S&P Global Ratings’ Credit Conditions Committees meet quarterly to review macroeconomic conditions in each of four regions (Asia-Pacific, Emerging Markets, Europe, and North America). Discussions center on identifying credit risks and their potential ratings impact in various asset classes, as well as borrowing and lending trends for businesses and consumers.

Access all Global Credit Conditions coverage >

ON THIS PAGE

Downside Scenario Global Asia-Pacific Emerging Markets Europe North America

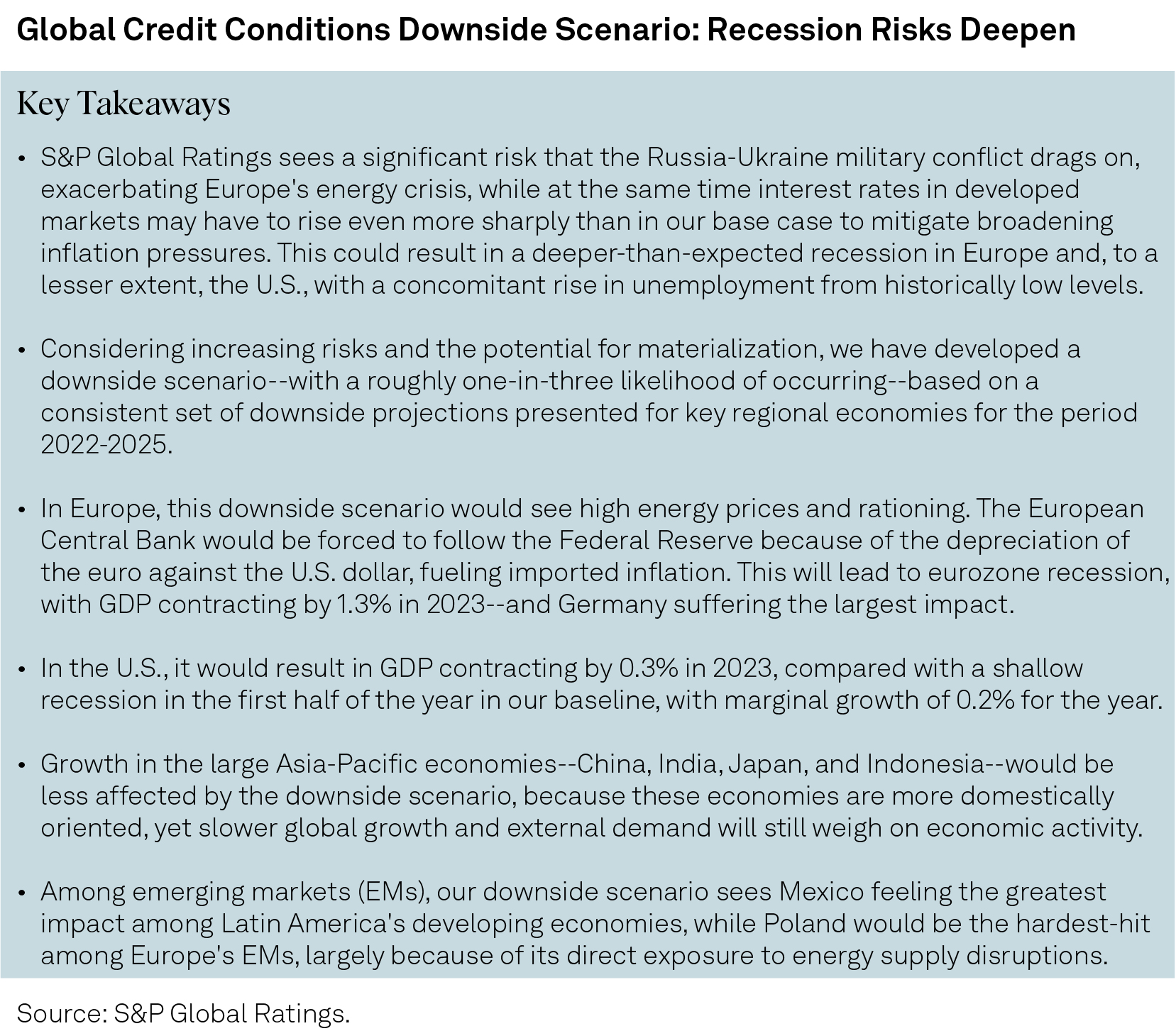

The potential for a prolonged period of rising inflation and low economic growth is increasing. Conditions remain fluid, and over recent weeks the U.K. and Germany have announced hefty support measures that could affect both our baseline and downside assumptions. Our downside scenario was designed to illustrate the sensitivity of key global economies to higher-than-expected policy rates and a prolonged energy crisis in Europe. This publication is aimed at providing the market with a sensitivity analysis if things were to deteriorate further compared with the estimates underpinning our base case.

