Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

In this edition, we take a closer look at changes that might impact the U.S. banking and financial technology landscape. The digital revolution has created a race to develop best-in-class technology that can win clients, reduce overhead costs and defend traditional banks against a multitude of fintech start-ups. As U.S. banks continue to adapt to the increasingly digital environment, headcount may drop dramatically and the importance of efficiency as a key metric of banking performance could rise. Online lenders, meanwhile, have used partnerships with federally chartered banks to avoid the hassle of obtaining individual state licenses. But President Joe Biden's recent repeal of the "true lender" federal banking rule, which provided safe harbor to such fintechs, gives state regulators more leverage to scrutinize partnerships in the name of consumer protection.

What may have sounded like science fiction a few years ago — deploying giant machines that draw in air and use chemicals to separate carbon dioxide from ambient air — is now getting closer to reality. Experts say direct air capture is needed to combat climate change, but a single plant that collects 1 million tons of carbon annually needs 300 MW of uninterrupted power. Can the technology overcome exorbitant energy costs?

Biopharmaceutical companies are setting themselves increasingly ambitious goals to ensure greater representation for women and minority communities, analyzing employee data to produce a more diverse pipeline of talent. The push for greater diversity reflects a cross-sector trend — 45% of new board seats at Russell 3000 companies were filled by women in 2019, compared to just 12% in 2008.

Bank Outlook in Focus

Repeal of fintech 'true lender' rule could embolden state banking regulators

Without an explicit federal rule, progressive states such as Illinois, New York and California are better positioned to enforce their local lending laws and inspect bank-fintech partnerships through which loans are disbursed, according to banking industry lawyers.

Read the full article from S&P Global Market Intelligence

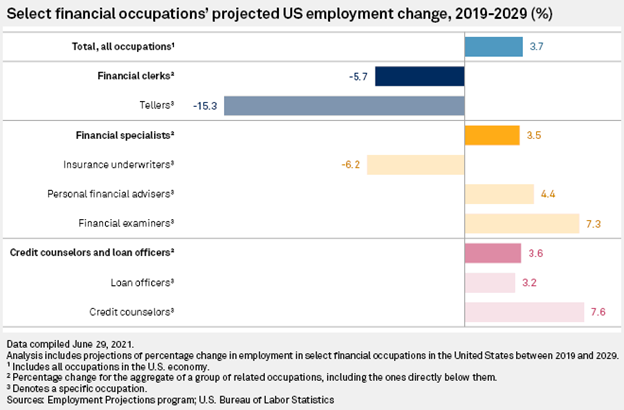

Digital revolution forces efficiency push, job cuts at US banks

The rise of digital banking, a long-running trend accelerated by the COVID-19 pandemic, could trigger thousands of layoffs at U.S. banks. According to one estimate, banks could cut up to 10% of their entire workforce in the next decade.

Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Banks leveraging PPP platforms to generate small-business loans

Following the close of the Paycheck Protection Program, some U.S. banks are finding lending growth opportunities in other Small Business Administration loans.

Read the full article from S&P Global Market Intelligence

Trade credit arrears may impact European firms' COVID-19 bank loan repayments

More companies across Europe are facing delayed payments for invoices, which puts their ability to repay loans at risk, according to market participants.

Read the full article from S&P Global Market Intelligence

India bank privatization plan fraught with challenges, may face delays

Selling public sector banks will not be easy due to their weak financial performance and low equity valuations, according to S&P Global Ratings analyst Nikita Anand.

