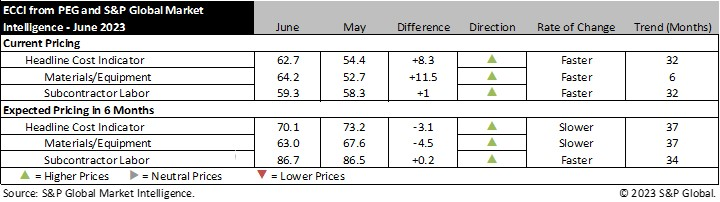

WASHINGTON, D.C. – June 28, 2023 – Engineering and construction costs increased again in June, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector, increased to 62.7 this month from 54.4 in May, indicating price increases were more widespread than last month. The sub-indicator for materials and equipment costs also rose to 64.2 this month from 52.7 in May; price pressures have remained strong since the December sub-50 reading. The sub-indicator for subcontractor labor costs increased modestly to 59.3 this month, up from 58.3 in May.

The equipment and materials indicator continued to show rising prices, with 9 of the 12 components posting increases. The largest single increase compared to last month was for ready-mix concrete, increasing almost 18 points to 75.0, but 7 other categories also saw double digit increases. Soft global trade activity continues to weigh on ocean freight. The only category in contractionary territory was ocean freight from Europe to the U.S.; ocean freight from Asia to the U.S. and carbon steel pipe were neutral with readings of 50.0. Transformers and electrical equipment components remain high and saw an increase back to a reading of 90.0 which was last seen in March.

“E-steel showed up as a problem in 2022, and it will remain scarce for years to come,” said John Anton, Economics Director, S&P Global Market Intelligence. “New demand from electric vehicles and charging stations is pushing aside traditional users such as industrial electric motors, generators, and transformers. Clients report lead times approaching 100 weeks for large motors and generators, and three to six years for transformers. The problem is that e-steel capacity is barely growing while global EV production is moving from 2 million vehicles in 2019 to 20 million by 2026 and 40 million by the end of the decade. E-steel capacity must be added, but until then the problems will grow worse not better.”

The sub-indicator for current subcontractor labor costs remained fairly steady this month, increasing just one point to 59.3. This continues the trend, first visible in March, of consistently weaker readings. While labor markets are not as tight as they were in 2022, a reading of 59.3 indicates that cost increases continue. According to survey responses, labor costs continued to rise in most regions of the United States but were flat in Canada and the U.S. Northeast.

The six-month headline expectations for future construction costs indicator decreased by 3.1 points to a reading of 70.1 in June. The six-month expectations indicator for materials and equipment came in at 63.0, 4.5 points lower than last month’s figure. The outlook for most categories is much weaker than last month with the only increases coming in ready-mix concrete, transformers, and electrical equipment. The price outlook for fabricated structural steel, carbon steel pipe, and pumps and compressors is now neutral.

The six-month expectations indicator for sub-contractor labor was unchanged compared to last month, up just 0.2 points to a reading of 86.7. This continues to indicate that a majority of survey respondents expect higher labor costs in six months. All regions show strong expectations for labor growth, and expectations for Canada were revised higher from last month, bringing them closer to in line with expectations in the U.S.

Respondents continued to report material shortages in June, particularly for transformers and electrical equipment. They also reported seeing price increases for sand and aggregate materials which are feeding through to the increases in price expectations for ready-mix concrete.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Kate Smith, S&P Global Market Intelligence

P. +1 781 301 9311

E. katherine.smith@spglobal.com