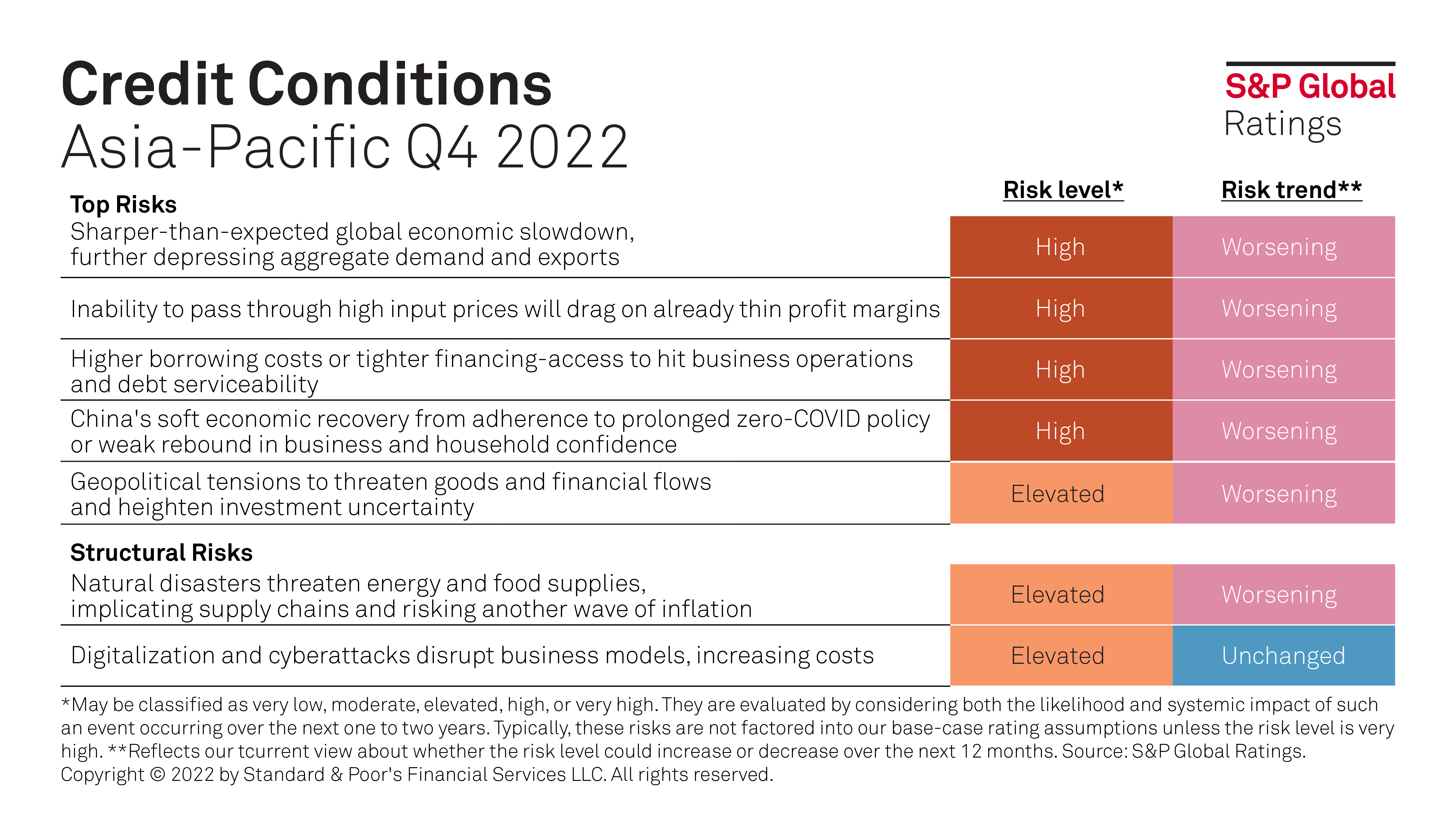

Lower growth. Asia-Pacific's economic growth is being hit by potential recessions in the U.S. and Europe, and China's lower growth rates. As the region is a net exporter, a global slowdown will hinder the recovery of corporate and government revenues, many of which aren't yet back to 2019 levels.

Higher cost of goods. Although consumer price index (CPI) inflation in parts of Asia-Pacific is not as high as in Europe or the U.S., the higher prices of energy, commodities and other goods are hurting borrowers. Energy subsidies are squeezing government finances. Many corporates have yet to fully pass through the additional cost of goods, implying some persistency of CPI inflation.

Tighter financing. Excepting China and Japan, official interest rates in the region are rising--in part to combat inflation, in part to defend domestic currencies against the strong U.S. dollar. Chinese authorities have lowered policy rates to boost the economy. Meanwhile, the Bank of Japan refuses to cave into market pressure. Regardless, investors and lenders are becoming more selective, particularly towards the lower end of the credit scale. This implies financing conditions may further tighten.

China slowing. China's intermittent lockdowns have dented consumption and economic activities. And the property sector slump has undermined market confidence. With real estate accounting for nearly a third of the country's GDP, prolonged weakness will subdue economic growth. We have cut our GDP growth forecast for China by 60-70 basis points (bps) to 2.7% in 2022 and 4.7% in 2023.

Ratings. The net rating outlook bias remains steady at negative 5% (August 2022). However, a deteriorating macroeconomic backdrop, high input prices and elevated borrowing costs pose significant rating downside for rated corporates and could lead to a spike in loan-loss provisions for banks.

