Fintech offers major business opportunities to Japan's three biggest financial groups (see note 1), which have relatively high capacity for investment in technology, and to newly established banks able to create flexible IT systems. In the short term, however, fintech could produce negative and disruptive structural transformation of Japan's financial industry, which is unique among developed countries in that the nation's financial markets are divided by institution on geographic and business lines.

Fintech Is Not A New Concept

Fintech's precise meaning is elusive because the possibilities it offers are great in number and the degree of influence it will have on society and the economy is difficult to predict. For this report, we use fintech as a collective noun for information technology (IT) that transforms the way existing financial services are provided, most of the time through the unbundling or bundling of multiple existing financial services. For this reason, in this report, we have excluded simple business rationalization through robotic process automation, which major Japanese banks have recently announced, from fintech.

Fintech is not conceptually new. There have been many cases where advanced financial services have emerged through the use of new technologies. For example, derivatives that evolved out of physical transactions or third-generation online banking systems, which separate accounting systems and strengthen information databases to provide new services, are examples of the unbundling or bundling of conventional concepts with new technologies. Both fit into the broader definition of fintech. However, evolution of IT has made it possible to significantly change existing geographic and business boundaries in banking. For this reason, fintech is likely to have a bigger impact today than it has had in the past.

Japan's Banking Market And Fintech: A Good Match

Japanese financial markets have characteristics unique to developed economies. The Japanese banking market is divided geographically and major banks do not have high market share. Cash payment rates remain high. In addition, there are high sales commission rates and transaction fees for financial products such as those that investment trusts offer. Regardless of whether one views these factors as positive or negative, they result in overall balance of the current Japanese banking industry, as statistics show.

Geographic divides in the banking market: The domestic market share of major Japanese banks in Japan is low compared with those of many international peers. In addition, it is significantly lower in areas outside Japan's three major metropolises, which account for about 50% of GDP (or 35% of nationwide outstanding loans). There is, in other words, an urban-rural divide in Japanese financial markets: Major banks have the biggest share in the largest cities, and regional banks have the biggest shares in nonmetropolitan areas. Chart 1 shows lending share by banking category (regional or major) and area (nationwide; major metropolitan; other, nonmetropolitan areas). Major banks have a nationwide lending share of 40% overall, but the figure is bolstered by the high shares they hold in the three large metropolitan areas (see note 2). In regional areas, major banks have only about 10% of the aggregated share that regional banks (Tier 1 and Tier 2) hold. This indicates that regional banks have an overwhelming presence in nonmetropolitan areas.

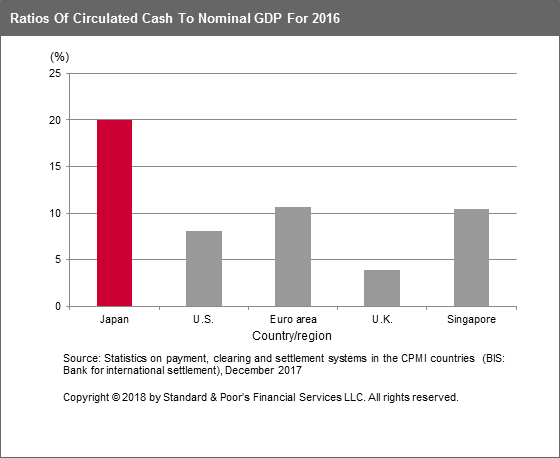

High cash payment rate: Japanese consider paying in cash natural and unnecessary to explain. However, disclosure standards for national statistics differ between countries, making it extremely difficult to make accurate international comparisons of cash payment ratios. Some countries, for example, use transaction numbers and others transaction value to measure ratios. Captured payment transactions in ratios can also differ by country, depending on how statisticians measure the population.

Against this background, in this report, we indicate Japan's high dependency on cash settlement by indirectly showing the ratio of circulated cash volume to the size of the national economy. Figures on both of these measures are disclosed on an equal footing globally. Chart 2 shows the ratio of circulated cash (banknotes, coins) to nominal GDP by country or area (see note 3). Japan's ratio of circulated cash to nominal GDP is about double those of the U.S. and the euro area.

High commissions for financial products: Sales and trust fees for investment trusts shine a light on the high prices paid for financial services in Japan. As Japan gets grayer, the key business for the nation's financial industry is likely to be asset management for individual investors. In addition, the accumulated wealth of Japanese citizens is likely to feel some impact from the way financial institutions handle investment fees. Nevertheless, sales commissions and trust fee ratios for investment trusts are about five to six times higher in Japan than they are in the U.S. For example, according to data disclosed by Japan's Financial Services Agency (see note 4), the average ratio of sales commissions and trust fees is 0.59% and 0.28% respectively in the U.S. In Japan, the same data shows sales commissions of 3.20% and trust fees of 1.53%. One caveat, however, is that a part of the divergence may stem from the fact that the net asset size of investment trusts is generally smaller in Japan than the U.S.

Fintech, which is about problem solving, has affinity with the above three characteristics of the Japanese financial market. Fintech can provide tools that reduce geographical constraints, making it likely that a greater degree of change will come along with fintech penetration in Japan than in other developed countries. In this context, S&P Global Ratings sees fintech providing major business opportunities to Japan's three major financial groups (classified as global systemically important banks), which have relatively large capacity to invest in new technologies, and also for newly established banks that can create flexible IT systems.

