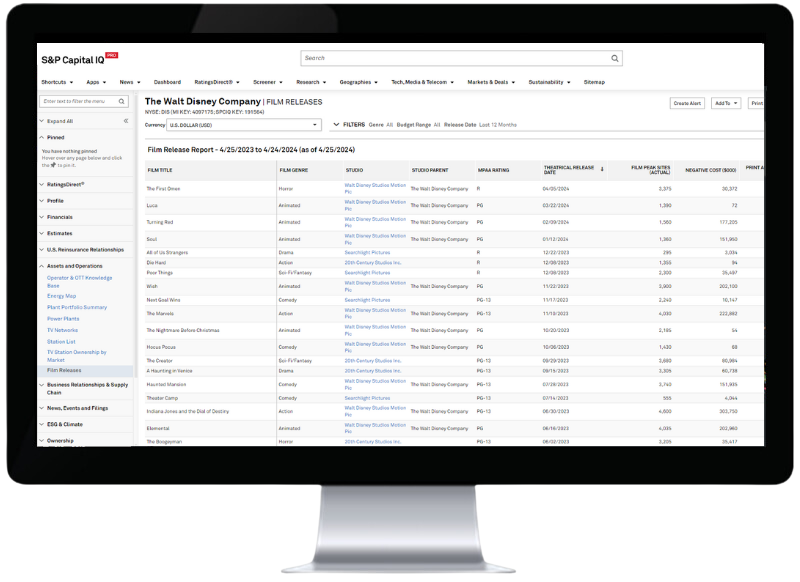

Monitor the industry

Media and Telecom Insights, Informed by Best-In-Class Data and Analysts

- Stay up to date on the media and telecom industry with a curated dashboard.

- Access industry analysis including financial performance benchmarks, competitive analysis with historical revenue, cost and usage data, quantitative projections and deep qualitative insights.

- Customize widgets for Kagan research on trends like OTT, broadband, pay TV, wireless, TV networks, broadcast, film, TV programming and more.

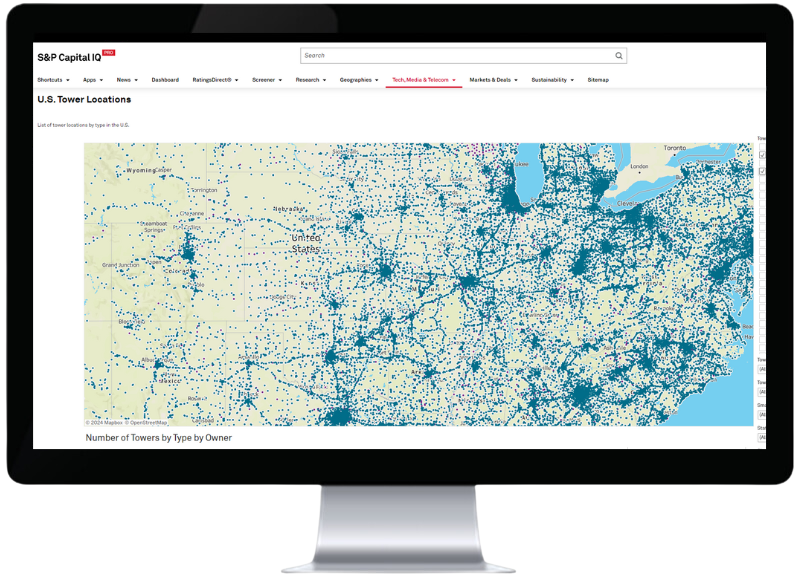

Visualize global telecom assets

Media and Telecom Insights, Informed by Best-In-Class Data and Analysts

- Utilize visualization tools to map TV station signal reach, broadband/video footprint, wireless licenses and more.

- Add your own proprietary data, layering existing maps with custom spatial relationships.