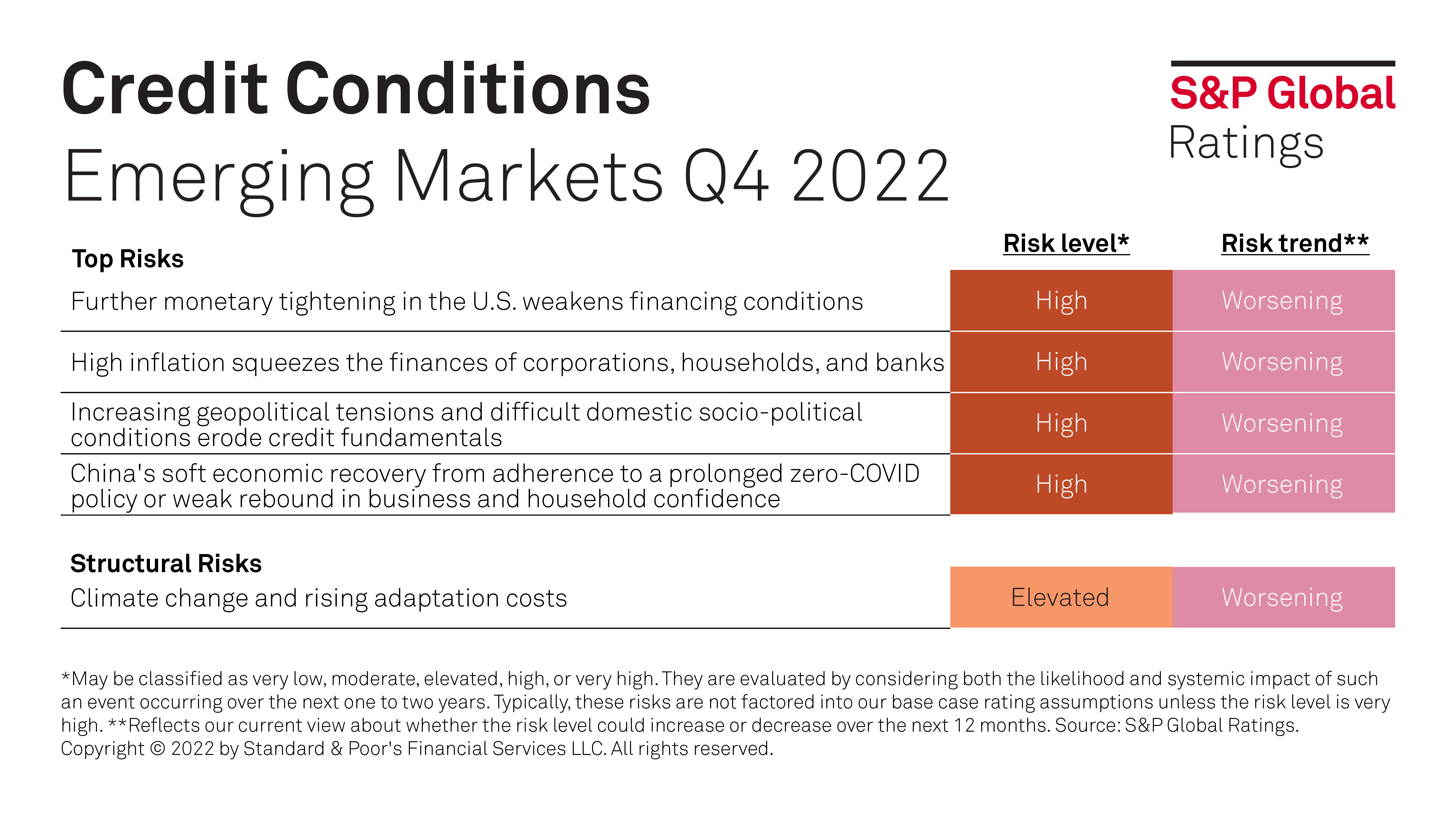

Overall: Tightening financing conditions, slower growth in China, weaker economic prospects in Europe, and a potentially deeper recession in the U.S. than projected signal tough times ahead for emerging markets (EMs).

With core inflation picking up, monetary policy will likely continue to tighten. Coupled with persistently high energy and food prices, we expect the effects on EM households, corporations, and banks to start surfacing.

Risks: A resolution of the Russia-Ukraine conflict seems far off. This--in addition to sustained gas supply disruption in Europe, more aggressive tightening by the Fed, and lower growth momentum in China--could hurt EMs by dampening global economic and trade growth.

Financing will be harder to come by and the strengthening of the U.S. dollar is not helping. Such a situation could fuel tensions and trigger social unrest, particularly for EMs with limited fiscal space or high debt. We believe international support is key to alleviating the pressure.

Credit: We expect our negative outlook bias for rated issuers across EMs to widen over the coming quarters because rising interest rates, persistent inflation, and weakening demand could erode corporate profits, households' purchasing power, and banks' asset quality. Few issuers will continue to benefit from this complex panorama, mainly commodity exporters.

