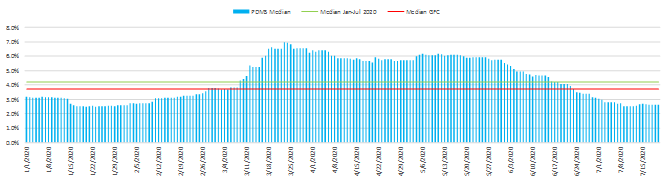

The default risk of companies in the developing markets is now back to levels last seen before the outbreak of COVID-19, according to our proprietary Probability of Default Model Market Signals (PDMS) model. PDMS is a structural probability of default (PD) model that incorporates stock prices and asset volatility to calculate a one-year PD. Our sample portfolio of developing markets consists of 6,154 financial and non-financial corporates based in Central Asia, European Emerging Markets (EMs), Middle East and North Africa (MENA), Sub-Saharan Africa, and the Indian sub-continent. PDMS showed that the credit stress of these corporates peaked in March of 2020, when lockdowns were implemented and the COVID-19 breakout intensified. The decline in the default likelihood of our sample portfolio, as of July 20, 2020, comes on the back of the reopening of economies globally and an improvement in financial conditions. According to S&P Global Ratings, “Financial conditions for EMs have improved over the last quarter (i.e., Q2 2020), in line with our expectations. Ultra-accommodative monetary conditions in advanced economies amid the massive expansion of the balance sheets by the Federal Reserve and other major central banks, as well as the expectation of a more evident global economic recovery in the second half of the year, are shoring up investors' appetite for higher-yielding, riskier EM assets”.[1]

Figure 1: Probability of Default Evolution

Source: S&P Global Market Intelligence Credit Analytics, as of July 20, 2020. For illustrative purposes only.

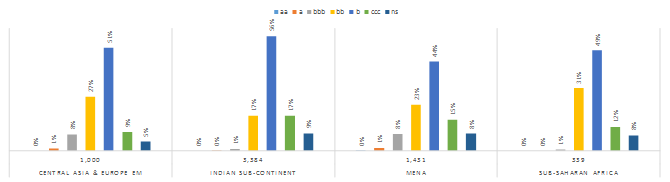

The improvement in PDs could easily reverse if we see a reappearance of the conditions that initially triggered concern, mainly an increase in the number of COVID-19 cases. This is particularly important for those countries in our sample, having a credit landscape that is largely skewed towards the lower-end of the scoring spectrum (as shown in Figure 2). Corporate credit risk would further put a drag on the respective sovereign’s financial resources that are already stretched in most EMs. Ranking entities across a credit spectrum is useful, as it helps identify which entities are more likely to default compared to their peer corporates. Experience leads us to believe that entities with weaker credit scores, especially ‘b’ and below, are more susceptible to adverse business, financial, and economic conditions.

We used Credit Analytics’ CreditModel™ (CM), a fundamental scoring model to assess the creditworthiness of our sample from a fundamental point of view.[2]

Figure 2: Credit Scoring Distribution

Source: S&P Global Market Intelligence Credit Analytics, as of July 20, 2020. For illustrative purposes only.

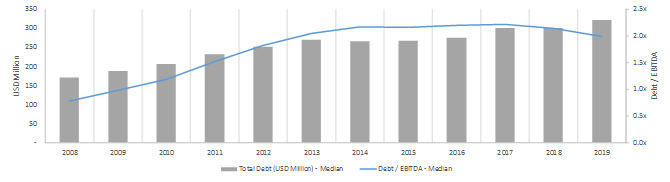

The last decade saw an extraordinary increase in leverage, with companies taking advantage of the lower cost of funds that came as a result of the 2007-2008 global financial crisis (GFC). This increase in leverage included our sample companies, as shown in Figure 3, with the median Debt/EBITDA at year-end jumping from close to 0.8x in 2008 to 2.0x in 2019. Similarly, the median Total Debt for the sample increased from USD $170 million to USD $300 million over the same period.

Figure 3: Leverage Profile of Sample Companies – Excluding Financial Corporates

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

The lockdown of economies will likely chip away at company earnings and further inflate leverage ratios, as a result of the current economic recession. In its report dated July 15, 2020,[3] S&P Global Ratings stated that it now forecasts a deeper economic contraction in 2020 for most key EMs. “Our downward GDP revisions mostly reflect the overall worsening pandemic among many EMs and a larger hit to foreign trade compared to our expectations at the end of April. Our forecast is for the average EM GDP (excluding China) to contract by 4.7% this year, and then to grow 5.9% in 2021. In other words, we forecast EMs to be permanently smaller compared to our pre-COVID projected GDP trajectory, with the gap relative to the pre-COVID GDP path as large as 11% in India, 6%-7% in most of Latin America and South Africa, 3%-4% in most of Emerging Europe, and 2% in Malaysia and Indonesia.”