Read the full article from S&P Global Market Intelligence

ESG

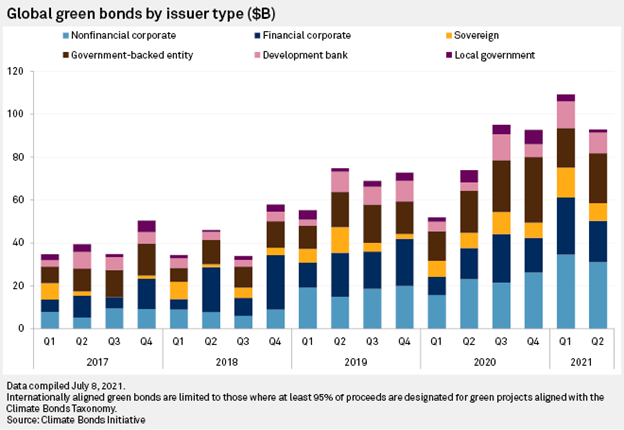

Global green bond sales may set record in 2021 on Europe's sustainability push

Europe issued $53.37 billion of green bonds for the April-to-June period, up 30% from the levels in the same period of the previous year, according to data from Climate Bonds Initiative, a nonprofit U.K. green bond tracker.

Read the full article from S&P Global Market Intelligence

Energy and Utilities

Vacuuming carbon from the sky no joke for rapidly warming world

The prospect of sucking carbon dioxide out of the atmosphere is gaining traction as policymakers and fossil-heavy companies ponder new ways to tackle climate change without upending the world economy.

Read the full article from S&P Global Market Intelligence

Chesapeake Utilities, a small utility operator, has big renewable gas plans

Chesapeake Utilities executives discussed how they plan to scale up their early forays into renewable natural gas and green hydrogen.

Read the full article from S&P Global Market Intelligence

Proposed US 'grid authority' needs bold mission, new paper argues

A new "grid authority" included in a $1.2 trillion bipartisan infrastructure framework should be tasked with coordinating the buildout of a U.S. "macrogrid," according to a new policy blueprint.

Read the full article from S&P Global Market Intelligence

Credit and Markets

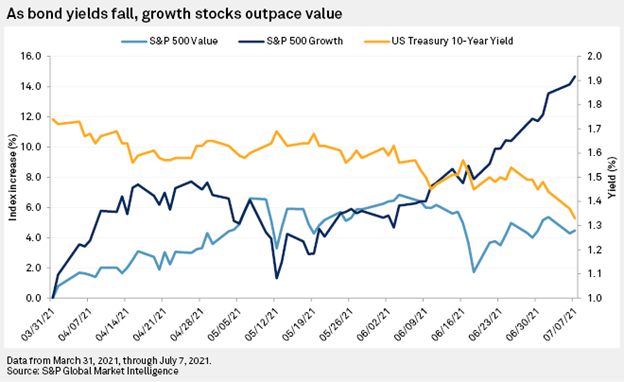

Growth stocks rally as Treasury yields fall amid waning economic confidence

The benchmark U.S. Treasury 10-year yield fell to the lowest point since February as growth stocks continue to outpace value.

Read the full article from S&P Global Market Intelligence

Healthcare

Big Pharma sets ambitious diversity goals to ensure 'pipeline' of talent

Biopharmaceutical companies are setting themselves increasingly ambitious goals to ensure greater representation for women and minorities, using internal data to produce a more diverse pipeline of talent.

Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

Redbox's SPAC-funded evolution from DVD rentals to digital media

As it prepares to go public via a reverse-merger with a special purpose acquisition company, Redbox is planning to bolster its DVD rental business with a combination of streaming, partnerships and a growing third-party kiosk maintenance business.

Read the full article from S&P Global Market Intelligence

Metals and Mining

Market value of metals, mining companies falls 6.9% in June

The market capitalization across the metals and mining companies analyzed by S&P Global Market Intelligence is still up by a median of 81.1% year over year as of the end of the month.

Read the full article from S&P Global Market Intelligence

The Week in M&A

F.N.B. pays up for in-market deal but is focused on incremental growth

Horace Mann may consider more M&A after 'complementary' Madison National deal

Universal SPAC deal among leaders in June media, telecom M&A

The Big Number

Trending

—Read the full article from S&P Global Market Intelligence and follow @KarinRives on Twitter

Anticipate the unknown. Credit Risk News & Insight.

[Webinar] Global Credit Risk – Trends and Outlooks for 2021 and Beyond | July 20, 2021

Climate Change Reshapes the Automobile Sector

How to Use ESG Heat Maps in Credit Risk Analysis

Climate Credit Analytics: Diving into the model

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.