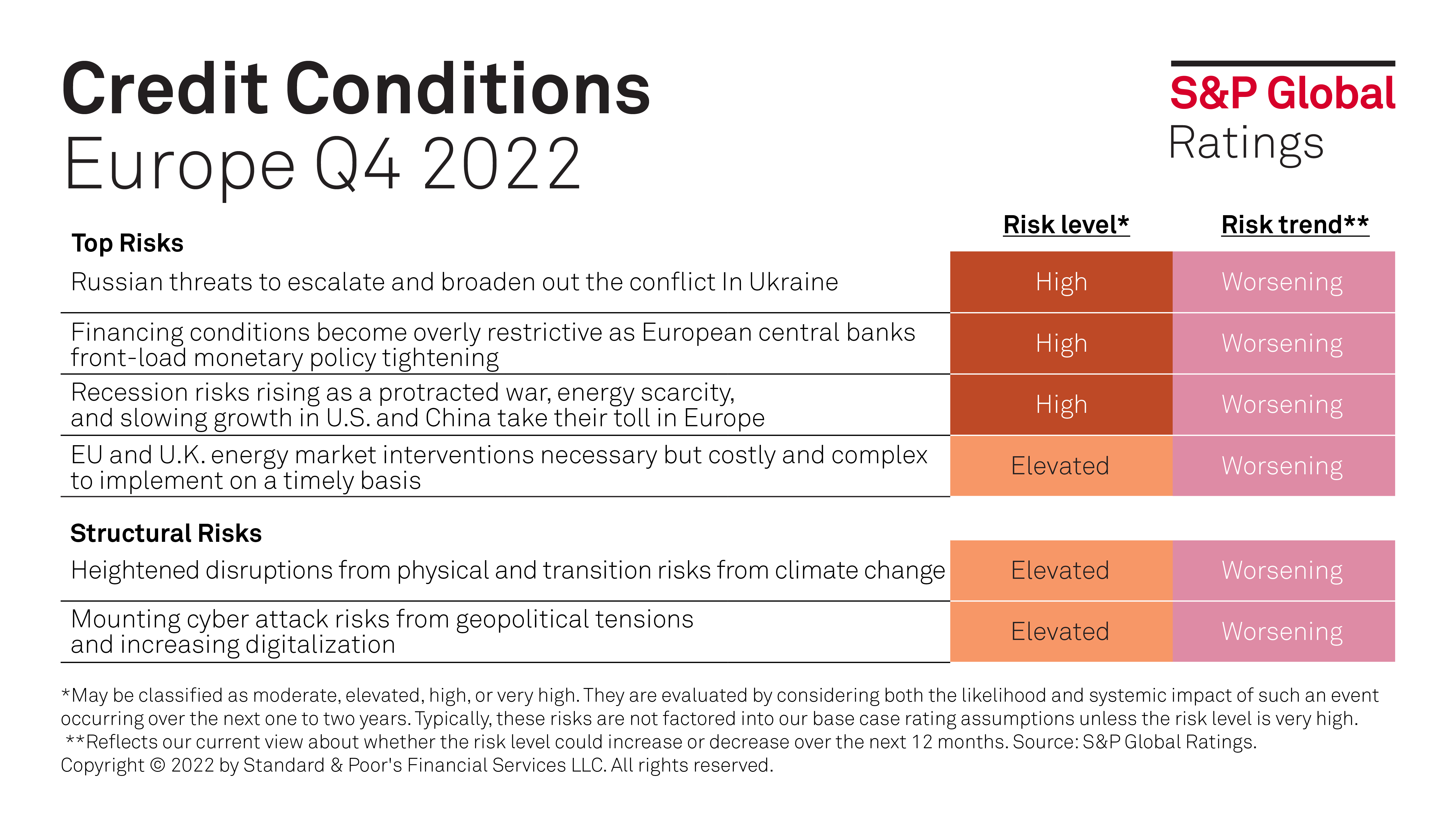

Overall: Europe faces a difficult and uncertain geopolitical and economic outlook as Russia’s political risk appetite appears to increase after losses of territory in Ukraine, and exorbitant energy prices fuel inflation, triggering interventions to support consumers and businesses, with central banks recalibrating interest levels in quick order. We expect the eurozone to stagnate in 2023 after contracting in late 2022 and early 2023, while we believe the U.K. is already in the throes of a moderate four-quarter recession that started in the second quarter.

Risks: Russia resorting to an escalatory pathway over Ukraine. Financing conditions becoming more restrictive amid high inflation, even as growth stalls and the likelihood of a full recession increases. EU and U.K. energy market interventions, while necessary, are costly and complex to implement on a timely basis.

Ratings: Credit ratings actions in Europe have remained balanced, but we anticipate a greater erosion of buffers heading into 2023. While refinancing is not an immediate concern for most, a recessionary outlook and falling valuations will sharpen the focus of owners and creditors on the viability of more vulnerable businesses. Defaults are starting to tick up, albeit from historically low levels, and expected to reach 3% by mid-2023.

