Technology is shaking the pillars of traditional banking. A new type of competition is emerging from FinTech--technology-enabled, nonbank providers of financial services. Some players have caught on quickly and within a few years of existence have become "unicorns," exceeding market valuations of $1 billion. Globally, FinTech investment more than tripled to about $12 billion in 2014, according to The Economist magazine, and Standard & Poor's expects double that in 2015.

Overview

- The rise of the FinTech sector is a global trend, reaching developed and developing economies alike.

- We've seen how technology can disrupt whole industries, negatively affecting creditworthiness.

- The competitive threat of FinTech is not yet disruptive for banks' creditworthiness, but we believe that its significance will grow in the coming decade.

- The largely unregulated nature of the sector, along with often better customer experience, is allowing for rapid growth, and banking authorities have generally welcomed this new form of competition.

- However, the various segments that make up FinTech are largely untested and often haven't been through a full credit cycle.

- We believe that regulations and the access of banks to extensive customer data may in the long run support their ability to compete.

Are banks facing "an Uber-type situation?" That's how Mark Carney, governor of the Bank of England, put it during a discussion at the 2015 World Economic Forum in Davos. But we believe that this is not the end of banking as we know it. The technologies that FinTech companies are employing are an opportunity for traditional banks to revamp their products, services, and distribution--and reduce costs too. However, the competitive threat from unicorns and other emerging FinTech players is far from mythical. Many banks are still adjusting their business models to take on the latest regulatory requirements, and are struggling with legacy IT systems, low interest rates, and slow economic growth, for instance. Meanwhile, these new, unregulated, and nimble FinTech players are chipping away at the revenue of traditional banks. We believe there is little room for complacency, despite the differences in scale and ubiquity. Customer interactions with banks have already started to change, but have not yet disrupted the balance of power.

Banks are aware of the danger of a sudden change, given technological "disruptions" in other industries. And they are not standing idly by. They are starting to collaborate and engage by acquiring or partnering with Fintech companies, setting up venture funds to invest in them, and incubating or launching their own digital finance companies. Yet, we have seen that disruptive technological change has eroded the creditworthiness of a large number of incumbents in other industries such as radio broadcasters, bookshops, newspapers, or the paper pulp makers. (See "Recovery, Divergence, And Disruption: European Corporate Credit Outlook 2016," published on Dec. 9, 2015, as well as reports in our Digital Disruption series such as "The Digital Disruption: What's The Credit Impact Of Netflix Inc.'s Continued International Expansion? published on Aug. 27, 2015, on RatingsDirect.) We believe that the disruptive power of technology can affect not only an industry's revenue base, but also its overall creditworthiness.

View the infographic at http://www.spratings.com/documents/20184/1481001/Fintech+Infographic/7ce2b4dc-fca8-4a09-974e-8d0477c6e266

Not Yet A Game Changer For Bank Ratings

The unique nature of banking may offer some protection. First, the business is highly regulated and the barriers to entry are high. Second, customers typically build a long-term relationship with their banks, with whom they entrust their money and personal information. But these protections may wear thin. Authorities in certain regions are trying to reduce the reliance of economies on bank funding. Also, in some markets where the banking infrastructure is poorly developed, authorities perceive Fintech as a way to fight financial exclusion. Indeed, in less developed markets Fintech promises to provide banking services to a wider proportion of the population and at a lower cost.

For the moment, we view FinTech as the new competitor on the block, but not yet a game changer for bank ratings. For that reason, it's not yet a negative rating driver over our rating horizon, which typically extends out to two years. However, we believe it will increasingly become a force to be reckoned with. The eventual impact on bank ratings will depend not only on how banks respond to the new competition and the particular vulnerability of their business models, but also on the response by authorities and regulators to FinTech's growing clout. Here, we consider how FinTech competition could affect the creditworthiness of traditional banks. We walk through the criteria we use to rate banks, starting with systemic factors and then addressing bank-specific factors (see chart 1 below, which summarizes our bank criteria, "Banks: Rating Methodology And Assumptions," published on Nov. 9, 2011).

