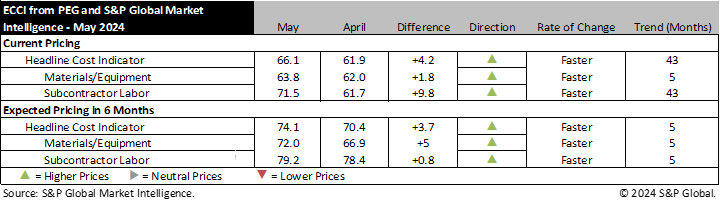

New York – May 22, 2024 – Engineering and construction costs increased again in May, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector increased 4.2 points to 66.1 this month. The sub-indicator for materials and equipment costs edged up 1.8 points to 63.8 while the sub-indicator for subcontractor labor costs rose to 71.5 in May from 61.7 in April.

The equipment and materials indicator continued to show rising prices in May. Eight of the 12 components increased compared to last month while the rest saw only moderate decreases. Only the ocean freight categories saw sizable declines this month, with routes from Asia to the U.S. declining 10.0-points and routes from Europe to the U.S. falling 27.8-points to a neutral reading of 50.0. Carbon steel pipe and alloy steel pipe each also registered neutral readings of 50.0 in May. All other equipment and material categories remain in expansionary territory. Transformers and electrical equipment continue to show very high readings of 85.0 and 81.8 respectively. Pumps and compressors saw the largest increase this month, moving from neutral in April to a reading of 70.0 in May. Copper-based wire and cable also saw a strong 11.6-point increase to 72.7 this month.

“We have seen an overall surge in copper prices over the past 3 months which is also filtering downstream into copper wire and cable prices,” said Amanda Eglinton, Economics Associate Director, S&P Global Market Intelligence. “The rise in copper prices has been largely driven by speculative funds and we expect prices to correct back down by late in the second quarter or early in the third quarter. Current price levels will incentivize a supply-side response and will weigh on demand, resulting in higher visible inventories and lower prices during the second half of the year.”

The sub-indicator for current subcontractor labor costs saw a moderate 9.8-point increase compared to last month. The growth was widespread, with modest to large increases in almost all regions and employment categories. The largest increases took place in the U.S. Northeast and West regions with double digit increases for all employment types. Generally, the increases in Canada were smaller than in the U.S., with modest increases in Western and no change in Eastern Canada.

The six-month headline expectations for future construction costs indicator increased modestly to 74.1 in May. The six-month expectations indicator for materials and equipment came in at 72.0, 5.0 points higher than last month’s figure. Seven of 12 categories saw price expectations increase this month, four saw declines and expectations for ready-mix concrete were unchanged. All categories are now above 50.0, indicating higher prices are expected in six months. Transformers, electrical equipment and copper-based wire and cable saw the largest increases of 12.2-15.9 points to readings between 83.3-90.9; these are the tightest categories and indicate very strong expectations for higher prices six months from now. The ocean freight categories each saw increases of around 10.0-points to move from readings of 45.0 and 50.0 to solidly in expansionary territory. Carbon steel pipe, alloy steel pipe, shell and tube heat exchangers and pumps and compressors were the four categories that saw minor declines of 2.8-7.6 points.

The six-month expectations indicator for sub-contractor labor saw a minor 0.8-point increase to a reading of 79.2, continuing to show expectations for a tight labor market. Most of the increases were present in Canada, with modest increases for expectations in all employment categories in both Eastern and Western Canada. Meanwhile in the U.S., expectations saw a minor increase in the South region, minor decreases in the Midwest and West regions and were unchanged in the Northeast region.

Respondents reported some shortages this month for copper and labor, especially electricians. They also noted that major electrical equipment is running long lead times.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.

###

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact:

Katherine Smith, S&P Global Market Intelligence

P. +1 781-301-9311

E. katherine.smith@spglobal.com