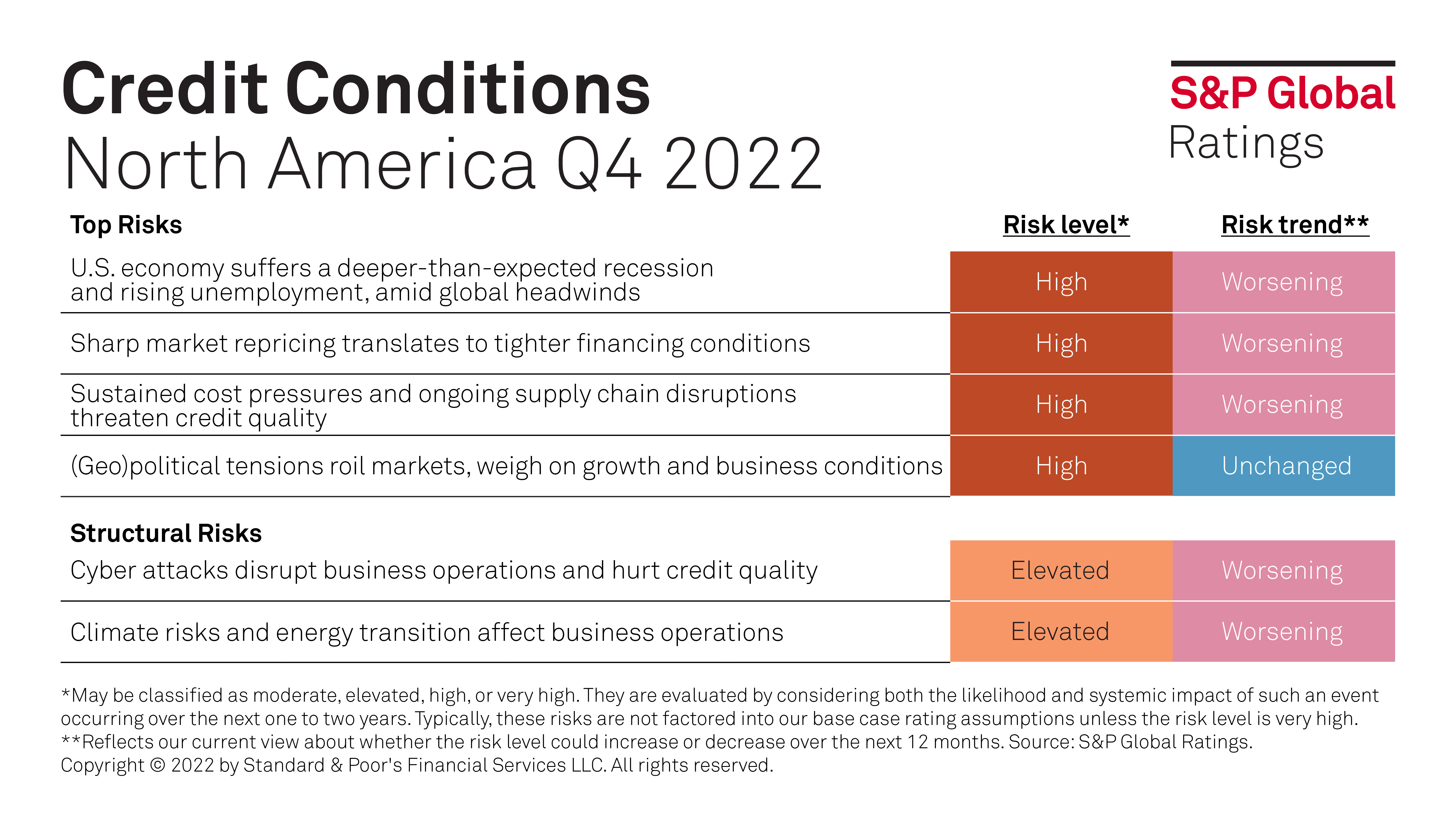

Overall: Credit conditions for borrowers in North America remain under stress, and could worsen further, amid the economic slump in the U.S. and the jump in interest rates.

Risks: In the face of sustained cost pressures and heightened geopolitical tensions, any worsening of the economic prospects, including a steeper-than-expected U.S. recession, could further tighten financing conditions and weigh on credit quality.

Ratings: Rating trends are turning negative. Negative outlook bias has begun to increase after declining for almost two years. We expect the U.S. trailing-12-month speculative-grade corporate default rate to reach 3.5% by June 2023, from 1.4% in June 2022.