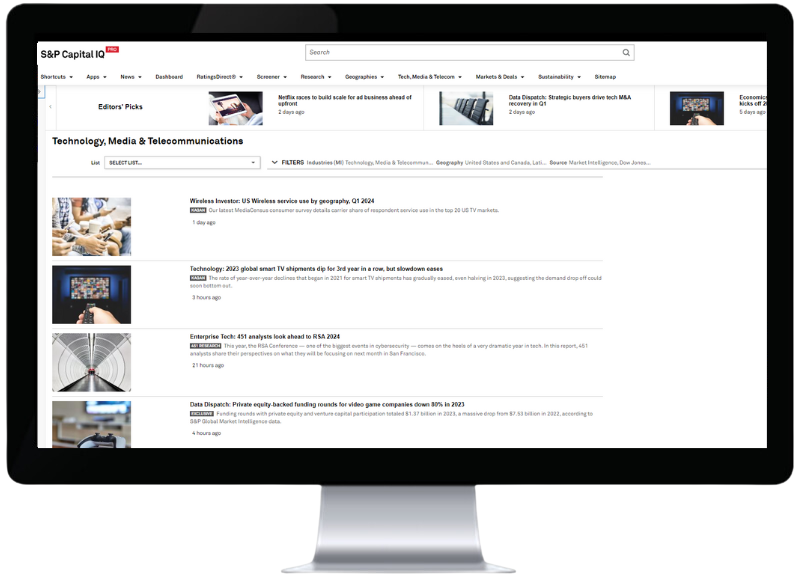

Stay up-to-date on industry news & trends

Media and Telecom Insights, Informed by Best-In-Class Data and Analysts

- Read news articles across the industry, including ESG policies, merger announcements, policy news and more.

- Access industry expert analysts.

- Subscribe to the Media Talk podcast for weekly analyst insights.

- Schedule or trigger alerts directly to your inbox or monitor via your Dashboard.

Analyze ESG metrics

Media and Telecom Insights, Informed by Best-In-Class Data and Analysts

- Monitor environmental, social and governance practices at media & telecom companies.

- Understand how your peers respond to ESG challenges.

- Track resource usage metrics to assess environmental risk.

Access private company financials

Media and Telecom Insights, Informed by Best-In-Class Data and Analysts

- Utilize financials of small and medium sized enterprises in your financial analysis and valuation models.

- Access financials for 10M+ companies in Europe.

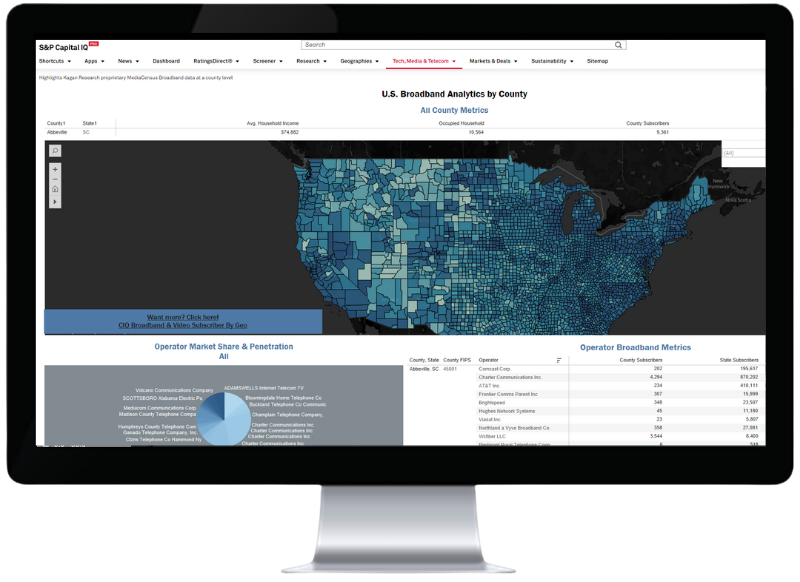

Evaluate consumer trends

Media and Telecom Insights, Informed by Best-In-Class Data and Analysts

- Leverage reliable measures of technology adoption and vendor performance supporting sales, marketing and client retention strategies and product roadmaps.

- Understand vendor market share and business momentum to source potential acquisitions and partnerships.