The recent stress events at Silicon Valley Bank (SVB), First Republic Bank and Credit Suisse have put a spotlight on the global banking system. Accordingly, S&P Global Ratings has published research that is available on RatingsDirect® and the Banking Sector Risk page that closely monitors these developments.

This article provides suggestions for credit risk monitoring of similar stress events going forward by addressing the following three questions:

- Looking in the rearview mirror, were there any early warning signs of potential stress events for these banks?

- Could we develop filtering criteria for credit risk surveillance, given this volatile environment?

- Since time is of the essence, are there ways to perform more time-efficient and scalable credit surveillances?

1. Looking in the rearview mirror, were there any early warning signs of potential stress events for these banks?

A. Fundamentals Driving Credit Ratings

Credit ratings that are ‘B+’ and below would generally be included on a watchlist for entities that are prone to macro, industry and interest rate shocks. However, given that the recent three banking stress events occurred in larger banks operating in developed markets, these entities would start off with a relatively favorable anchor and, hence, would be unlikely to land in the highly speculative grade range on credit ratings (see Table 1 below).

From a fundamental point of view, it is possible to go one layer below the credit ratings (i.e., the underlying scores and factors) and see the context behind these scores. When a modifier (i.e., risk position) causes a notching down of a credit rating, it means that entity’s modifier is significantly weaker than its peers with the same credit rating. Looking at the scores and factors sourced from S&P Global Ratings’ latest publication prior to the stress events in March 2023, and the commentary surrounding them, helps determine if these risks were flagged previously.

Table 1: Components of the credit ratings of SVB, First Republic Bank and Credit Suisse Group AG extracted from the last S&P Global Ratings publication prior to March 2023

|

|

Anchor |

Business Position |

Capital and Earnings |

Risk Position |

Funding |

Liquidity |

Date of the last publication before March 2023 |

|

SVB |

bbb+ |

Moderate (-1) |

Strong (+1) |

Adequate (0) |

Adequate (0) |

Adequate (0) |

11/11/2022 |

|

First Republic Bank |

bbb+ |

Adequate (0) |

Strong (+1) |

Adequate (0) |

Adequate (0) |

Adequate (0) |

4/16/2022 |

|

Credit Suisse Group AG |

a- |

Moderate (-1) |

Strong (+1) |

Moderate (-1) |

Adequate (0) |

Adequate (0) |

11/12/2022 |

Source data is from RatingsDirect on the S&P Capital IQ Pro platform and the RatingsXpress Scores and Factors package as of March 25, 2023. For Illustration Only. Note that the Scores and Factors package via RatingsXpress would provide revisions to these scores even if no corresponding article was published and, therefore, can occasionally be more timely than the data on research articles alone for surveillance purposes.

- SVB Moderate

(-1) Business Position: “… Our assessment of SVB's business position reflects its concentration of business with higher-risk borrowers, such as early- and mid-stage private companies in the technology, health care and life sciences sectors, which are highly reliant on the volatile equity markets for their operating performance…. In recent years, SVB's loans have increased significantly due to the rising demand for private equity and venture capital call loans… In the past year, balance-sheet growth has been fueled by rapid deposits due to quantitative easing and strong exit opportunities at its private clients…as the demand for alternative assets remains strong amid low interest rate regimes. We believe the company's brisk growth might carry heightened risks,…”

- Credit Suisse Moderate

(-1) Business Position: Poor Performance and Weakening Franchise Constrain The Assessment. For the medium term at least, we see Credit Suisse falling behind domestic and international peers in terms of the competitive position and risk-return. There are also tail risks to the financial forecast, if the management team does not succeed in reinforcing customers' and investors' trust, resulting in the continued erosion of the franchise…” Moderate (-1) Risk Position: “Complex, With Tail Risks in Investment Banking, Asset Management, and Structured and Leveraged Products.…The group's investment banking operations in particular entail elevated exposures.”

