Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn

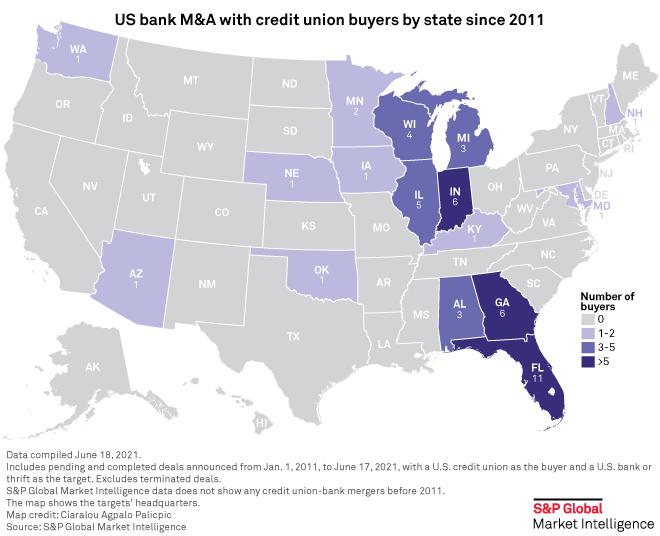

In this edition, we take a closer look at bank merger-and-acquisition activity in the U.S. After a very quiet 2020, Ohio saw three bank deals announced in June alone. On fundamental banking performance, the state's community banks largely lagged the broader industry during the first quarter. However, they outshined the sector in terms of credit quality, with a median nonperforming assets ratio that was 7 basis points lower than the national median. In Florida, the market has seen more credit union-bank deals than any other state over the past decade. According to deal advisers, more of these transactions could be on the way as President Joe Biden's proposal to hike the capital gains tax prompts potential sellers to act sooner rather than later.

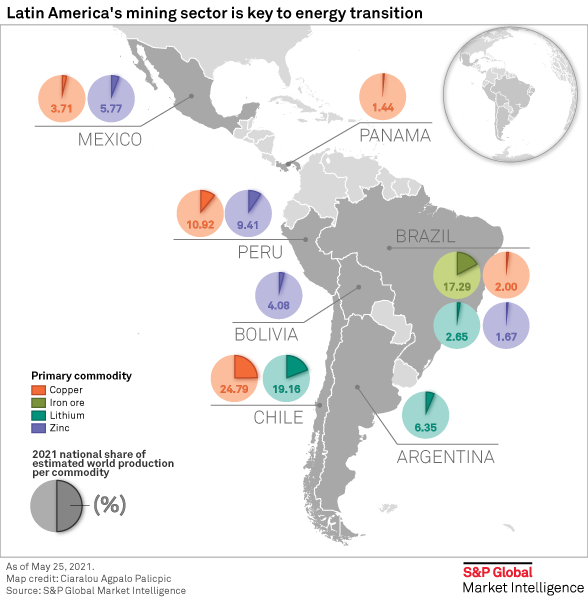

Latin America, a critical supplier of the minerals that underpin solar panels, wind turbines and electric vehicles, could be on the verge of a mining bonanza as governments and businesses all over the world rush to cut greenhouse gas emissions. But extracting those minerals is expensive and creates its own set of environmental and social consequences. Without more supplies from the region, the green-energy industry could find itself short of critical minerals.

Investors in the U.S. remain keen on getting exposure to fast-growing insurance technology companies and in some cases may be willing to look past widening losses. China's $42 billion insurtech market can help meet that demand by supplying insurtech IPO candidates with high growth potential. The attractiveness of U.S. exchanges for China's insurtechs should only rise following new rules in the Asian country that make the screening process for fintech IPO applicants much more stringent.

Bank M&A in Focus

Ohio's largest community banks look to M&A for growth in '21

Three Ohio community banks were targeted in M&A deals announced in June, bringing this year's deal tally in the Buckeye State to four, compared to just one in 2020. Farmers National Banc's purchase of Cortland Bancorp is the largest Ohio bank deal announced since September 2019.

Read the full article from S&P Global Market Intelligence

Florida remains hotspot for credit union-bank M&A as regulators give green light

While some state regulators have barred credit union-bank deals, others have shown little hesitancy in approving them even in the face of opposition from banking industry groups. The CEO of one advisory firm said his company is currently working on 14 potential credit union acquisitions of banks.

Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Banks use excess liquidity to shed another $100B of CDs

U.S. banks are cutting their higher-cost funding as they take advantage of historic deposit growth. Loans, meanwhile, have contracted since the end of 2020, leaving institutions sodden with excess liquidity.