Fintech can, for example, offer financial services through mobile/nonmobile internet services that make it possible for banks to provide low-price, high-quality financial products to customers nationwide without being bothered by the hindrance of geographical constraints (or boundaries) between urban and rural areas. Fintech could also drastically change the ratio of cash payments in Japan. The high cash payment ratio will probably be among the first fields to show visible changes brought about by fintech development. Indeed, the current cash payment ratio has declined by 6% compared with four years ago as electronic money has spread in Japan. In addition, the government will also support momentum toward Japan becoming a cashless society as part of its "Japan reconstruction" strategy. With regard to high financial commission fees, new capabilities to reduce transaction times and overcome geographical constraints are also likely to be positive. If fintech channels become mainstay sales tools for banks, consumers will be able to compare and consider prices of cutting-edge features on products regardless of their whereabouts. It is likely that commission rates in Japan, which are high internationally, will converge to the global average.

Fintech May Be Negative For The Financial Industry In The Short Term

On the other hand, the development of fintech may be a risk factor for Japanese financial markets. The current equilibrium of the financial industry could collapse if new service providers begin offering convenient services to customers via fintech, greatly reducing the profitability of some existing financial institutions. As a result, overall industry stability could decline in the short term.

Beyond the three features mentioned earlier, Japan's financial industry is stable and balanced. However, most Japanese customers do not seem to desire this equilibrium, which has led to a situation of low-level stability or stagnation. In particular, customers do not necessarily desire the type of equilibrium in Japan's financial markets that geographic divides maintain. It seems that many companies would like to enjoy the more advanced services of the major banks in rural areas. This is also the case for individual customers who are dissatisfied with high commission rates. Against this background, S&P Global Ratings believes that the development of fintech may destabilize the equilibrium of Japanese banking markets.

Bringing Customers Accumulated Wealth Is Key For Fintech Development

Nevertheless, in the medium and long term, in considering the existing macro-prudential policy of the authorities, it is unlikely that the entire financial market in Japan will be brought into great disorder. Also, in the long run, if fintech brings customers benefits, such as lower marginal costs for transactions, and establishes new competitive dynamics by, for example, eliminating overbanking, we believe it will have a positive effect on Japan's macroeconomy and banking industry as a whole by improving efficiency. We believe the positive impact will emerge in terms of our sub-score assessment of competitive dynamics in our Banking Industry Country Risk Assessment (BICRA) for Japan.

S&P Global Ratings thinks the banks that survive the fintech era are basically likely to be the majors, with other exceptional cases such as boutique-type banks that offer focused products to a select number of customers. The major banks have two necessary advantages for developing fintech: They can afford marginal investment (i.e., they have investment power), and they have large customer bases. At the same time, however, the legacy assets of major banks, which they inevitably hold because of their large sizes, could become burdens to change. Rigid and less-flexible corporate cultures may also work against innovation in the fintech era. In particular, we will closely monitor the pace of change in low-profit domestic retail businesses, looking out for events such as the retrenchment of unnecessary branch networks.

In the short term, dramatic changes brought about by fintech development may be a negative factor that disturbs financial markets in Japan. Weaker banks that do not adapt to the changes may not survive. However, in the medium to long term, only relatively large and excellent financial institutions with sufficient investment capacity for fintech--those that can offer competitive services to customers--can evolve and survive. We cannot overlook the possibility that fintech will stimulate Japan's overall economic activity by bringing about, for example, a decrease in marginal costs for financial transactions. In other words, in the medium to long term, S&P Global Ratings believes the development of fintech will be positive for Japan's macroeconomy and its banking industry as a whole because it will deliver benefits to customers and establish new competitive dynamics. However, in order for Japanese banks to enjoy these positives, they will have to rapidly implement structural changes employing fintech. For this reason, S&P Global Ratings currently sees only a low possibility of Japanese banks fully enjoying the positive aspects of fintech over the next two to three years, which is the general target period reflected in our ratings.

Notes

1. Japan's three major financial groups are: Mitsubishi UFJ Financial Group Inc., Mizuho Financial Group Inc., and Sumitomo Mitsui Financial Group Inc.

2. The three largest metropolitan areas span the following: Greater Tokyo (Tokyo, and Kanagawa, Saitama, and Chiba prefectures), Greater Nagoya (Aichi Prefecture), and Greater Osaka (Osaka, Kyoto, and Hyogo Prefecture).

3. The ratio of circulated cash (banknotes, coins) to nominal GDP was sourced from: "Statistics on payment, clearing and settlement systems in the CPMI countries" (Dec.2017), issued by BIS. Credit Saison, a Japanese credit card company, also indicates that the cash payment ratio of Japan is 50%, while that of the U.S. is 16%, in investor relations materials provided alongside the company's fiscal 2016 financial results.

4. Source: Materials from the March 30, 2017, expert meeting held by Japan's Financial Services Agency on stable asset formation by households.

Chart 2

Related Research

- The Future Of Banking: How Much Of A Threat Are Tech Titans To Global Banks? Jan. 15, 2018

- The Future Of Banking: Is Orange Changing The Color Of Banking In France? Dec. 11, 2017

- Japan Banking Outlook 2018: Clouded As Risk Appetite Rises And External Conditions Darken, Jan.10, 2018

- Banking Industry Country Risk Assessment: Japan, Sept.21, 2017

Only a rating committee may determine a rating action and this report does not constitute a rating action.

| Primary Credit Analyst: | Ryoji Yoshizawa, Tokyo (81) 3-4550-8453; ryoji.yoshizawa@spglobal.com |

| Secondary Contact: | Chizuru Tateno, Tokyo (81) 3-4550-8578; chizuru.tateno@spglobal.com |

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P’s opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

Any Passwords/user IDs issued by S&P to users are single user-dedicated and may ONLY be used by the individual to whom they have been assigned. No sharing of passwords/user IDs and no simultaneous access via the same password/user ID is permitted. To reprint, translate, or use the data or information other than as provided herein, contact S&P Global Ratings, Client Services, 55 Water Street, New York, NY 10041; (1) 212-438-7280 or by e-mail to: research_request@spglobal.com.