B. Market Signal-based Indicators

Point-in-time measures based on market indicators can complement other risk measures from a purely fundamental approach.

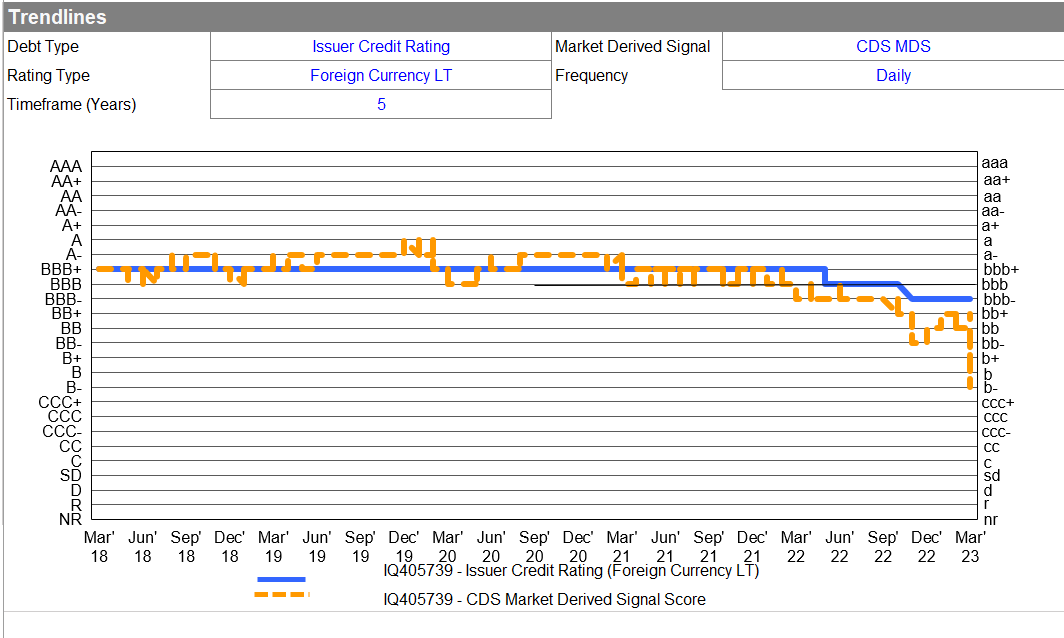

From Figure 1 below, the CDS-based market derived signal (MDS) for Credit Suisse, which converts CDS spreads to a lowercase score that is in the same scale as those provided by S&P Global Ratings, has remained at least one notch below the credit rating since March 2021. This gap widened in 2022, with the lowest being ‘bb-’ in November of that year, suggesting that the market’s confidence in the company’s credit risk was waning.

Figure 1: CDS-based MDS versus Issuer Credit Ratings for Credit Suisse AG, March 2018 to March 2023

Source data is from the Excel Template Library for RatingsDirect on S&P Capital IQ Pro platform. It is also available in the RatingsXpress MDS and CDS package. As of March 25, 2023. For Illustration Only.

C. Downside and Upside Scenario Statements

Another interesting observation looking in the rearview mirror is the Upside Scenario sections provided in the S&P Global Ratings’ credit analysis for all three banks, which indicated that the analysts doing the reviews were unlikely to raise the credit ratings. Furthermore, the triggers to these stress events were all included in the Downside Scenario sections (see Table 2 below, highlighted in red).