A Global Reach

Although we believe that FinTech competition will touch individual banks, we can't exclude that over time it could affect the creditworthiness of whole banking systems. Our Banking Industry Country Risk Assessment (BICRA) criteria are designed to capture such systemic risk. We use the criteria to determine a bank's anchor, or the starting point to rate banks in a given country. In our view, FinTech competition could over time affect this starting point to the ratings of banks in a number of countries. We're talking not only about developed but also developing economies, as the reach of the various kinds of FinTech is global. In emerging-market economies, with weak banking penetration and sparse branch networks, we see just as rapid growth prospects for the sector, aided by growing mobile and Internet access, and the shift toward cashless transactions.

Our BICRA analysis comprises two main assessments: one for economic risk and the other for industry risk. We believe that the rise of FinTech could primarily raise industry risks, affecting the competitive dynamics of banking systems. For example, the segments where FinTech competes with banks are often capital-light businesses, where technology gives new players a cost or service advantage. Such competition will likely weaken the return on equity of banks, which may in some cases retrench back to more capital-intensive regulated activities, or decide to lower profit margins to retain their competitiveness--with implications for their overall risk appetite.

The core activities of traditional banks also face increasing competition from digital banks, such as in the U.K. In April 2013, the U.K.'s Prudential Regulation Authority and the Financial Conduct Authority made changes to banking regulation and authorization, making it easier for companies to apply for a banking license. As a result, 29 companies applied in 2014, and the new banks launching in 2015 include some digital-only ventures, such as Atom Bank. What's more, FinTech's revenue-generating ability is much larger than their generally modest capitalization indicates. In other sectors, a number of well-known disruptors don't own any inventory or large amounts of fixed assets: AirBnB doesn't own the properties it offers on its platform, and Uber doesn't own the cars in its network. Similarly, many FinTech companies operate on a marketplace model and don't hold risks on their balance sheets (think peer-to-peer lenders, crowdfunders, or financial aggregators). That means they need relatively small amounts of equity compared to bank rivals. Furthermore, we believe that FinTech companies and the larger established Internet giants have the capacity and willingness to take greater risks, compared to banks, many of which are still under regulatory pressure to beef up their capitalization and put less emphasis on top-line growth.

Will Success Invite Regulatory Scrutiny?

The largely unregulated nature of FinTech at some point is likely to come back to bite. We consider it inevitable that some customers of unregulated FinTech companies will fall prey to losses, mis-selling, data security breaches, or misuse of personal data. In case of serious or repeated occurrence of FinTech accidents, the reaction of customers and regulatory authorities could determine FinTech's future competitiveness.

Another scenario is that as FinTech players become a crucial part of the financial system, they will naturally invite greater regulatory scrutiny. Some aspects that could attract attention are outsourcing by banks to FinTech partners or exposure by banks to FinTech companies, or the possible systemic consequences of the failure of a large number of small players. We expect that regulations around anti-money laundering, conduct, and in some cases data privacy protection will progress the fastest initially. Extensive prudential regulations in our view remain a long way off.

As a distant prospect, FinTech competition might disrupt banks' funding sources, for example their pool of retail deposits. Today's online payment systems such as PayPal and Alipay, for instance, are starting to accumulate savings in their ecosystem, though albeit for the convenience and not for any interest-bearing feature. We're also seeing some offer the prospect of a higher return to individuals than traditional bank savings accounts for example via crowdfunding, but at higher risk. One big reason for the growing attractiveness of alternative investment opportunities is, in our view, persistently low interest rates.

Could FinTech Lead To Credit Bubbles?

FinTech is unlikely to pose economic risks to banking systems, mainly because of the small amount of loans and finance involved. For instance, in the U.S., we estimate that peer-to-peer lending currently amounts to about only 1% of total personal finance and small business lending. That said, we believe it's worth monitoring the sector to gauge the impact of nonbank regulated activities on private-sector leverage and the possible build-up of asset bubbles, particularly in light of the lack of regulations around activities such as peer-to-peer lending.