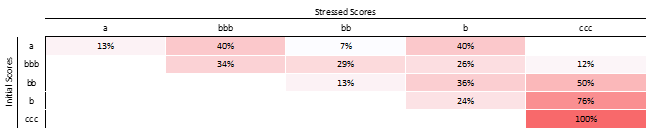

Figure 4 illustrates a stress-testing exercise where we applied a 25% haircut on the revenue of our non-financial corporates in the sample (circa, a sizable 5,000+ entities). Such a haircut may seem extreme, but given that lockdowns have been imposed for close to three months in most EMs, this potential loss seems possible. In this scenario, we see a significant negative migration of the sample companies, with 76% of ‘b-’ scored entities moving to ‘ccc’, and 50% of ‘bb’ entities moving to ‘ccc’.

Figure 4: Credit Score Migration – Initial Portfolio Score vs Stressed Portfolio Scores

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

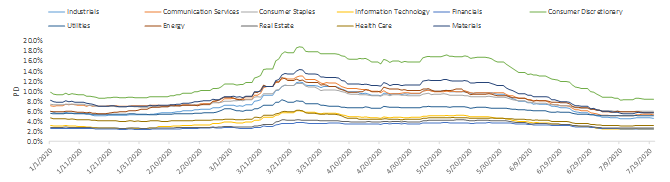

Looking at PDMS at the sector level, as shown in Figure 5, we see a decline in PDs across all sectors, by late May 2020. The highest risk is with the Consumer Discretionary sector, with an average 12-month PD of 8.4%, as of July 20, 2020. This is a global trend, with investors fearing that non-essential spending will be severely hit. Communication Services, Consumer Staples, Energy, and Materials have the second highest level of risk, these sectors having an average 12-month PD of 5.7%. Financials has the lowest level of risk, with a 12-month PD of 2.5%, in part thanks to capital having been built up following the GFC. When assessing EM banks, S&P Global Ratings cites that, “emerging market banks are often more exposed than developed market peers, we expect most will face an earnings rather than a capital shock, exacerbated by lower rollover rates for systems dependent on external financing, and the oil-price shock for some.”[4]

Figure 5: PDMS Evolution by Sector

Source: S&P Global Market Intelligence Credit Analytics, as of July 20, 2020. For illustrative purposes only.

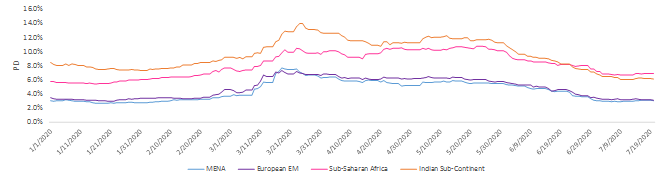

Looking at PDMS at a regional level, as shown in Figure 6, the higher risk that existed in late March for Indian-based corporates compared to their African counterparts reversed around late June, coinciding with the rise of COVID-19 cases in big African economies, such as South Africa. Both regions have shown significantly higher PDs, however, when compared to MENA and Europe EM corporates.

Figure 6: PDMS Evolution by Region

Source: S&P Global Market Intelligence Credit Analytics, as of July 20, 2020. For illustrative purposes only.

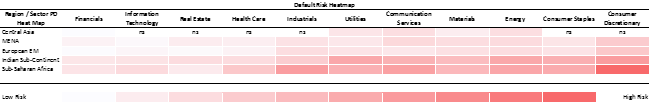

Figure 7 shows a heat map of average PDs across sectors and regions. The heat map confirms, to a large extent, a common investor risk sentiment across sectors given the current environment.

Figure 7: PDMS Heatmap Snapshot - Region and Sector

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

S&P Global Ratings Research

- “Emerging Markets: The Long Road To A New Normal”, S&P Global Ratings, July 13, 2020

- “Deeper Economic Contraction, Higher Leverage, Slower Recovery”, S&P Global Ratings, July 15, 2020

- “How COVID-19 Is Affecting Bank Ratings: June 2020 Update”, S&P Global Ratings, June 11, 2020

RatingsDirect® subscribers: Sign-in Here > to access the most up-to-date research from S&P Global Ratings.

[1] “Emerging Markets: The Long Road To A New Normal”, S&P Global Ratings, July 13, 2020.

[2] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence CM scores from the credit ratings issued by S&P Global Ratings.

[3] “Deeper Economic Contraction, Higher Leverage, Slower Recovery”, S&P Global Ratings, July 15, 2020.

[4] “How COVID-19 Is Affecting Bank Ratings: June 2020 Update”, S&P Global Ratings, June 11, 2020