Table 2: Excerpts from the most recent ratings research prior to March 2023 for SVB, First Republic Bank and Credit Suisse Group

|

Article |

Downside Scenario |

Upside Scenario |

|

SVB Financial Group And Silicon Valley Bank Outlooks Revised To Stable From Positive; Ratings Affirmed (published on November 10, 2022) |

“We could lower the rating on SVB if:

|

“We are unlikely to raise our ratings over the next two years because of SVB's industry and deposit concentrations relative to higher-rated peers…. |

|

Full Analysis on First Republic Bank (published on April 6, 2022) |

“We could lower the rating if asset quality deteriorates .. underwriting standards are loosened …. or on-balance-sheet and contingent liquidity do not remain commensurate with the concentrations in the bank's deposit base…” |

“We are unlikely to raise the ratings over the next two years because of relativities with higher-rated peers…. |

|

Full Analysis on Credit Suisse Group AG and Credit Suisse AG, (published on Dec 15, 2022) |

“We could lower the ratings on Credit Suisse Group AG and its operating subsidiaries over the next 12-24 months if: The bank fails to stabilize and rebuild confidence in its core businesses and its reshaped franchise is materially weaker than we currently anticipate. We will assess flows in assets under management and deposits relative to peers, liquidity buffers, and the maintenance of strong risk management and governance controls to mitigate further reputational damage;… higher-than-expected losses during the early phase of restructuring or poor execution of the plan if the cost-cutting program and investment bank restructuring fail to achieve their early milestones….” |

“We are unlikely to upgrade Credit Suisse over the next 12-24 months, but we could take this action if we saw swift, sustainable progress in the restructuring and a materially more stable franchise with resilient earnings and a better risk-return profile….” |

Source data is from S&P Global Ratings reports, which are available on RatingsDirect on the S&P Capital IQ Pro platform. It is also available in digitized format from RatingsXpress Research (Sections) via Xpressfeed for custom credit memo creation. As of March 25, 2023.

D. Credit Risks Trends of the Industries (or Geographies) Linked to these Companies

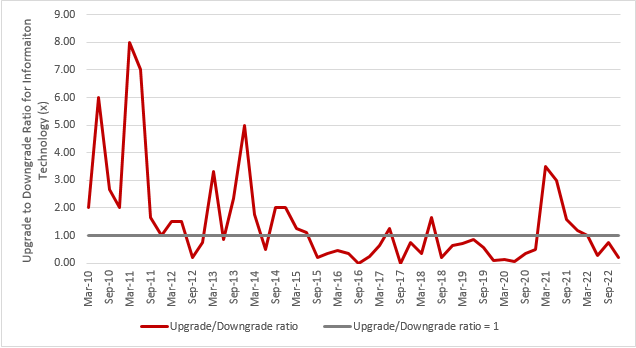

Figure 2 below shows the ratio between the number of ratings upgrades versus the number of ratings downgrades quarterly from Q1 2020 to Q4 2022. When the red line is persistently below the grey line, credit ratings downgrades outweigh upgrades, providing a negative signal.

Figure 2: Ratio of credit ratings upgrades versus downgrades for the Software & Services, and Media & Entertainment industries. Q1 2010 to Q4 2022

Source: CreditPro®, S&P Global Market Intelligence, as of March 2023. For Illustration Only

After a few years of strong ratings upgrade momentum, there was a bias towards downgrades starting in Q1 2022, with the number of downgraded entities exceeding upgrades by a ratio of 5 to 1 (upgrade/downgrade ratio = 0.2) in Q4 2022. This was also consistent with the Technology sector and downsizing news throughout 2022.

