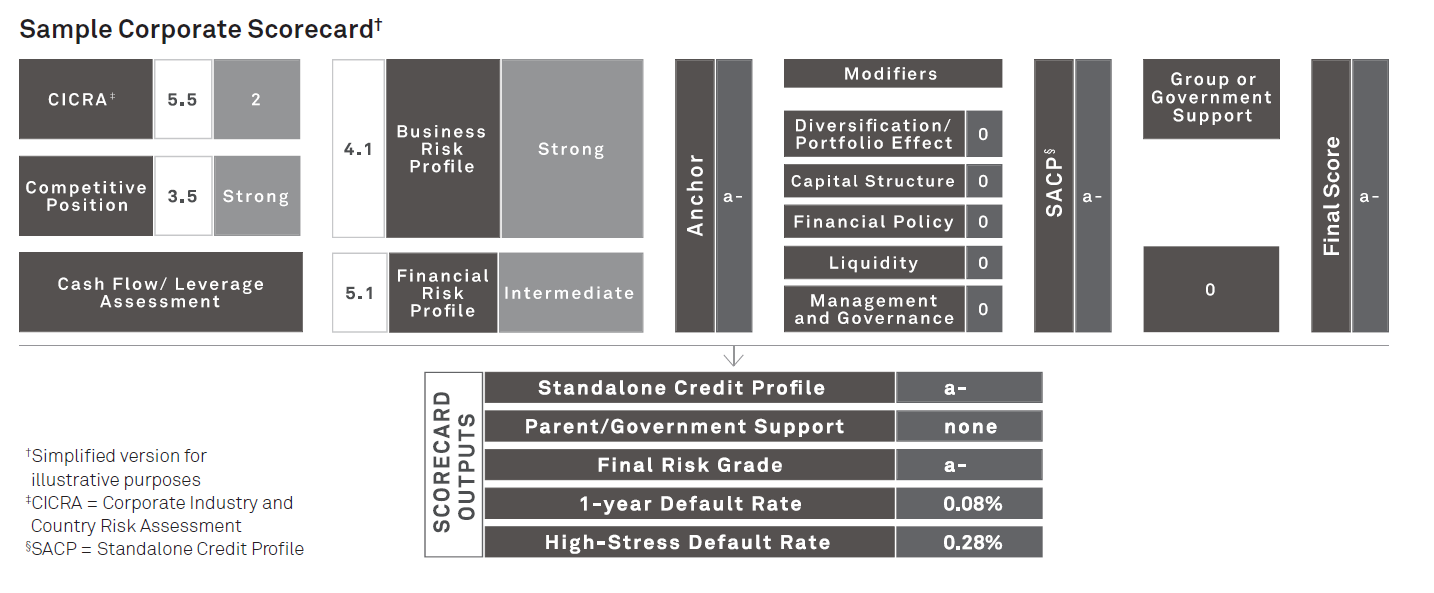

Proactive monitoring of quantitative and qualitative risk factors can help to understand and assess the rising credit risks associated with this pandemic. S&P Global Market Intelligence’s Corporate Scorecard provides an effective framework to navigate today’s climate, especially for low-default portfolios that, by definition, lack the extensive internal default data necessary for the construction of statistical models that can be robustly calibrated and validated. Additionally the Corporate Scorecard provides:

- Identification of Default Risk through a granular 20-point rating scale. Users can generate PD values for Corporate portfolio(s) and perform sensitivity analyses, scenario analyses, and stress tests.

- Microsoft Excel based model that provides a consistent framework for calculating credit risk.

- Scores that are designed to broadly align with S&P Global Ratings[1] supported by historical default data dating back to 1981.

- Point-in-time factors combine with forward-looking qualitative factors, converging trends, and relationships between key drivers to provide a full picture of credit risk.

- Leading benchmarks include over 140 industry and country risk scores.

According to S&P Global Ratings, the effects of the coronavirus pandemic containment measures may lead to a global recession this year. A cash flow slump and poor financial conditions as well as the simultaneous oil price shock will hurt creditworthiness. These factors will likely result in a surge in defaults for the rated universe.[2]

But what impact will the pandemic have on the creditworthiness of the unrated universe?

The magnitude of the impact will vary by industry, geography, and rating level. Companies operating in the most affected sectors which were already assessed at 'b' or below before the pandemic, will be more vulnerable to the extremely adverse business, financial, and economic conditions. Developed economies may have the capacity to exercise larger and more effective incentives, given their wealth and access to funding. Emerging markets have less room for policies to cushion the economic hit; in some extreme cases, their access to funding is limited[3].

To read the full article click here.

If you would like to learn more about how our Corporate Scorecard can help analyze the impact on corporate credit risk, contact us here.

[1] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence.

[2] COVID-19 Credit Update: The Sudden Economic Stop Will Bring Intense Credit Pressure. Date: 17 Mar, 2020

[3] S&P Global Ratings, Coronavirus Impact: Key Takeaways From Our Articles. Date: April 03 2020