Finance

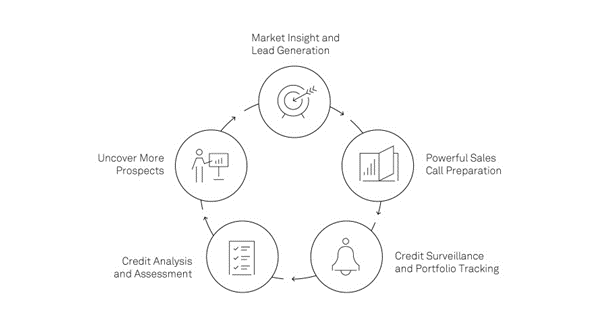

Balancing profitability and risk requires intelligence that cuts across silos

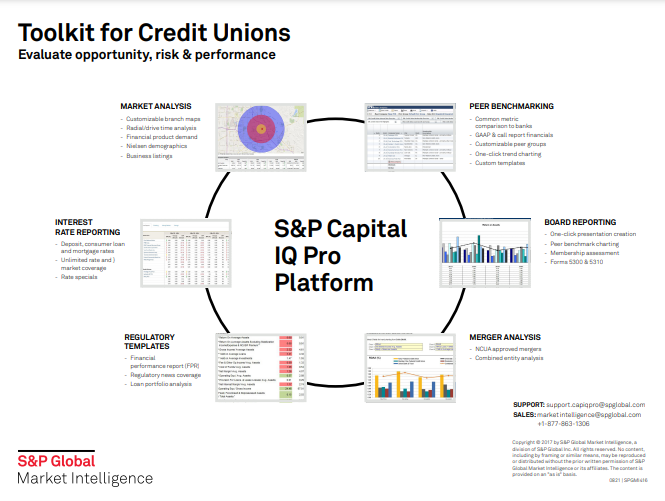

When given the chance to innovate or be left behind, which would you choose? Seize the moment with powerful reporting tools that bring essential insights to the surface, driving your institution’s performance and profitability.

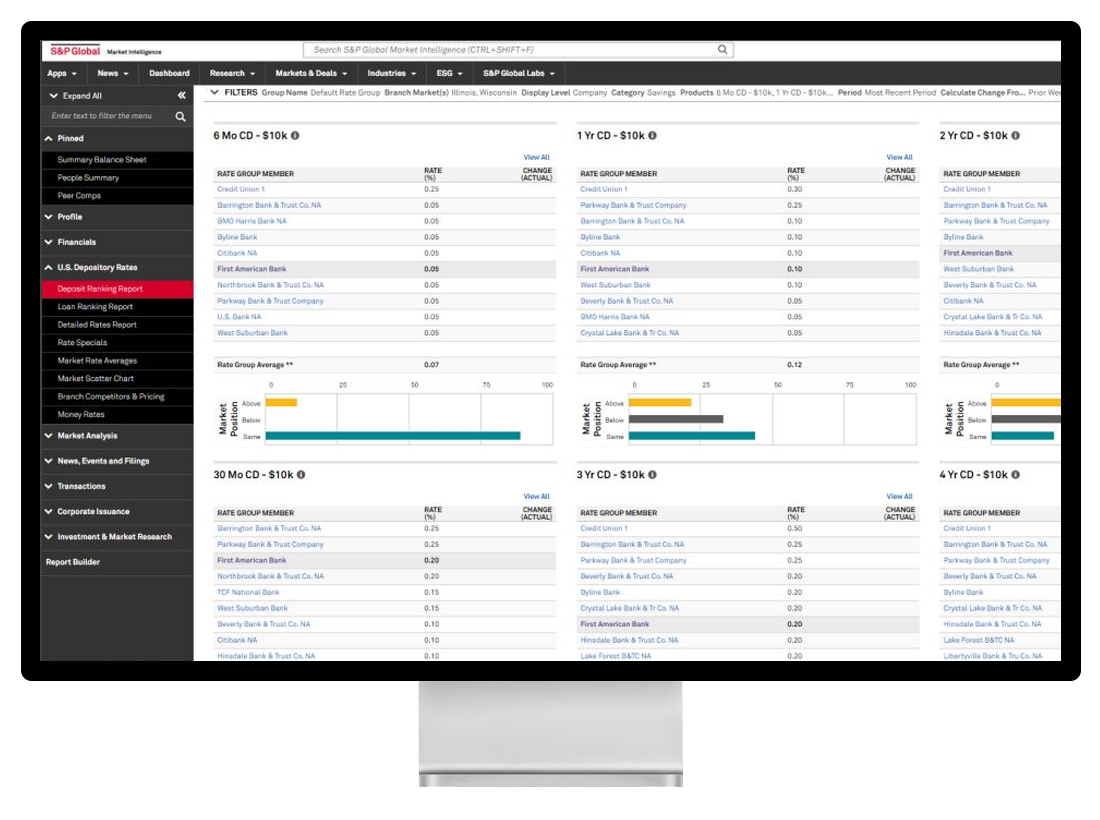

- Quickly compare yourself against your bank and credit union peers.

- Model mergers and acquisitions.

- Monitor and measure drivers of performance in real time.

- Prepare insightful reports for regulators and boards.