E. Percent of Entities with Aggressive (6) or Highly Leveraged (5) Cash Flow / Leverage Scores

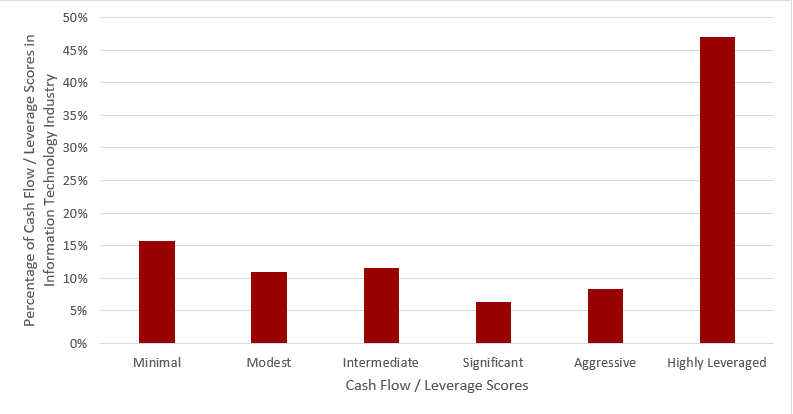

This indicator is less informative because banks have high exposure to entities that are not rated by a credit rating agency. Nevertheless, it is interesting to monitor any anomalous trends, as this could indicate potential industry-wide aggressive investments in projects on the back of cheap credit, or weak earnings relative to debt. These vulnerabilities could lead to defaults on bank payments, given a slowing macroeconomy, uncertainty in supply chains and interest rate hikes.

In the case of the Information Technology industry, which is linked to SVB and First Republic Bank, Figure 3 below does not have the benign bell-shaped curve, but is highly skewed to the lower end. The percentage of entities with “Aggressive (5)” or “Highly Leveraged (6)” Cash Flow / Leverage scores was 55%, indicating potential systemic defaults in this industry.

Figure 3: Distribution of Cash Flow / Leverage scores for the Information Technology industry

Source: RatingsDirect on the S&P Capital IQ Pro platform, as of March 2023. For Illustration Only. This data is also available in the RatingsXpress Scores and Factors package, which is updated on a near real-time basis.

2. Could we develop filtering criteria for credit risk surveillance, given this volatile environment?

Below are some potential data sources and filters for continued credit risk surveillance.

Bank level filters:

- Entity credit ratings at ‘BB+’ and below.

- Ratings modifiers – which are negative.

- PD MDS or MDSCDS at one notch or more below the credit ratings.

- Upside and Downside Scenario Statements from ratings research.

Bank borrower filters:

- Industry credit default and ratings upgrades/downgrades ratios < 1.

- Percentage of corporates in the same region or country with cash flow/leverage scores that are Aggressive or Highly Leveraged.

Sovereign level filters:

- MDS based on CDS spreads for sovereigns (daily monitoring).

Applying Filters

- Bank modifiers and market indicators filters. Filtering out the global bank universe that is rated by S&P Global Ratings with:

-

- At least one modifier that results in a negative notching on the credit ratings; and

- At least one market signal indicator (i.e., PD MDS or CDSMDS)

…results in approximately 9.7% of rated banks potentially falling under a watchlist to be kept on the radar screen.

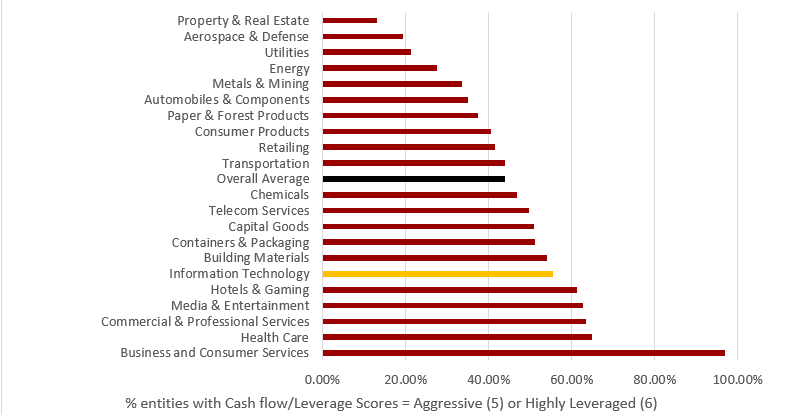

- Cash Flow / Leverage scores of corporate industries where the bank has high exposures.

When bucketing the percent of S&P Global Ratings rated entities with Aggressive (5) or Highly Leveraged (6) Cash Flow / Leverage scores by industry within the global sample, Information Technology was highlighted as a risky industry. However, as shown in Figure 4, several other industries appeared to have similar risks in terms of being able to pay their public or bank debt obligations.