The economic impact doesn't necessarily have to be a risk to the system. Our assessment in this area could benefit a banking system. For example, some systems where societies aren't broadly served by banks could benefit from greater financial inclusion. To the extent that FinTech companies unlock access to an expanded customer base whose needs, they could facilitate greater circulation of credit and perhaps eventually banking services in an economy. What's more, greater diversification among providers of credit to an economy could improve its resilience to crises, especially when the new emerging sector is not as dependent as the incumbent banking sector on maturity transformation (the use of on-demand or short-term funding sources to finance longer-term lending) and leverage. In addition, the national, often cross-border, nature of some of these players, which are not tied to physical distribution channels, could reduce geographic concentrations.

How We Look At The Credit Consequences At A Bank-Specific Level

Business position

Whether FinTech competition affects the business position of a bank, in our view, depends on the nature of its activities and their relative contribution to overall revenue. We believe that FinTech will be less focused on certain regulated and capital-intensive activities (such as certain lending segments or personalized investment advice). But everything else may be fair game. Right now, FinTech players in the U.S. carry out lending, payments, international money transfers, savings, investment, asset management, and, most recently, trading and back-office functions--extensive key elements of a traditional bank's business. We expect most banks are or will begin to feel the presence of FinTech companies, even if its disruptive nature will vary from one player to the next.

Business Position

Business position indicates the strength of a bank's business operations. We define business position as the combination of specific features of the bank's business operations that add to or mitigate its industry risk score. These features fall into three categories: business stability, concentration or diversity, and management and corporate strategy.

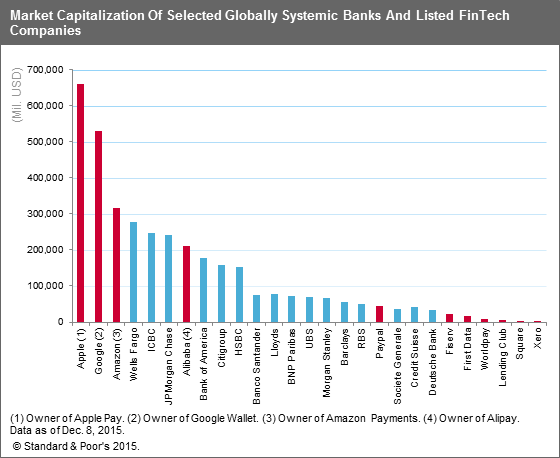

How will banks respond to the competitive threat? Acquisitions are probably unlikely to be norm, given banks' increasing capital requirements, the higher relative valuations of FinTech players, and the large amount of cash and huge capitalization of some technology companies such as Google and Apple (see chart 1). Nor do we think it is very likely that tech companies large or small will eagerly plunge into the regulated world of banking. As we noted above, banks are acquiring or partnering with Fintech companies, setting up venture funds to invest in them, and incubating or launching their own digital finance companies. FinTech competition is also sometimes leading to previously unexpected cooperation between banks. In Germany for instance, traditional players across subsectors have banded together to establish a unified online payment scheme (Pay Direct) and defined a new standard in response to growing competition from PayPal and other non-bank payment service providers.

Chart 1

Scoping Out The FinTech Sector: A Global Phenomenon

Lending

- Lending Club (U.S.)

- Kreditech (Germany)

- CAN Capital (U.S.)

- Zopa (U.K.)

- Kabbage (U.S.)

- Funding Circle (U.K.)

- GetBucks (South Africa)

- Prosper (U.S.)

- SoFi (U.S.)

- OnDeck (U.S.)

International money transfers

- TransferWise (U.K.)

- SumUp (Ireland)

- WorldRemit (U.K.)

Savings and investments

- Wealthfront (U.S.)

- Personal Capital (U.S.)

- CircleUp (U.S.)

- Nutmeg (U.K.)

- Betterment (U.S.)

- Personal Capital Advisors (U.S.)

Payments

- Stripe (U.S.)

- Klarna (Sweden)

- Square (U.S.)

- Mercadolibre (Brazil)

- BitPay (U.S.)

- GoCardless (U.K.)

- Apple Pay (U.S.)

- Alipay (China)

- iZettle (Sweden)

- Paypal/Venmo (U.S.)

