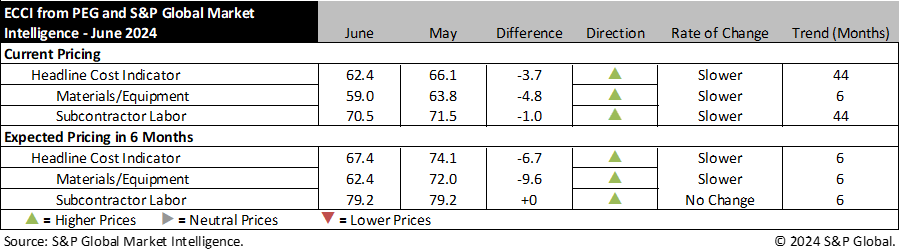

New York – June 26, 2024 – Engineering and construction costs increased again in June, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector decreased 3.7 points to 62.4 this month, but remained above the neutral threshold of 50.0, indicating prices are still rising. The sub-indicator for materials and equipment costs slid 4.8 points to 59.0 while the sub-indicator for subcontractor labor costs edged down to 70.5 in June from 71.5 in May.

The equipment and materials indicator softened noticeably but continued to show rising prices in June. Eight of the 12 components decreased compared to last month, some of them significantly. The three steel categories—carbon steel pipe, alloy steel pipe and fabricated structural steel—all saw declines of around 20-points, settling solidly in contractionary territory with readings of 27.3, 30.0 and 36.4, respectively. Additional significant declines in gas and steam turbines (18.8-points) and shell and tube heat exchangers (11.1-points) resulted in neutral readings of 50.0 for these categories in June. Modest declines were also recorded this month for ready-mix concrete, copper-based wire and cable and pumps and compressors, but all three remain in expansionary territory. Continuing their hot streak, the transformers and electrical equipment categories saw minor increases and now sit at 90.0 and 86.4 respectively. Only the ocean freight categories saw sizable increases this month, with routes from Asia to the U.S. rising 33.9-points and routes from Europe to the U.S. increasing 31.3-points to solidly expansionary readings of 88.9 and 81.3.

“Steel pipe prices had remained stubbornly strong in recent months despite input costs from steel going through a downward correction,” said Tommy McCartin, Principal Economist, S&P Global Market Intelligence. “The decline in pipe pricing will likely run out of room in the second half of 2024, though weak demand for line pipe and oil country tubular goods suggests little upside price risk.”

The sub-indicator for current subcontractor labor costs saw very little movement this month with just a 1.0-point decrease compared to last month. There were a variety of small movements that all generally offset; the U.S. Midwest and West saw minor increases for all employment categories, while the U.S. South and Western Canada saw declines. All regions and employment categories remain solidly in expansionary territory with readings ranging from 83.3 down to 61.1.

The six-month headline expectations for future construction costs indicator decreased modestly to 67.4 in June. The six-month expectations indicator for materials and equipment came in at 62.4, 9.6 points lower than last month’s figure. All 12 categories saw price expectations decrease this month. The largest declines were seen for ready-mix concrete, down 20.8-points, copper-based wire and cable, down 15.2-points, pumps and compressors, down 15.0-points and gas and steam turbines, down 10.3 points. Expectations for carbon steel pipe and ocean freight from Europe to the U.S. settled at neutral readings in June, but all other categories remain above 50.0. Despite minor declines, pricing expectations for transformers and electrical equipment remain very tight with readings of 85.0 and 81.8 respectively.

The six-month expectations indicator for sub-contractor labor was unchanged in June at a reading of 79.2, continuing to show expectations for a tight labor market.

Respondents reported some shortages this month for electrical equipment, shipping containers and labor, especially along the gulf coast. They also noted rapid price increases for copper.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact :

Kate Smith, S&P Global Market Intelligence

P. +1 781 301 9311

E. katherine.smith@spglobal.com

Submitting your email above means you agree to the Terms and have read and understood the Privacy Policy