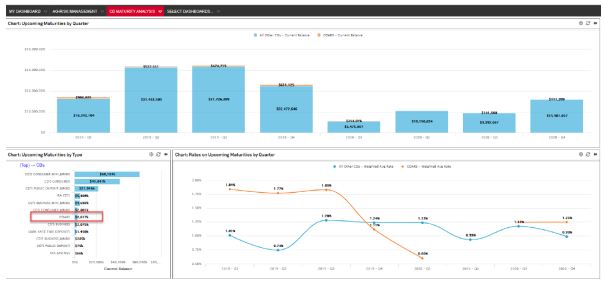

- Monitor and measure drivers of performance in real time.

- Prepare insightful reports for regulators and boards.