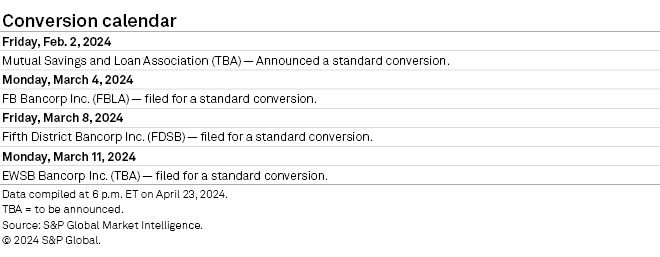

This feature has the latest news from the mutual bank conversion sector. As of April 23, four conversions were in the pipeline.

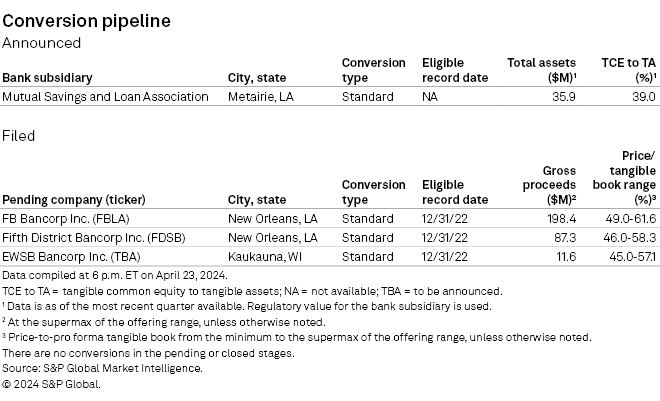

On March 11, EWSB Bancorp Inc., the newly formed proposed holding company for Kaukauna, Wis.-based East Wisconsin Savings Bank, filed a registration statement for a mutual-to-stock conversion. The company disclosed in the application that the bank entered into a confidential memorandum of understanding (MOU) with the Federal Deposit Insurance Corp. and the Wisconsin Department of Financial Institutions in July 2023.

"The MOU requires that the Bank address certain practices and conditions identified during regulatory examinations, including, among other things, the level of its capital, earnings, liquidity, investments, and information technology. The MOU also requires enhancements to board oversight, asset/liability management, and risk management," according to the filing.

Additionally, East Wisconsin Savings Bank's net worth ratio of 4.32% at March 31, as disclosed in an amended registration statement filed April 22, was lower than the 6% requirement for Wisconsin-chartered savings banks.

"If our net worth ratio continues to be less than 6%, the Department may direct us to adhere to a specific written plan established by the Department to correct the deficiency, as well as a number of other restrictions on our operations, including a prohibition on the payment of dividends," the company said in the amended filing.

East Wisconsin Savings Bank has lost money for nine consecutive quarters. At March 31, its tangible common equity ratio was 3.92% and its leverage ratio was 6.17%.

Also notable is that East Wisconsin Savings Bank's planned merger of mutuals with Lake City, Minn.-based Lake City Federal Bank was terminated Sept. 30, 2023. Lake City Federal Bank announced another merger of mutuals later the same year, this time with Marshfield, Wis.-based Forward Bank.

Also in March, two newly formed holding companies for New Orleans-based mutual banks filed registration statements for a mutual-to-conversion. Fifth District Bancorp Inc., the proposed holding company for Fifth District Savings Bank, filed March 8. And FB Bancorp Inc., the proposed holding company for Fidelity Bank, submitted its application March 4. At the supermax of the offering range, gross proceeds are $87.3 million for Fifth District Bancorp and $198.4 million for FB Bancorp.

In its conversion application, Fifth District Bancorp revealed the identification of material weaknesses.

The company said that "management did not maintain sufficient evidence of independent review or supporting documentation related to key methodologies, assumptions, and calculations, including support for the qualitative factors, utilized in the allowance for credit losses as of December 31, 2023, and the allowance for loan losses as of December 31, 2022; and management did not maintain sufficient evidence of independent review or supporting documentation, including support for the qualitative factors, related to the January 1, 2023 adoption of Accounting Standard Update (ASU) 2016-13 Financial Instruments – Credit Losses."

On Feb. 2, Metairie, La.-based Mutual Savings and Loan Association announced a mutual-to-stock conversion. At the end of March, the institution had $35.9 million in total assets and a tangible common equity to tangible assets ratio of 39.0%.

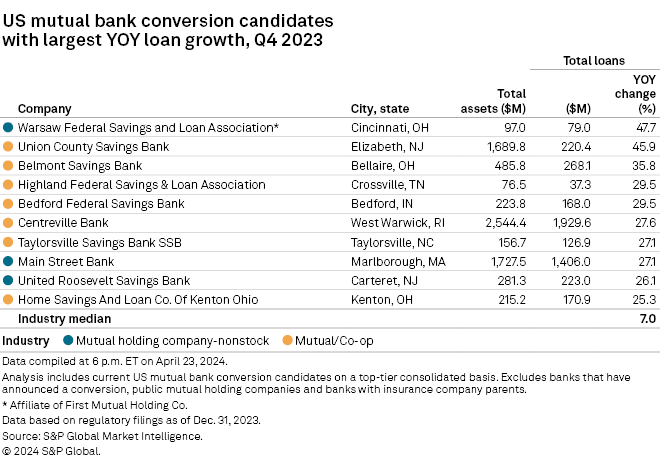

Download a template showing the conversion pipeline, the market performance of recent conversions, the valuations of mutual holding companies and a list of conversion candidates.

Other conversion features

2023 conversion class features 2nd-largest standard deal in last 15 years

Luse Gorman dominates 2023 mutual bank conversion adviser rankings

Other news stories about mutuals, mutual holding companies, recent conversions and activist investors

Arlo Financial to acquire Systematic Savings Bank

Gouverneur Bancorp names new president/CEO

Florida-based First Federal Bank to acquire Watson Mortgage

Massachusetts-based Mutual Bancorp, Fidelity Mutual Holding complete merger

We encourage reader participation and feedback. Please forward any suggestions to ConversionNews@snl.com.