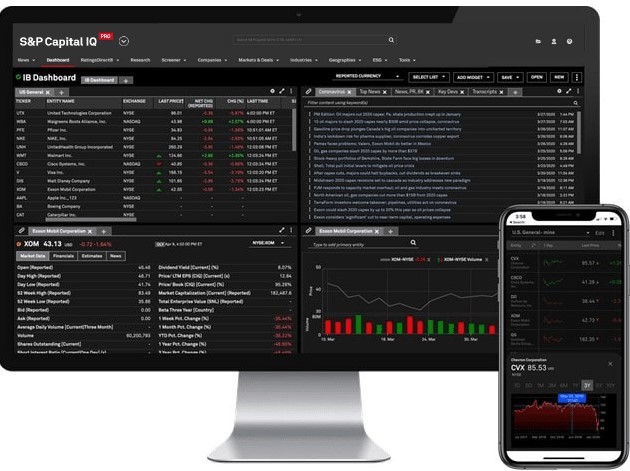

Desktop Intelligence

Fuel your decisions with a single source of actionable intelligence

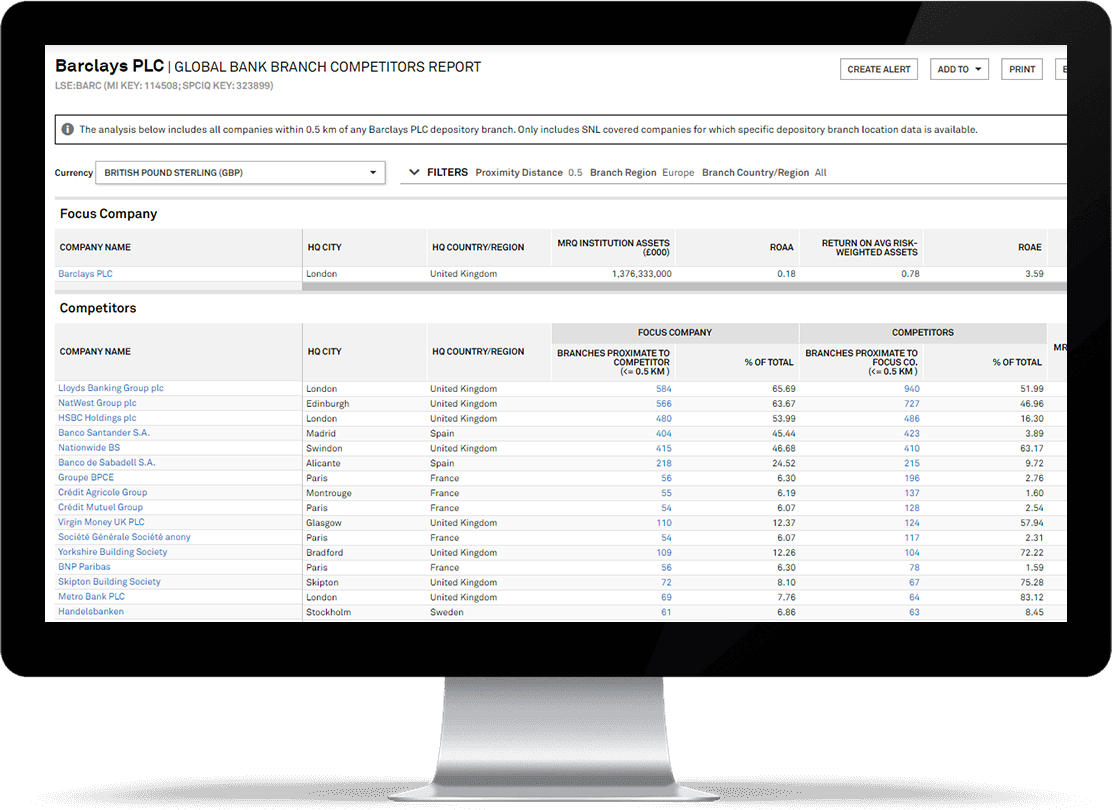

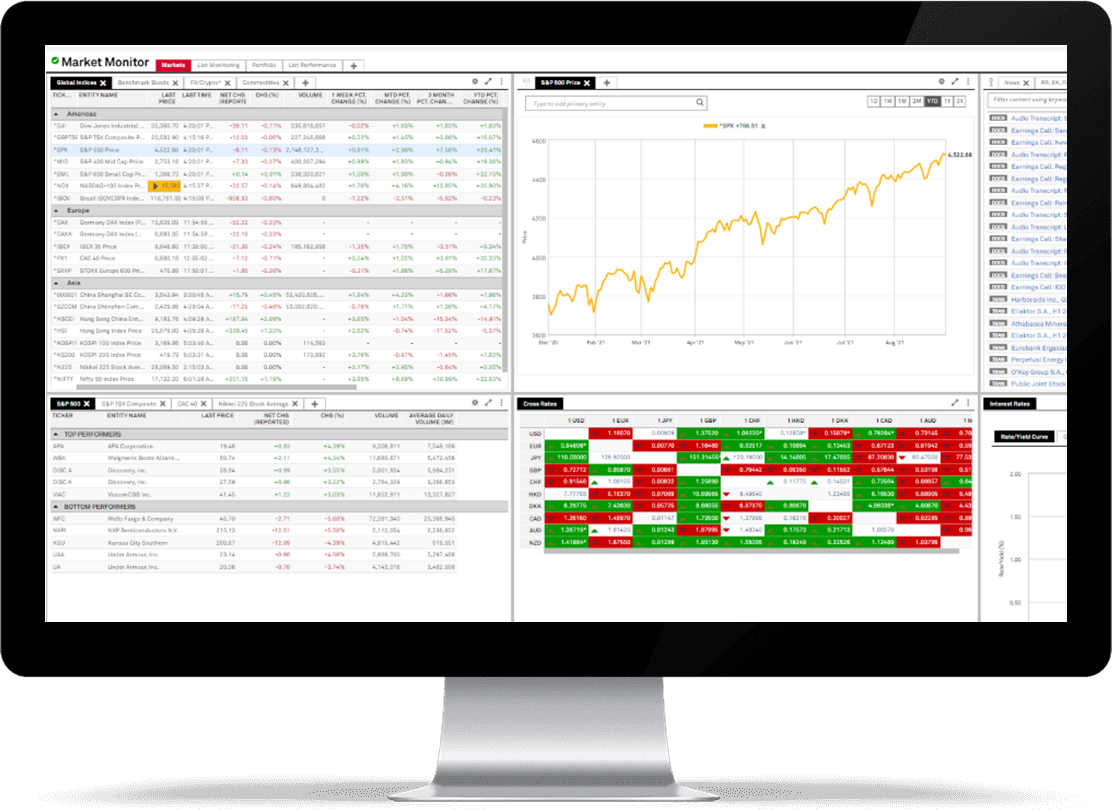

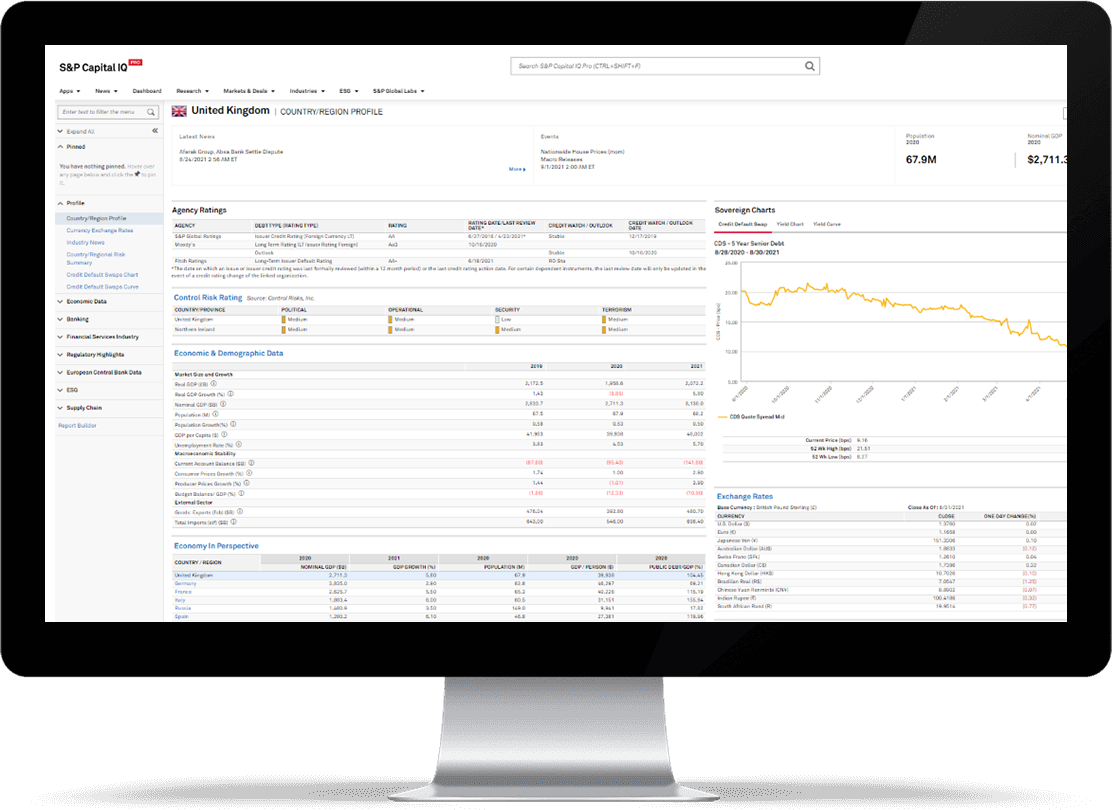

With S&P Capital IQ Pro's comprehensive, industry-specific data, the possibilities for driving top and bottom-line performance and strengthening your credit risk and counterparty risk assessment are yours. Gain access to data to help navigate volatility and identify risks in the banking sector with liquidity coverage ratio (LCR) composition as well as minimum requirements for capital ratios, leverage ratios, and TLAC/MREL ratios for US and Global banks. Enhance your fundamental commercial banking industry analysis and stay one step ahead of the competition with deep asset-level coverage, global public and private company information across key industries, and flexible and intuitive analytical tools. That's the power of S&P Capital IQ Pro.