Walt Disney Co.'s ESPN (US), Fox Corp. and Warner Bros. Discovery Inc. have joined forces to launch a "skinny bundle" of networks aimed at sports fans. Reactions to the announcement of the service have been mixed, with some calling it a game changer and others noting the service is missing key sports content. Furthermore, virtual multichannel service provider fuboTV Inc. filed an antitrust lawsuit against the companies behind the service, alleging that it will destroy competition and inflate prices for consumers.

Key strength: Price

A lower price tag seems to be the main selling point of the new service. The triumvirate of ESPN, Fox and Warner Bros. Discovery saw the rising prices and large channel lineups on current virtual multichannel services as an opportunity to launch a service that was targeted at potentially a more affordable option. While pricing details have yet to be announced, some analysts are predicting a price tag of about $40 per month. The networks that will be available at launch have been named, and we estimate that they run traditional operators about $26.34 per subscriber per month in affiliate fees to carry. The ESPN+ streaming service is also included, which runs new subscribers $10.99 per month and has an average revenue per user of $6.09. Walt Disney Co. stands to be the largest member of the joint venture with its seven linear TV networks accounting for nearly 60% of the total affiliate revenue per average sub per month generated by the group of 14 channels.

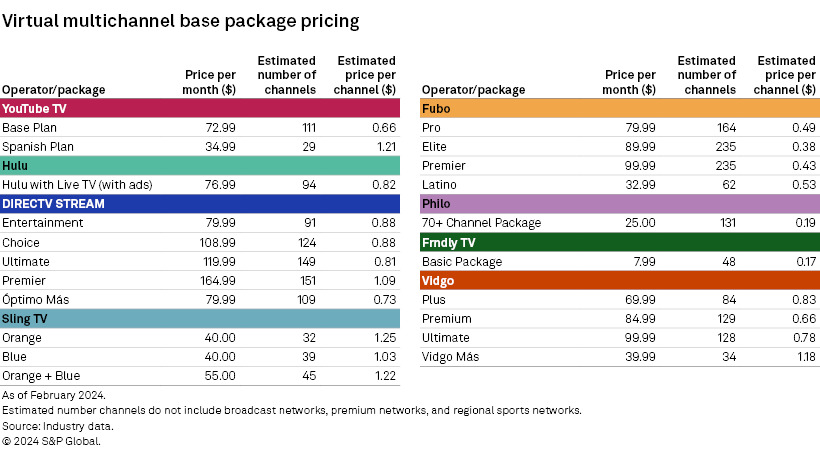

Given that the 14 networks in the service carry a combined license fee of $26.34 per month and that the service will include ESPN+, it is likely that the service could see an initial offering rate of $40 per month. A potential price tag of $40 per month would put the service well below competitors such as Alphabet Inc.'s YouTube TV, Hulu with Live TV and FuboTV, which are all priced above $70 per month. It would be comparable to DISH Network Corp.'s Sling Orange and Blue packages, which both cost $40 when sold separately and $55 with a combined purchase.

It is no secret that networks have been able to pass along higher rates to smaller virtual multichannel operators such as FuboTV, so by launching their own service, the networks involved will be able to cut out the middleman and charge the most competitive prices to consumers. Additionally, the companies involved in the new joint venture might choose to make their product more appealing by making their networks exclusive to their virtual multichannel service, which is a concern of FuboTV.

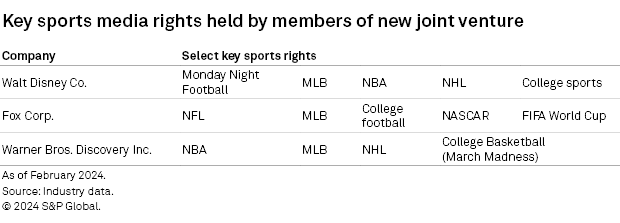

Key weakness: An incomplete sports video solution

While the new sports service has valuable sports rights content across the major professional and collegiate leagues, it has some sizeable gaps in programming. The networks with the most amount of live sports content that are not included in the new joint venture are Paramount Global's CBS (US) and CBS Sports Network (US), Comcast Corp.'s NBC (US) and USA (US), as well as sports league nets such as NBA TV (US), the NFL Network (US), MLB Network (US) and the NHL Network (US). Furthermore, the new service does not offer regional sports networks. While the RSN industry is under some duress related to issues with Diamond Sports Group LLC, these networks are still essential for fans looking to indulge in regular season MLB, NBA and NHL games from their local teams.

CBS holds rights across the NFL, college football, college basketball (including March Madness), the PGA and an assortment of other rights. NBC holds the rights across the NFL, MLB, the Olympics, NASCAR, horse racing, tennis, the PGA and others. The absence of these two broadcast networks creates the most programming holes for sports fans. Of course, cord cutters and potential subscribers to the new joint venture sports service could supplement their subscription with an antenna and access to the broadcast networks; however, those watching on devices would not have that luxury.

Protecting the traditional bundle

While the partners in this joint venture see an opportunity to reach customers who have left the traditional pay TV ecosystem, they are all still invested in making sure the industry stays healthy. On recent earnings calls, both Disney's Bob Iger and Fox's Lachlan Murdoch mentioned that they do not see this product as a replacement for a traditional linear pay TV package. All three companies generate significant affiliate revenues from the traditional pay TV operators, and therefore it would not be in their best interest to accelerate cord-cutting trends by pricing this new package at such an appetizing level. Still, the migration from linear to streaming is not slowing, and to stay competitive the companies need to get their networks in front of the widest audience possible. In line with that thinking, Disney is planning on bringing the ESPN flagship network direct-to-consumer in August 2025.