Trading

- Robinhood (U.S.)

- eToro (Cyprus)

- ZuluTrade (U.S.)

Note: This list, which represents selected players in key segments, is not exhaustive.

These approaches can be seen as an inexpensive option in the future growth of the sector, or an effort to borrow FinTech operations to improve cost control. However, we view them mostly as a defensive strategy to preserve revenue that FinTech is capturing.

What's important to remember is that banks benefit greatly from their incumbent position as a relationship lender and provider of a broad range of financial services. A customer may have a checking/current account, a mortgage, a credit card loan, an insurance policy, and an asset management account all with the same banking institution. That's not the typical FinTech business model, which tends to focuses on one niche in the value chain. Nevertheless, if it succeeded in capturing substantial market share, a successful FinTech player could over time hurt banks reliant on cross-subsidization of products and services. For example, some institutions provide certain services, such as current or checking accounts, for free or at below cost to promote the sale of ancillary, more remunerative, services and products. As new entrants capture a growing number of remunerative activities, traditional banks could be left with a preponderant share of high-cost and more capital-intensive business lines.

Capital and earnings

FinTech's initial focus has been capital-light, "infrastructure"-type activities such as payments. They have also progressively turned to other advanced functions, including lending and trading, which may hurt the returns of traditional banks and their internal generation of capital. Banks that are the most reliant on them as profit centers will feel the most pain. We believe that the main pressure from FinTech on banks' bottom line will be because of price competition, rather than the amount of business they capture. For example, the growing trend toward robo-advisers--online automated wealth management services--could hurt the margins of active asset management. Through cost efficiency and, in the case of aggregators, enhanced price discovery, FinTech competition should make a bigger dent on traditional banks' margins than on the amount of business they capture.

Capital And Earnings

Capital and earnings measures a bank's ability to absorb losses, providing protection to senior creditors on a going-concern basis. We assess capital and earnings by looking at regulatory requirements, the projected level of risk-adjusted capital (as per our own measure), and the quality of capital and earnings. We look at several measures of capital; however, our projected risk-adjusted capital ratio is the most important.

Banks will have to continue to deploy substantial investments, if in response to FinTech competition they choose to digitally transform all or part of their business. IT spending will undoubtedly rise, not just for the development of new products, services, or distribution channels, but also to bolster defenses around related emerging risks (such as cyber risk, see "Credit FAQ: How Ready Are Banks For The Rapidly Rising Threat Of Cyberattack?" published on Sept. 28, 2105). This would reduce the positive impact of cost containment measures that we've been seeing lately on banks' efficiency. What's more, we believe that transformative IT spending has become a recurring expense line, if banks are to keep abreast of technological developments and consumers' evolving expectations.

Any large acquisition by banks of FinTech players, if leading to material goodwill, could weigh on our assessment of capital and earnings. For now, we believe acquisitions will largely be limited to small players, especially in light of strengthened regulatory capital requirements for banks, and gaps in valuation metrics between FinTech players and banks.

Risk position

It's unlikely at this stage that in response to FinTech competition, banks will raise their credit or market risk to boost margins and other income. One reason is that for now the two are not competing for the exact same customer. For instance, FinTech's credit-based activities are often complementary to bank lending. In the U.K., the authorities asked banks to refer rejected loan applications from small and midsize enterprises to peer-to-peer platforms for financing. Similarly, in the U.S., FinTech companies are taking on correspondent banking services or small-dollar loans to businesses, which banks there are increasingly reluctant to extend.

Risk Position

Risk position serves to develop a more refined view of a bank's actual or specific risks compared to the standard assumptions that we use in our capital and earnings analysis. To differentiate a bank's unique risk position, five areas are analyzed:

- How the bank manages growth and changes in its risk positions,

- The impact of risk concentrations or risk diversification,

- How increased complexity adds additional risk,

- Whether material risks are not adequately captured by RACF, and

- Evidence of stronger or weaker loss experience.