Figure 4: Percentage of entities with Cash Flow / Leverage scores that are Aggressive or Highly Leveraged, by industry

Source: RatingsDirect on the S&P Capital IQ Pro platform, as of March 2023. For Illustration Only. This data is also available on RatingsXpress Scores and Factors package, which is updated on a near real-time basis.

- Sovereign ratings filter: The impact on subsequent bailouts of sovereign credit risk (assuming a central bank steps in as a lender of last resort) is worth monitoring on a daily basis as events evolve. Table 3 below shows the results as of March 27, 2023. If the difference between sovereign issuer credit rating and MDSCDS negative (positive) the CDS market is reflecting an expected sovereign ratings downgrade (upgrade). As market indicators tend to be noisy, we strongly recommend that users consider sovereign credit ratings as well as the MDSCDS trends over time in monitoring sovereign risks

Table 3: Sample comparisons between sovereign credit ratings with MDSCDS in March 2023

| Country | Difference between issuer credit rating and MDSCDS (in notches) |

| Estonia | -4 |

| Argentina, Chile, China, Ecuador, Egypt, Kenya, Latvia, Lithuania, Pakistan, Ukraine | -3 |

| Bahamas, Iceland, Israel, Qatar | -2 |

| Australia, Bulgaria, Canada, Croatia, El Salvador, Ethiopia, Hong Kong, Kuwait, Malaysia, Mexico, Nigeria, Panama, Peru, Romania, Saudi Arabia, Serbia, Singapore, The Philippines, United States | -1 |

| Angola, Cameroon, Azerbaijan, Denmark, Dominican Republic, Finland, Georgia, Germany, Indonesia, Italy, Ivory Coast, Kazakhstan, Luxembourg , Mongolia, Montenegro, Morocco, Netherlands, Norway, New Zealand, Nicaragua, Sweden, Switzerland, Trinidad & Tobago, Turkey, Uruguay | 0 |

| Austria, Belgium, Colombia, Costa Rica, Cyprus, Czech Republic, Greece, Hungary, India, Jordan, Macedonia, Malta, Rwanda, Senegal, Slovenia, South Africa, South Korea, Spain, United Kingdom | +1 |

| Armenia, Barbados, Brazil, France, Guatemala, Iraq, Ireland, Oman, Poland, Slovakia, Thailand, Vietnam | +2 |

| Bahrain, Jamaica, Japan, Portugal | +3 |

| Belize | +4 |

3. Since time is of the essence, are there ways to perform more time-efficient and scalable credit surveillances?

The RatingsXpress product suite has developed time-saving solutions for risk professionals, several of which are highlighted below:

- Scores and Factors, PD MDS and MDSCDS on Xpressfeed: These provide near real-time updates to any changes in credit risk fundamentals and market indicators and can be encoded in a broader enterprise risk system’s exceptions/alerts logic.

- CreditPro® on XpressAPI Drive: This capability enables risk professionals to easily and flexibly run large numbers of ratings changes, upgrades/downgrades and default reports across multiple industries, countries and time periods, by just adjusting a custom *.txt file template and uploading into an FTP server. This is useful for stress testing. A REST API version is available to embed into systems.

- RatingsXpress Research on Xpressfeed (sections): This enables end users to pull multiple Outlook, Downside Scenario, Upside Scenario and blurbs related to scores and factors across multiple companies and industries over different time periods. This supports fast custom credit memo generation versus downloading reports one-by-one and cutting/pasting each section, monitoring of industry trends and creating sentiment scores.

These time-saving solutions will be addressed further in the next installment of this blog series.

Other blog posts and articles related to this topic include:

- S&P Global Ratings’ Banking Sector Risk landing page with the latest information on the banking sector.

- A COVID 19 Systemic Risk Story in Seven Simple Charts.

- In Search for Resilience: A Data Driven Scoreboard.

- Vulnerable Angels Spotlight on US Oil Gas Companies Rated BBB by S&P Global Ratings.