Sovereigns no longer borrow money with the intention to repay the full amount. They simply assume that the debt will be rolled over by borrowing from others to repay balances that are due.[1] But will the current environment with economic and commodity price shocks caused by COVID-19 challenge this operating model? Will it become more difficult for some countries to refinance their debt? These conditions have led to an increased focus on sovereign credit risk and the need for ongoing monitoring of creditworthiness at a country level.

The reality is that countries are struggling to balance their books, with S&P Global Ratings downgrading 21 sovereigns over the last 12 months or so. Tellingly, 19 of these downgrades occurred since March 1, 2020, around the time that the global reach of COVID-19 was becoming apparent. Currently, about one fifth of sovereigns (24) are on Negative Outlook by S&P Global Ratings, implying a greater probability of further downgrades.[2] While most sovereigns are not expected to default during these difficult times, losses given default could be high for those that do, particularly for countries within emerging markets.[3]

Taking a Close Look at Loss Given Default (LGD)

LGD is an estimate of the portion of an exposure (bond or loan equivalent) that will likely not be recovered in the event of default. Given market realities, bondholders may want to pay more attention to expected LGD. This is particularly the case for similarly rated sovereigns, which will often have different loss expectations, increasing the need to be more granular in assessing credit risk. The ability to correctly estimate losses can also potentially have adverse impacts on institutional investors, such as insurance companies, that often hold large proportions of government bonds and need to provision for expected losses under International Financial Reporting Standard 9 (IFRS 9).

A Scorecard Approach to Assessing LGD

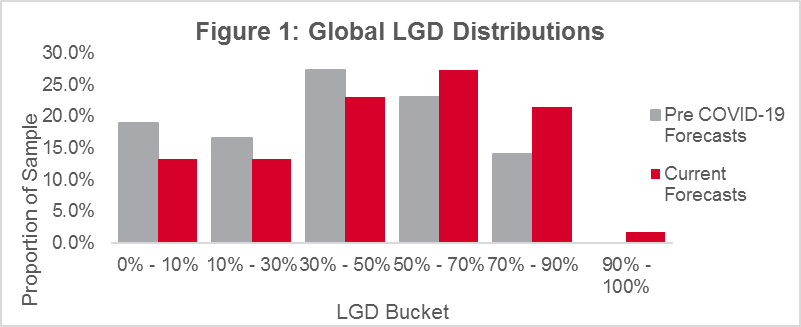

S&P Global Market Intelligence LGD Scorecards were constructed over 17 years ago with the aim of estimating LGD at the exposure level. The Sovereign LGD Scorecard produces estimates of LGD which are point-in-time (PIT), reflecting current economic conditions. This feature is designed to reflect the finding that defaults during an economic downturn are typically accompanied by lower recoveries. Given the evolving environment caused by COVID-19, we have explored how LGD expectations have been changing. This was achieved by estimating LGD based on forecasts for the same timeframe that were made pre- and post-COVID-19 in order to gauge the impact of the pandemic. Figure 1 shows the results based on 121 rated sovereigns.

Source: S&P Global Market Intelligence Sovereign LGD Scorecard. May 27, 2020. For illustrative purposes only.

Approximately five regions experienced a change in their LGD bucket, in all cases towards a higher bucket. Notably, these included North America, Eastern Europe, South America, and Sub-Saharan Africa. Countries in Western Europe experienced an average increase of 6%, moving from approximately 18% to 24%.

Given the uncertainty about how long COVID-19 will continue to impact economic conditions globally, it is imperative that bondholders keep a close eye on the creditworthiness of sovereigns and potential changes in estimates of LGD.

Please click here for more information on our Sovereign LGD Scorecard.

[2] “An Overview Of Sovereign Rating Actions Related To COVID-19”, S&P Global Ratings, May 11, 2020.

[3] Based on defaulted sovereign bond recovery data gathered by S&P Global Market Intelligence, as of December 2019.