Private Credit & Middle Market CLOs

Private Credit And Middle-Market CLO Quarterly: The Times They Are A-Changin'

(Q4 2024)

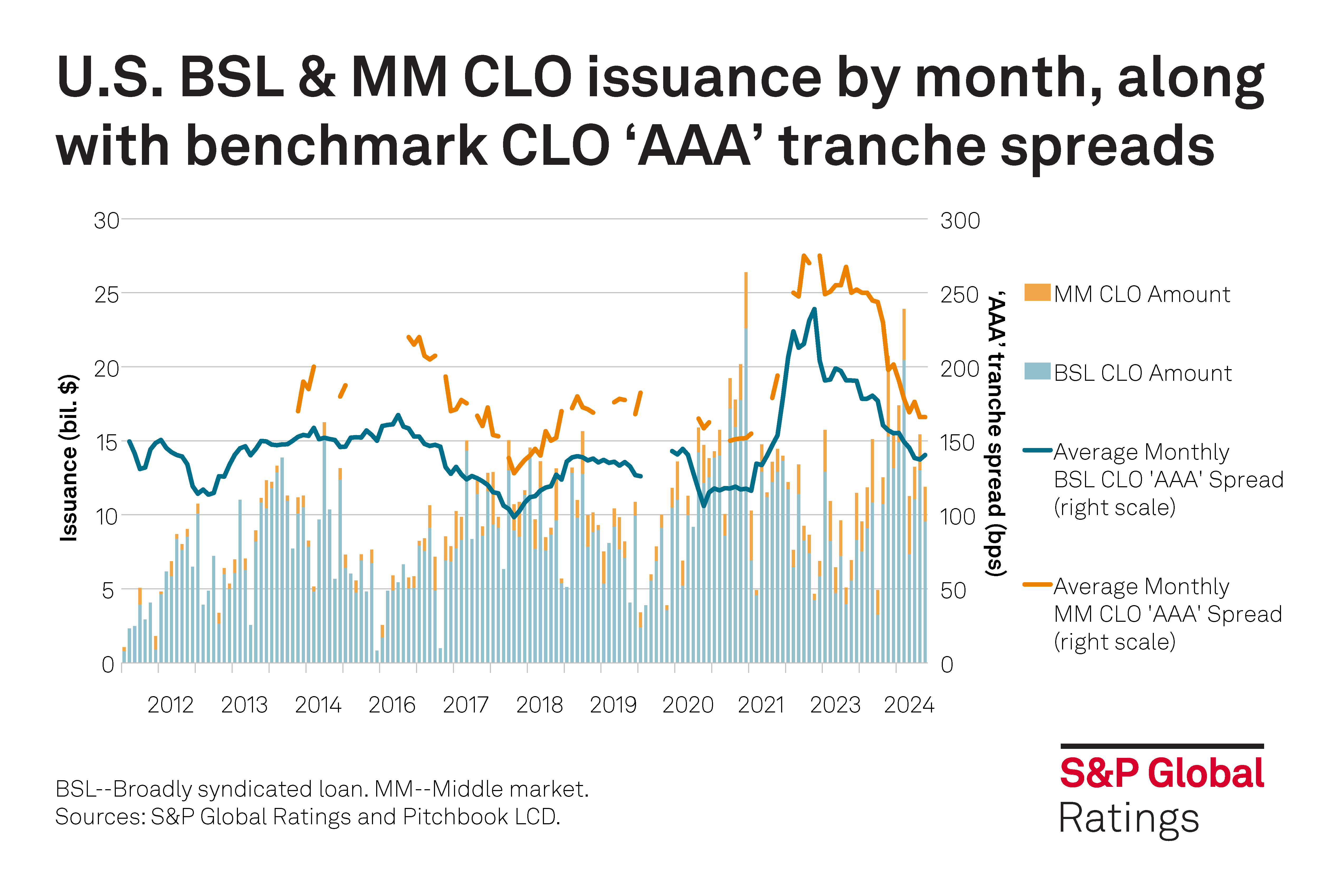

The pace of U.S. middle-market collateralized loan obligation (CLO) issuance continues to fuel the growth of credit estimates. For the third quarter, a total of 870 credit estimates were issued, of which 183 were new and 687 were refreshes of existing credit estimates. Year to date, S&P Global Ratings has completed an aggregate of 2590 credit estimates, of which 634 are new and the remaining refreshes of existing estimates. Our view on credit estimates serves as a good proxy for our perspective on the broader direct lending market as portions of loans held in the middle - market CLOs we rate are allocated by CLO managers/GPs to other funds and vehicles they manage. We estimate the aggregate value of committed senior first-lien debt from companies we’ve credit estimated over the past 12-months to be more than $640 billion, an indication of the size of the direct portion of the private credit market.