Read the full article from S&P Global Market Intelligence

Robust stress-test results set stage for 100% payout ratios at US banks

Some analysts expect dividends and share buybacks to approach 100% of net income for U.S. banks, but detailed capital plans might not be available as lenders have flexibility under the regulatory framework.

Read the full article from S&P Global Market Intelligence

Brazil's XP takes its fight with banks to the 500B reais loan market

The tech-driven financial services firm is growing beyond its core investing business and into Brazil's credit market, which is dominated by five major players.

Read the full article from S&P Global Market Intelligence

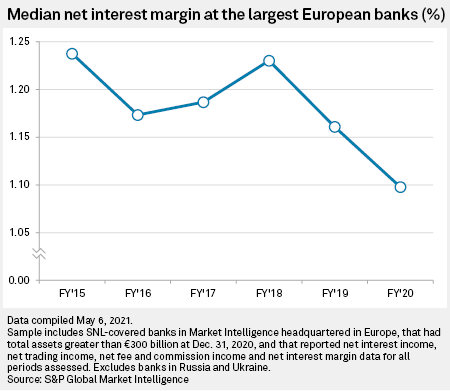

Negative rates: European banks must reinvent themselves in quest for profit

Several years of low and negative interest rates have eroded European banks' profitability and necessitated a shift from traditional interest income-based business models, according to market observers.

Read the full article from S&P Global Market Intelligence

Insurance

US investor appetite should fuel more Chinese insurtech IPOs

Amid rising customer acquisition costs and regulatory headwinds, China's insurtechs may pin their IPO hopes on U.S. investors' enthusiasm for technology companies operating in the insurance sector.

Read the full article from S&P Global Market Intelligence

Credit and Markets

Stocks surge, comfort grows as market's fear gauge falls to pre-pandemic levels

The Chicago Board Options Exchange Volatility Index closed June 25 at its lowest point since February 2020 as investors seek less options protection. Analysts say the drop is a sign that investors are growing more comfortable with risk.

Read the full article from S&P Global Market Intelligence

Elevated default risks highlight uneven pandemic recovery for travel, leisure

Median probability of default scores for U.S. restaurants, hotels, cruise lines, leisure facilities and casinos remain at or near highs reached following the emergence of the COVID-19 pandemic.

Read the full article from S&P Global Market Intelligence

Metals and Mining

Turmoil casts doubt on Latin America's mining of energy-transition minerals

Since 2019, Latin America has been roiled by demonstrations over what researchers have called an "inequality crisis." International mining companies have been spooked by growing social and political risks in major markets such as Chile and Peru, and there are questions about whether parts of Latin America are even open to new mining ventures.

Read the full article from S&P Global Market Intelligence

Private Equity

PE circles transforming aerospace, defense sector

Total disclosed private equity deal value in the sector globally was $9.76 billion in the year to June 11, according to S&P Global Market Intelligence data.

Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

COVID broadband subsidy program sees 'strong start,' but more outreach needed

Just one month in, more than 2.5 million American households took advantage of a federal broadband subsidy program aimed at blunting the effect of the COVID-19 pandemic. But millions more of eligible households have yet to sign up, experts say.

Read the full article from S&P Global Market Intelligence

Leveraged Finance

ESG goes mainstream across global leveraged finance markets in 2021

Global leveraged finance markets are embracing the concept of environmental, social and governance-linked transactions, with the first half of 2021 featuring a marked uptick in sustainability-linked issuance across leveraged loan and high-yield bond products.

Read the full article from S&P Global Market Intelligence

The Week in M&A

Pennsylvania-based Mid Penn Bancorp to acquire Riverview Financial for $124.7M

Minnesota-based Stearns Bank expects to drive revenue via fintech acquisition

Tellurian weighs business combination to aid upstream plan tied to Driftwood LNG

The Big Number

Trending

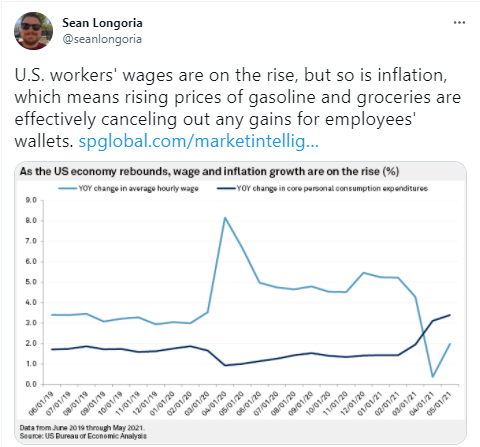

— Read the full article from S&P Global Market Intelligence and follow @seanlongoria on Twitter

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.