If this trend continues over the longer term, we could see some banks focus increasingly on a smaller number of "traditional," regulated activities, with partnerships with third-party FinTech providers for ancillary activities. Our assessment of risk position for such a bank would then balance the possible decrease in risk diversification (typically credit negative) against the decrease in complexity (credit positive). Our risk assessment would also take into consideration whether these core activities are adequately remunerated.

And if this trend transforms business models, we could see a shift in risk from banks to third-party FinTech companies and their investors. This would be the case for a bank that outsources activities to these companies and receives origination fees, instead of generating revenue from pursuing the activities themselves. Yet, there is still potential for operational risk. We believe that banks may be held responsible for the choice of third-party service or product providers, and face litigation in the event of data breach, mis-selling, or other possible act of misconduct by FinTech partners.

Above, we've noted that banks are starting to engage with Fintech companies, which are increasing their exposure to the FinTech sector, whether in the form of equity investment, lending, or operational exposures. Such exposures are small for now, but if they become substantial they could weigh into our assessment of risk position.

Funding and liquidity

FinTech companies will, in our view, compete increasingly with banks not just for credit, but also savings. Most FinTech players are currently enablers of activities such as lending and payments on the asset side. But to the extent that FinTech companies act as aggregators of data and information for consumers wanting to manage savings, they could certainly influence the liabilities side of traditional banks.

But we could also imagine instances where FinTech companies would support our assessment. For instance, FinTech companies could help simplify liability management through the use of blockchain technology, for example, to conduct repurchase operations. This could result in efficiency gains for margins as well for traditional banks.

Funding

The analysis of funding compares the strength and stability of a bank's funding mix, according to several metrics, with the domestic industry average funding assessment. The liquidity analysis centers on a bank's ability to manage its liquidity needs in adverse market and economic conditions and its likelihood of survival over an extended period in such conditions.

So far, FinTech competition has had little impact on bank deposits in most countries. All in all, we expect guarantee schemes to continue to underpin the stability of bank deposits. But we note the growing competition that traditional bank deposits have been facing from digital banks without branch networks, while also benefitting from deposit guarantee schemes. In a number of countries, digital banks are offering better yields and attracting a growing share of deposits, but we remain cautious whether such growth can persist once interest rates increase.

Remain Relevant, Or Left Behind

Banks are not remaining passive to the rise of FinTech competition. They are boosting investment in technology and some are re-evaluating their product offerings and delivery channels. But we believe that technological investments alone won't insulate banks from the risk of disintermediation. Indeed, what will ensure that banks will remain the financial system's main actors, especially in a regulatory context where authorities in a number of countries are keen to curb their systemic importance? We believe that changes in business model and culture, with a core focus on customer experience and innovation, are also prerequisites if banks are to remain relevant in the next decade.

Related Criteria And Research

Related Criteria

- Banks: Rating Methodology And Assumptions, Nov. 9, 2011

Related Research

- Recovery, Divergence, And Disruption: European Corporate Credit Outlook 2016, Dec. 9, 2015

- The Digital Disruption: What's The Credit Impact Of Netflix Inc.'s Continued International Expansion? Aug. 27, 2015

We have determined, based solely on the developments described herein, that no rating actions are currently warranted. Only a rating committee may determine a rating action and, as these developments were not viewed as material to the ratings, neither they nor this report were reviewed by a rating committee.

| Primary Credit Analysts: | Alexandre Birry, London (44) 20-7176-7108; alexandre.birry@spglobal.com |

| Devi Aurora, New York (1) 212-438-3055; devi.aurora@standardandpoors.com | |

| Secondary Credit Analyst: | Markus W Schmaus, Frankfurt (49) 69-33-999-155; markus.schmaus@standardandpoors.com |

| Research Assistant: | Jekaterina Muhametova, London |

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P’s opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

Any Passwords/user IDs issued by S&P to users are single user-dedicated and may ONLY be used by the individual to whom they have been assigned. No sharing of passwords/user IDs and no simultaneous access via the same password/user ID is permitted. To reprint, translate, or use the data or information other than as provided herein, contact S&P Global Ratings, Client Services, 55 Water Street, New York, NY 10041; (1) 212-438-7280 or by e-mail to: research_request@spglobal.com.