This quarter, for the first time, we've broken out corporate credit metrics (EBITDA, leverage, and interest coverage) by the number of managers that hold the loan, providing an interesting view of how metrics vary between widely-held obligors and less widely-headl ones.

Related Content

September 17, 2024

Documentation, Flexible Structuring Continue To Reign In Private Credit

July 17, 2024

Private Credit And Middle-Market CLO Quarterly: Pick Up In Performance And PIKs (Q3 2024)

April 24, 2024

Private Credit And Middle-Market CLO Quarterly: Not A Sunset, Just An Eclipse (Q2 2024)

January 30, 2024

ABS Frontiers: The Blurring Of Private Credit Funds And CLOs

January 26, 2024

Private Credit And Middle-Market CLO Quarterly: Shelter From The Storm (Q1 2024)

November 2, 2023

Scenario Analysis: Testing Private Debt's Resilience Through The Credit Estimate Lens

Listen to our webinar replay on Credit Estimates & Middle Market Issuer Performance.

Our extensive portfolio, totaling over $500 billion in debt, constitutes a substantial portion of capital deployed in private credit, offering vital transparency in this important asset class.

U.S. CLOs & Leverage Finance

Scenario Analysis: Stress Tests Show U.S. BSL CLO Ratings Able To Withstand Significant Loan Defaults And Downgrades (2024 Update)

Following two years of "higher-for-longer" interest rates and economic uncertainty, in September, the Federal Reserve provided a tailwind to corporate credit with a 50-basis-point rate cut that should be broadly supportive of corporate credit going forward and benefit CLO collateral.

As we've done in previous years, we have generated a series of stress scenarios to see how our BSL CLO ratings would perform under different economic environments. For this year's stress scenarios, we added scenarios with a 30% recovery assumption for defaulted assets alongside the 45% recovery assumption modeling we've published in prior years.

Related Content

October 30, 2024

U.S. Leveraged Finance Q3 2024 Update: Sponsor-Backed Companies Experiencing Highlights And Lowlights

August 14, 2024

CLO Spotlight: Will Market Volatility Reset CLO Reset/Refi Volume Expectations For Second-Half 2024?

August 07, 2024

U.S. BSL CLO And Leveraged Finance Quarterly: Will A Cooling Inflationary Breeze Support Credit Resiliency? (Q3 2024)

March 27, 2024

EBITDA Addback Study Shows Moderate Improvement In Earnings Projection Accuracy

March 26, 2024

The Impact Of Asset Diversification On CLO Performance

February 23, 2024

U.S. Leveraged Finance Q4 2023 Update: Possible Early Spring For Earnings Growth, But Cash Flow Credit Measures See Their Shadow

February 22, 2024

Calling All CLOs! Or Not? Assessing The Potential Volume Of CLO Refinances And Resets

The CLO Insights Index averages key credit metrics across a broad sample of U.S. BSL CLOs rated by S&P Global Ratings that have been reinvesting for at least 12 months. The metrics in the index provide insight into the performance of BSL CLO transactions and the underlying leveraged finance corporate loan issuers.

Log in to Ratings360 ® to access the dashboard.

Europe CLOs & Leverage Finance

CLO Pulse Q2 2024: Movers And Shakers In The Top 50 Obligors In European CLOs' Portfolios

European collateral loan obligations (CLOs) typically benefit from portfolio diversification, from both an issuer and a sector perspective.

In this publication, we examine the aggregate asset quality held by European CLOs, observed through key credit metrics and consolidated by S&P Global Ratings' CLO industry sectors. Specifically, this edition of sector average metrics for European CLO assets focuses on loans issued by 634 corporate issuers, which represents over 95% of the assets under management (AUM) held in reinvesting European CLOs rated by S&P Global Ratings as reported up to March 31, 2024, in the second quarter of 2024.

Related Content

May 15, 2024

CLO Pulse Q1 2024: High Leverage Affects Interest Coverage Ratios In European Obligors

March 27, 2024

Your Three Minutes In European CLOs: Altice France Isn't A Big Problem, For Now

March 26, 2024

February European Summary Report: Leveraged Finance

November 27, 2023

Why European Leveraged Loan Borrowers Like The “Snooze Drag”

November 16, 2023

Credit FAQ: Is There A Middle Ground For European Middle Market CLOs?

November 16, 2023

European Secured Debt Recovery Expectations Q3 2023 Update: Recovery Prospects Stable As Issuance Slows

October 26, 2023

Credit FAQ: How We Analyze Credit-Linked Notes Referencing Credit Derivative Definitions And Documentationy

September 28, 2023

CLO Pulse Q2 2023: The 'Snooze Drag' Takes Hold In Europe

S&P Global Ratings' leading Leveraged Finance analysts hosted a live webinar on key current trends, the impact of higher rates on S&P analysis, Jurisdiction Shopping, Default and Recovery. Click on the link to access the replay.

Watch ReplayRelevant Insights

Explore more of our CLO & Leveraged Finance content: